EUR/JPY Price Analysis: Faces robust resistance around 140.00 and collapses below 139.00

- EUR/JPY finishes negative in the week, down by 0.48% as the yen shows signs of strength.

- Deteriorated market mood, augmented appetite for safe-haven peers.

- EUR/JPY Price Analysis: In the near term is downward biased, eyeing a fall below 137.00.

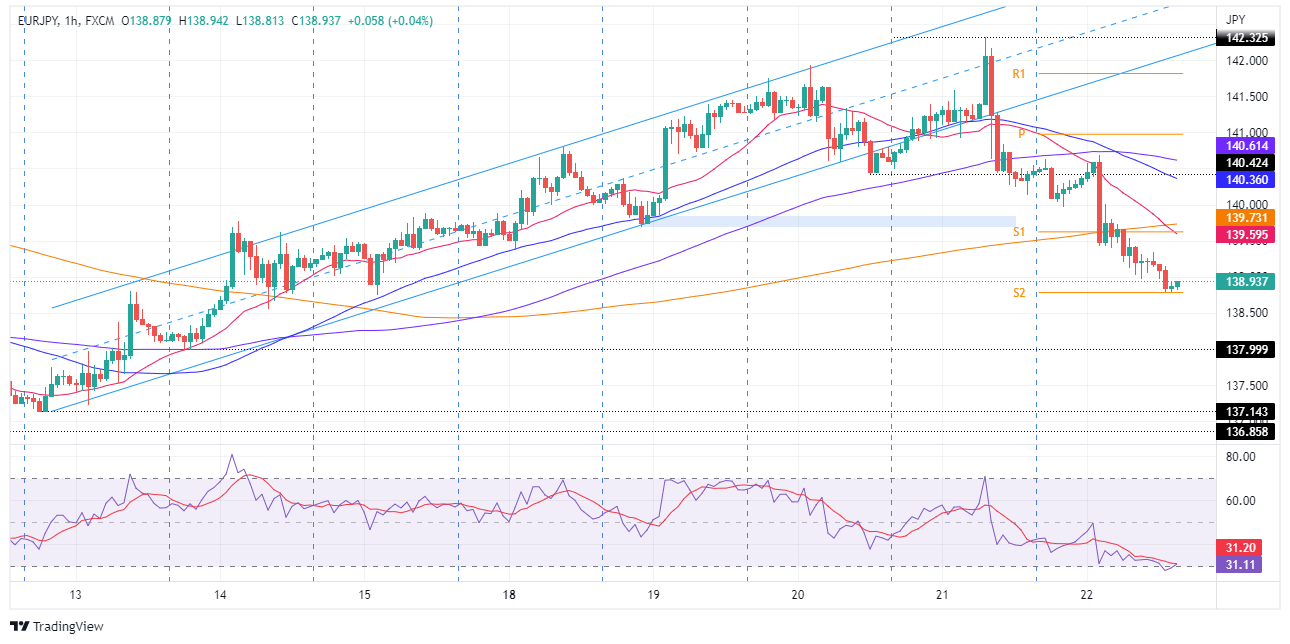

The EUR/JPY plummets from weekly highs hit on Thursday at 142.32, drops more than 160 pips on Friday, towards the 138.00 area, amidst a dampened market mood, which increased safety appetite, bolstering in the FX space, the Japanese yen. At the time of writing, the EUR/JPY is trading at 138.93.

US equities fell between 0.43% and 1.77% as Wall Street closed. Social media companies missing earnings estimations, alongside soft US economic data, added to recession fears. In the FX space, the greenback finished flat on Friday, as shown by the US Dollar Index, but slid 1.28%, snapping three consecutive weeks of gains.

Also read: EUR/JPY Price Analysis: Plunges 200 pips after hitting a two-week high

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY Is still upward biased, despite the ongoing pullback from weekly highs at 142.32, towards its lows at 138.89. Traders should note that the cross-currency slumped below the 20 and 50-day EMA, exacerbating the break below 139.00. However, unless EUR/JPY sellers reclaim the 100-day EMA at 137.06, the uptrend is intact.

EUR/JPY 1-hour chart

The EUR/JPY hourly chart illustrates that once the pair dived below the ascending channel bottom trendline alongside the 140.42 July 20 low, the bias would shift neutral-to-downwards in the near term. However, sellers outweighing buyers by large sent the cross plunging from the 140.00 area to 138.90s, breaking beneath the 200-hour EMA on its way down.

Therefore, the EUR/JPY in the near term is downward biased. The EUR/JPY first support will be 138.50. Break below will expose the July 13 low at 137.99, followed by the July 12 swing low at 137.14.

EUR/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.