EUR/USD appears offered and returns below 1.2200

- EUR/USD fades the initial spike to the area above 1.2200.

- ECB’s C.Lagarde said the bank is monitoring the exchange rate.

- EMU’s Industrial Production expanded 2.5% MoM in November.

The single currency could not sustain the earlier optimism and now drags EUR/USD back to the 1.2170 region, or daily lows.

EUR/USD weaker on ECB, USD-recovery

EUR/USD partially fades Tuesday’s advance and recedes to the 1.2170 area after a failed move to the 1.2220 region earlier in the session.

Indeed, USD-bulls regain control of the sentiment on Wednesday while dovish ECB-speak collaborates further with the downside. On the latter, ECB President Lagarde said earlier on Wednesday that the central bank is closely following the performance of the exchange rate.

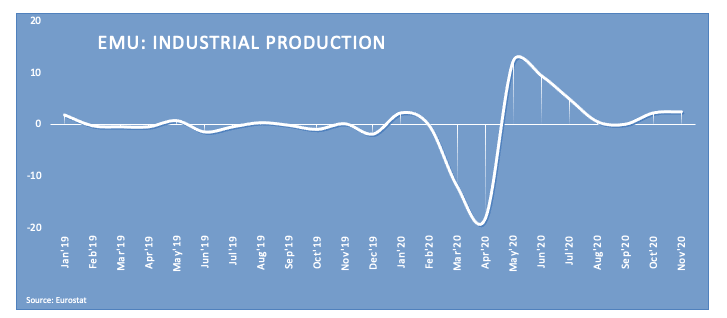

In the euro docket, Industrial Production in the broader bloc expanded at a monthly 2.5% in November and contracted 1.4% from a month earlier in Italy.

In the US data space, December’s inflation figures measured by the CPI will be in the spotlight seconded by the weekly report on crude supplies by the EIA and several speeches by FOMC’s members. In addition the Fed will publish its Beige Book.

What to look for around EUR

The upside momentum in EUR/USD run out of steam in the 1.2350 area earlier in the month. In spite of the corrective downside, the outlook for EUR/USD remains constructive and appears supported by prospects of a strong recovery in the region (and abroad), which is in turn underpinned by extra fiscal stimulus by the Fed and the ECB. In addition, real interest rates continue to favour the euro area vs. the US, which is also another factor supporting the EUR along with the huge, long positioning in the speculative community.

EUR/USD levels to watch

At the moment, the pair is losing 0.23% at 1.2177 and faces the next support at 1.2132 (weekly low Jan.11) seconded by 1.2058 (weekly low Dec.9) and finally 1.2032 (23.6% Fibo of the 2017-2018 rally). On the flip side, a break above 1.2349 (2021 high Jan.6) would target 1.2413 (monthly high Apr.17 2018) en route to 1.2476 (monthly high Mar.27 2018).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.