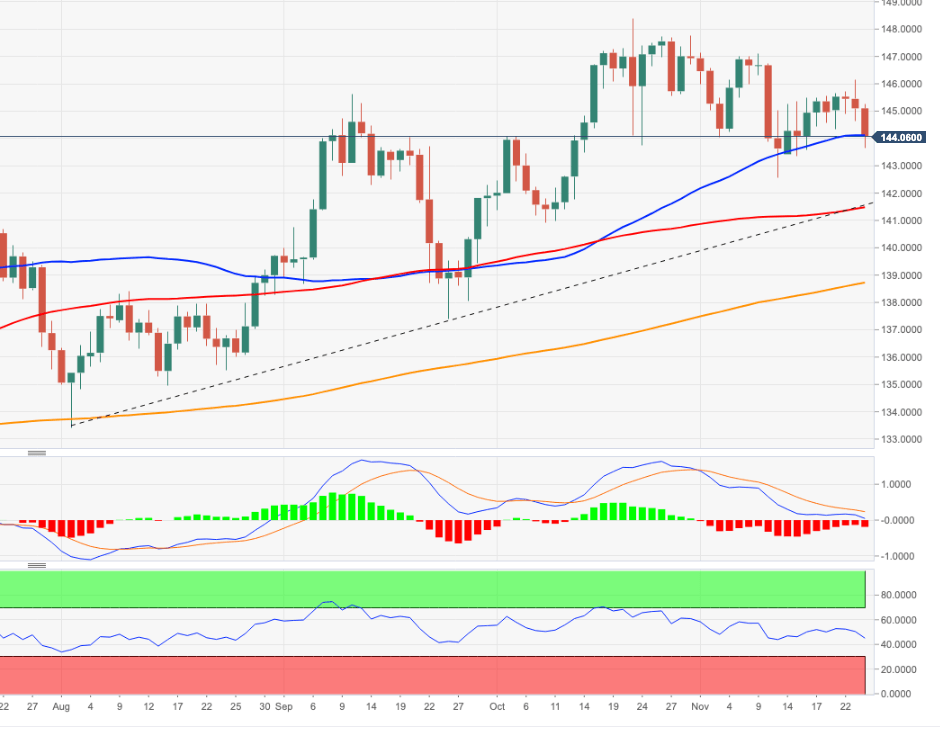

EUR/JPY Price Analysis: Change of direction could retest 142.50

- EUR/JPY adds to the corrective downside and breaches 144.00.

- The continuation of the leg lower could revisit 142.50.

EUR/JPY corrects further south and briefly tests the 143.60 region on Thursday, or multi-session lows.

The cross reversed the strong rebound soon after trespassing the 146.00 mark on Wednesday and sparked quite a marked reversal. That said, further weakness could now motivate EUR/JPY to slip back to the November low at 142.54 (November 11) sooner rather than later.

In the longer run, while above the key 200-day SMA at 138.68, the positive outlook is expected to remain unchanged.

EUR/JPY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.