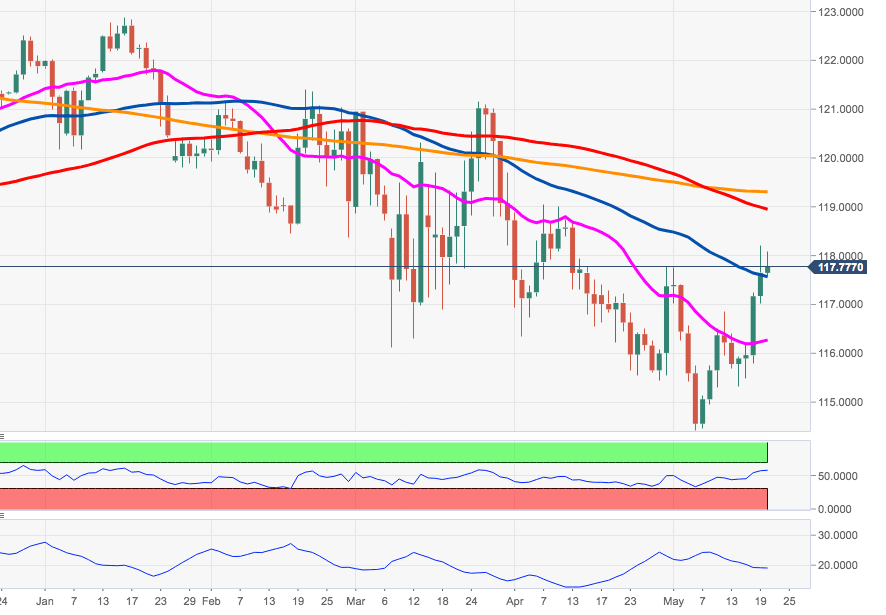

EUR/JPY Price Analysis: Target is now at the 119.00 area

- EUR/JPY has briefly advanced beyond the118.00 barrier on Wednesday.

- Immediately to the upside emerges the key barrier in the 119.00 area.

EUR/JPY is prolonging the upside momentum on the back of the renewed sentiment in the risk complex, managing to reclaim the 118.00, although running out of steam afterwards.

After breaking above the late-April/May tops near 117.80, the cross has now shifted the attention to April’s top in the 119.00 neighbourhood. This resistance is reinforced by the proximity of the 100-day and the 200-day SMAs at 118.92 and 119.25, respectively.

A move above the 200-day SMA should mitigate the downside pressure and allow for extra gains to March’s tops in the 121.00 region.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.