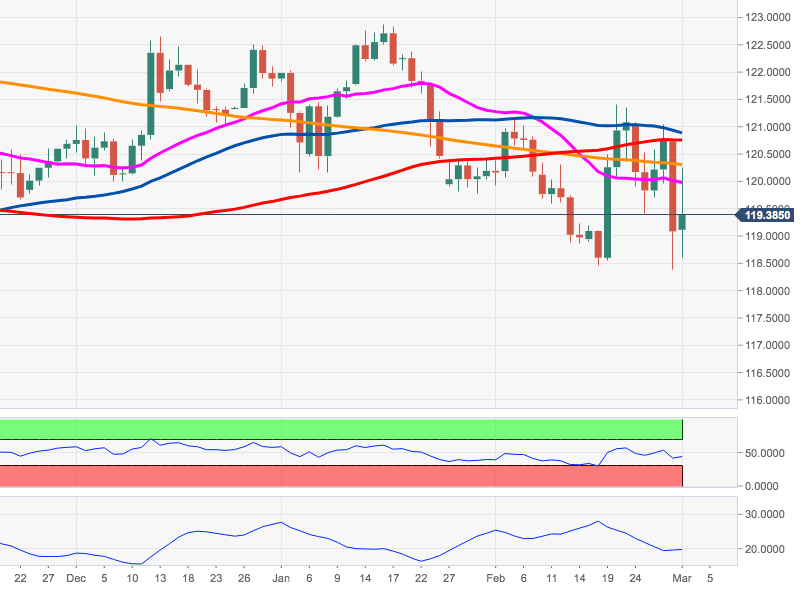

EUR/JPY Price Analysis: Upside stalled just ahead of the 200-day SMA

- EUR/JPY trims gains after testing the key 200-day SMA near 120.30.

- The cross remains volatile and keeps looking to risk trends for direction.

Volatility has picked up around EUR/JPY on Monday, always looking to developments from the Chinese coronavirus for near-term direction.

The daily price action saw a test of the boundaries of the 120.30 region, where sits the 200-day SMA, and the proximity of 118.50, area close to the 2020 lows recorded on Friday.

While the cross keeps waiting for a stronger catalyst for price direction, further consolidation should not be ruled out, likely between 121.50 and 118.50.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.