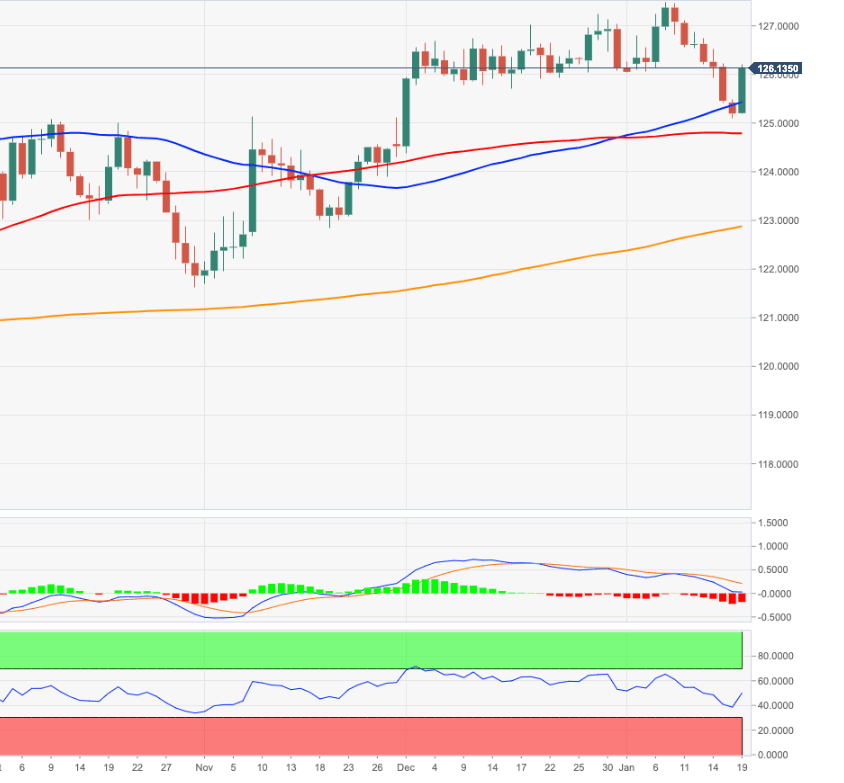

EUR/JPY Price Analysis: Decent support emerged around 125.00

- EUR/JPY manages to bounce off recent lows near 125.00.

- Next on the upside appears the 2021 high in the mid-127.00s.

The resumption of the upside bias allows for extra gains in EUR/JPY the near-term with the next target at the YTD peaks in the 127.50 region. On the opposite side, if sellers regain control of the market, then a move below the 125.00 area should not be ruled out.

A breakdown of this region should expose the 100-day SMA at 124.75 ahead of the Fibo retracement (of the October-January rally) at 124.55.

Looking at the broader picture, while above the 200-day SMA at 122.76 the outlook for the cross should remain constructive.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.