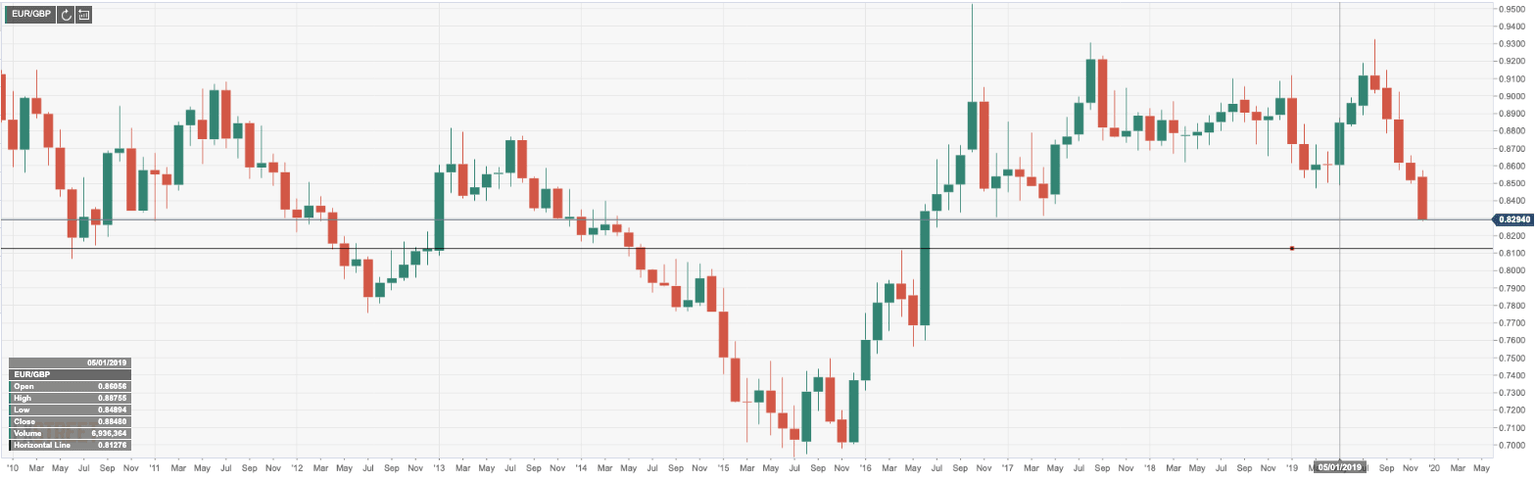

EUR/GBP takes out April 2017 lows at 0.8297 on landslide Tory exit polls

- EUR/GBP has dumped to the lowest levels since July 2016 on Tory landslide victory exit polls.

- Tories outright victory with 368 seats vs Labour 191 seats sends GBP on a tear.

EUR/GBP has stabilised at a key support level near the lows of the day post the exit polls. EUR/GBP currently trades at 0.8283 having travelled down from a high of 0.8445 to a low of 0.8278. The UK election exit polls give the Tory party a majority of 86 in what will be a “phenomenal victory” is the exit polls are accurate.

Exit poll results in full

And here are the full exit poll results.

- Conservative majority: 86

- Conservatives: 368

- Labour: 191

- SNP: 55

- Liberal Democrats: 13

- Plaid Cymru: 3

- Greens: 1

- Brexit party: 0

- Others: 22

John Bercow told Sky News it would be an “absolutely dramatic victory” that would allow Johnson to get “phase one” of the Brexit process through by the end of January" - GBP bullish.

However, reacting to this evening’s exit poll, a Labour spokesperson argued:

It’s only the very beginning of the night, and it’s too early to call the result.

We, of course, knew this was going to be a challenging election, with Brexit at the forefront of many people’s minds and our country increasingly polarised.

But Labour has changed the debate in British politics. We have put public ownership, a green industrial revolution, an end to austerity centre stage and introduced new ideas, such as plans for free broadband and free personal care. The Tories only offered more of the same.

EUR/GBP levels

EUR/GBP has taken out the April 2017 lows at 0.8297 and has marked a fresh low of 0.8278, lowest since July 2016 - (a double bottom 2016/2015 support area). On an extension here, bears can look for 0.8130/50 April 2016 highs and Feb 2014 lows.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.