EUR/JPY Price Analysis: Plunges 200 pips after hitting a two-week high

- EUR/JPY is set to finish the week with decent gains of 0.58%.

- The EUR/JPY seesawed on a 200 pip range due to ECB’s decision on Thursday.

- EUR/JPY Price Analysis: The hourly chart is neutral-downward biased and might print a leg up towards 141.00 before resuming downwards.

The EUR/JPY edges up as the Asian session begins, though it is trading near Thursday’s lows, printed on a volatile trading session, where the European Central Bank (ECB) hiked rates by 50 bps. After the ECB's decision, the EUR/JPY hit a fresh two-week high at 142.32 but nosedived to the daily low at 140.13 once investors dissected the monetary policy statement, alongside the ECB’s President Mrs. Lagarde’s presser. At the time of writing, the EUR/JPY is trading at 140.41.

Also read: EUR/JPY Price Analysis: Struggles around 142.00, tanks below 140.50

EUR/JPY Price Analysis: Technical outlook

The EUR/JPY daily chart depicts the pair as neutral biased, even though the daily EMAs reside below the spot price. EUR/JPY traders should note that buyers have been unable to challenge the YTD high around 144.27, signaling sellers that it was the time to step in. The latter ones piled around the GBP/JPY weekly high around 142.32 and sent the pair towards the 20-day EMA at 140.17, but they will need a daily close below to increase their chances of testing the 50-day EMA at 139.61.

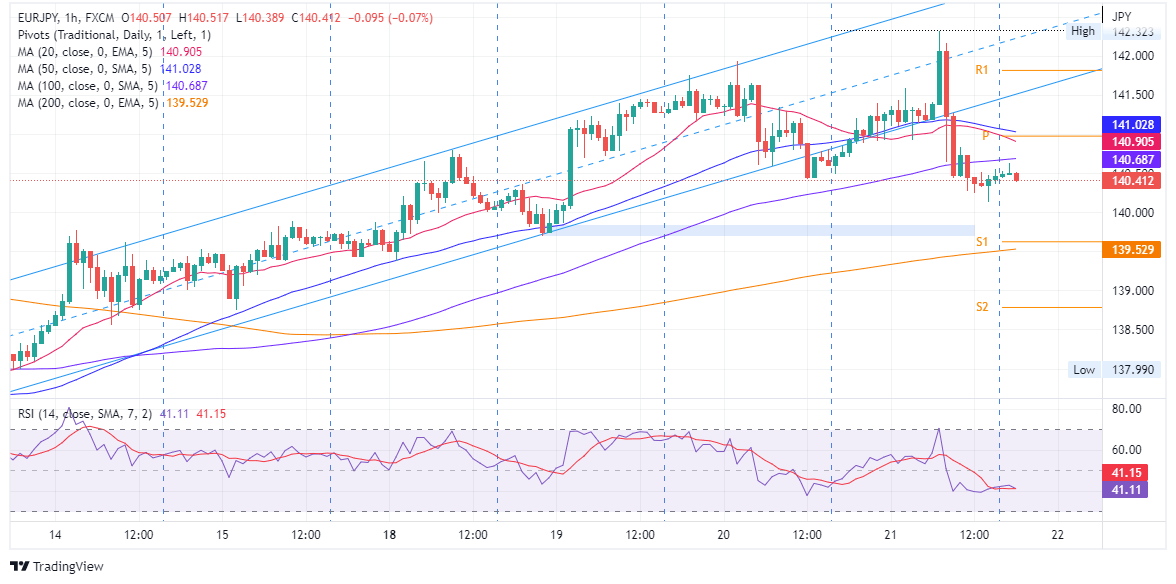

EUR/JPY 1-hour chart

The EUR/JPY hourly chart is neutral-to-downward biased. Although the hourly EMAs are above the exchange rate, except for the 200-hour, the Relative Strenght Index (RSI) shifted above the RSI’s 7-period SMA, used them in conjunction as buying/selling signals, suggesting that a leg-up is on the cards. Therefore, the GBP/JPY might aim to the confluence of the 20 and 50-hour EMAs, where the daily pivot resides around the 140.95-141.05 area, before resuming downwards.

That said, the GBP/JPY’s first support will be the July 21 daily low at 140.13. A breach of the latter will expose the confluence of the 200-hour EMA and the S1 daily pivot around the 139.53-63 range, followed by a challenge to the S2 daily pivot at 138.80.

EUR/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.