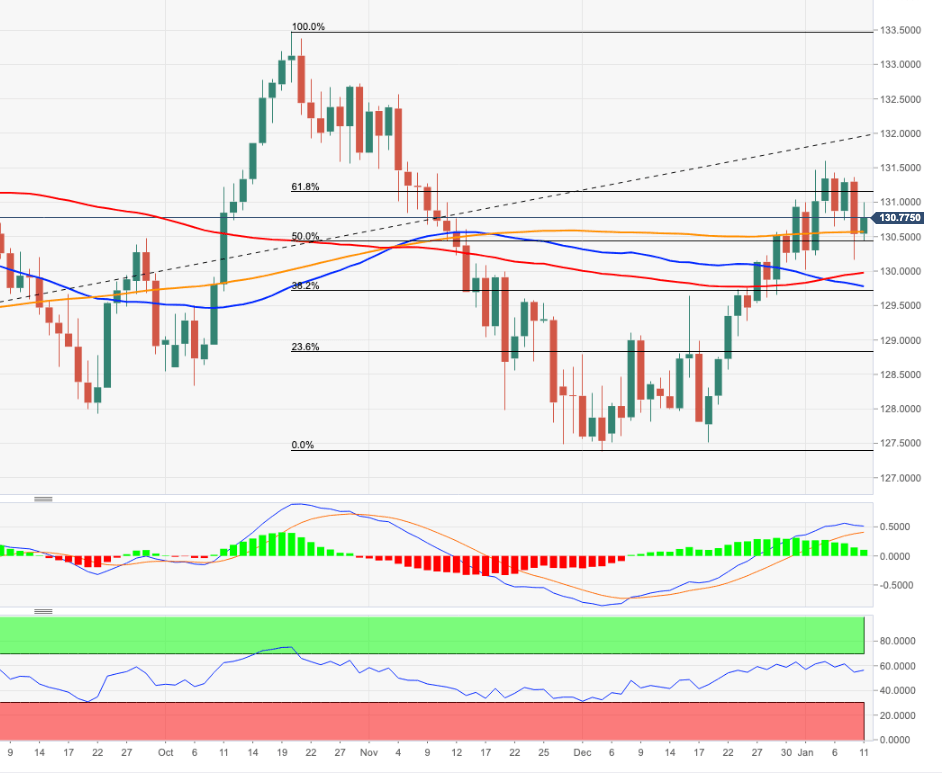

EUR/JPY Price Analysis: Potential consolidation around the 200-day SMA

- EUR/JPY reverses Monday’s sharp pullback and regains 131.00.

- Next on the upside comes the YTD highs near 131.60.

EUR/JPY manages to regain the smile and reverses the deep pullback seen at the beginning of the year.

Further consolidation in the cross appears likely in light of the ongoing price action, always around the key 200-day SMA in the mid-130.00s. The breakout of this scheme should lift EUR/JPY to the 131.50/60 band, while the 130.00 neighbourhood is expected to hold the downside for now.

While below the 200-day SMA, today at 130.52, the near-term outlook for EUR/JPY should remain negative.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.