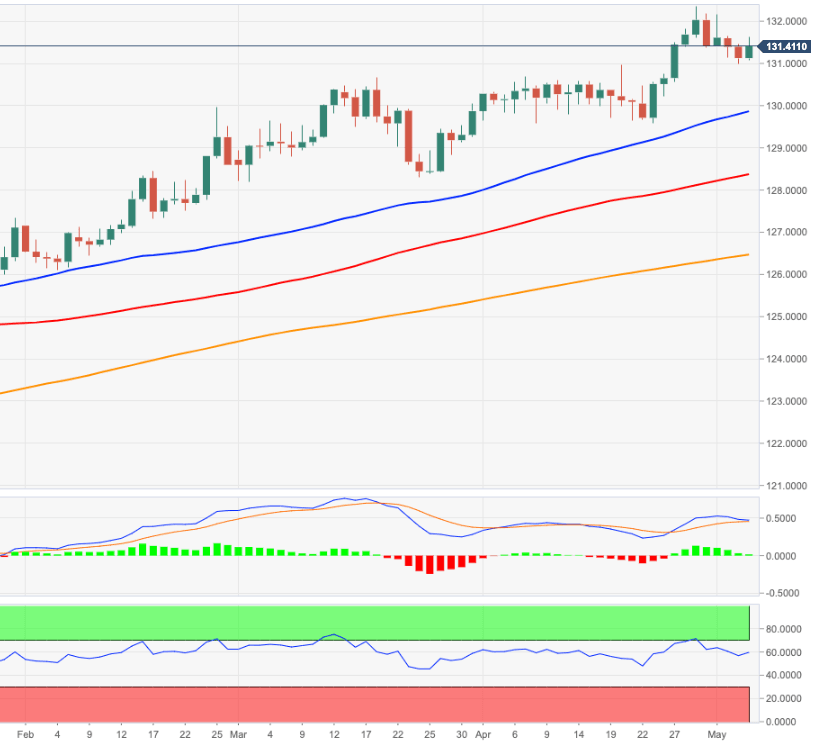

EUR/JPY Price Analysis: The 131.00 area holds the initial test

- EUR/JPY manages to regain upside traction beyond 131.00.

- The leg lower met decent contention in the 131.00 neighbourhood.

EUR/JPY regains the smile and the buying interest and advances further north. Of the 131.00 mark on Thursday.

While the recent leg lower is seen as corrective only, some decent contention appears to have emerged around 131.00 for the time being. A breach of this area carries the potential to extend the leg lower to the 130.00 zone, where converge the 50-day SMA and the immediate support line (off the March’s low).

This area should hold the downside and prompt some reversion.

In the broader picture, while above the 200-day SMA at 126.41 the broader outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.