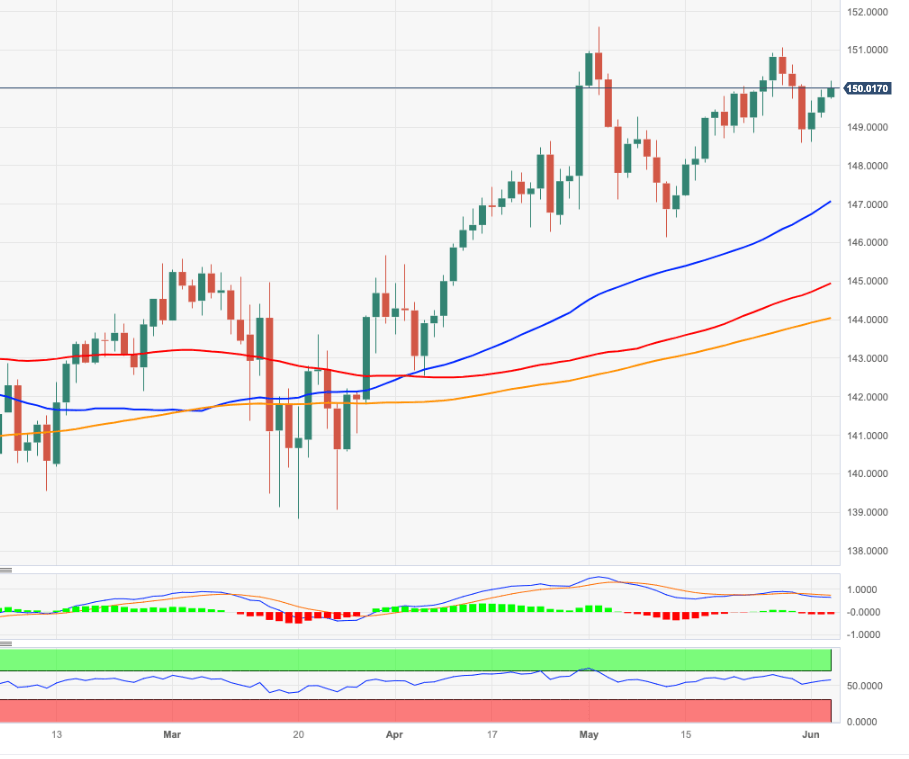

EUR/JPY Price Analysis: Immediately to the upside comes 151.00

- EUR/JPY extends the rebound and revisits the 150.00 region.

- Further up emerges the late month tops just above 151.00.

EUR/JPY climbs further and reclaims the area beyond the key 150.00 barrier at the beginning of the week.

Further recovery appears a plausible near-term scenario. That said, a convincing move north of 150.00 should retest the weekly high at 151.07 (May 29) ahead of the 2023 top at 151.61 (May 2).

So far, further upside looks favoured while the cross trades above the 200-day SMA, today at 144.01.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.