- EUR/GBP is resuming its main bull trend as the GBP has been hit hard by comments from UK Prime Minister Theresa May which warned of a potential “no deal” on Brexit.

- EUR/GBP bulls objective is re-conquer the 0.9000 figure and the 0.9032 level (August 9 high).

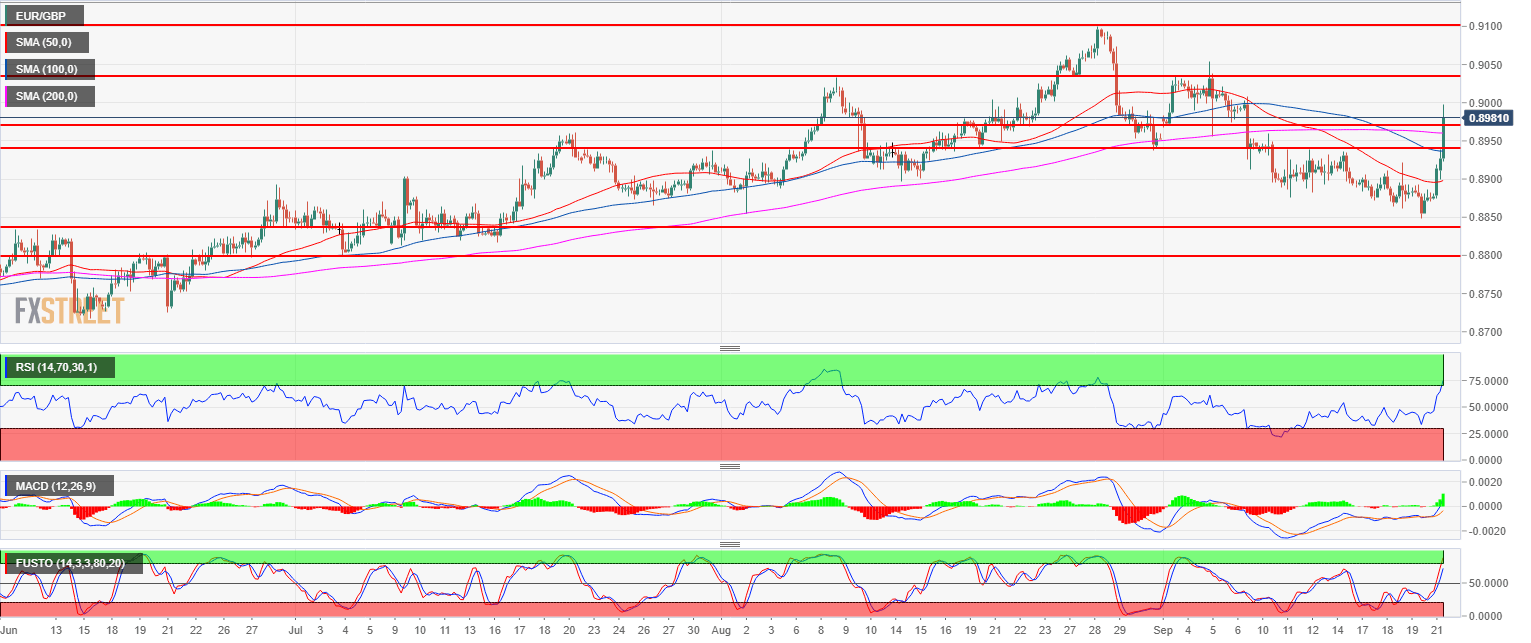

- EUR/GBP bulls made a statement as they re-conquered the 50, 100 and 200-period simple moving averages while the RSI, MACD and Stochastics indicators have turned bullish. Dips are likely going to become buying opportunities.

Spot rate: 0.8981

Relative change: 1.19%

High: 0.8995

Low: 0.8872

Main Trend: Bullish

Resistance 1: 0.9000 figure

Resistance 2: 0.9032 August 9 high

Resistance 3: 0.9100, current 2018 high

Support 1: 0.8974 September 6 low

Support 2: 0.8940 August 14 high

Support 3: 0.8896 August 14 swing low

Support 4: 0.8876 September 11 low

Support 5: 0.8840 key level

Support 6: 0.8800 figure

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.