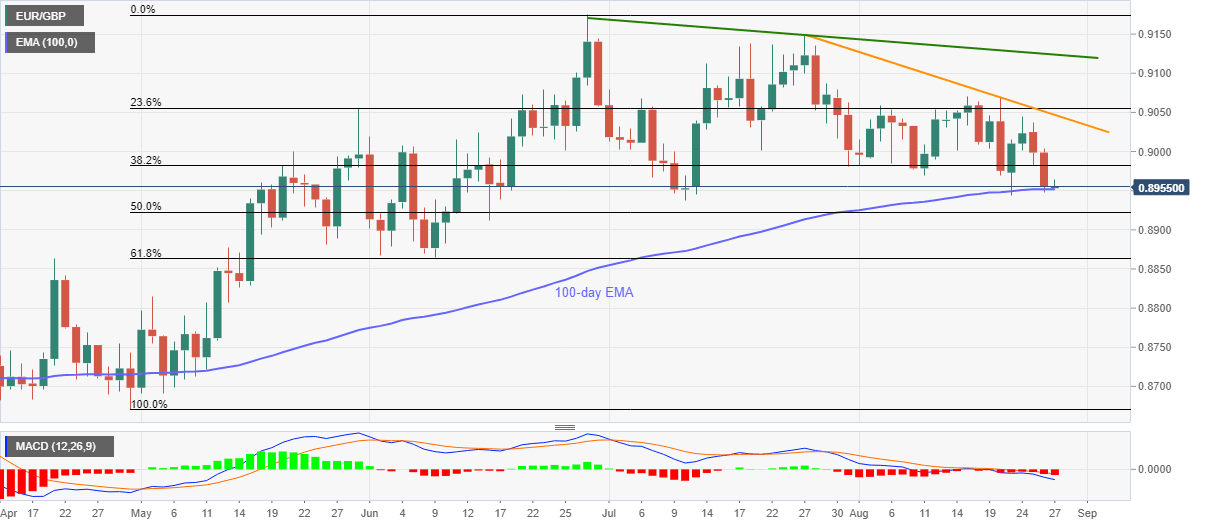

EUR/GBP Price Analysis: 100-day EMA probes bears attacking 0.8950

- EUR/GBP snaps two-day losing streak despite bearish MACD.

- Monthly resistance line guards recovery beyond 0.9000 threshold.

- 50% and 61.8% Fibonacci retracement levels will be the key for sellers.

EUR/GBP marks the third bounce off 100-day EMA in a week while heading into Thursday’s European session. Even so, the pair’s latest U-turn from 0.8953 seems to fade the upside momentum around 0.8960 by the press time.

While bearish MACD and failures to keep the buyers on the table favor the sellers, the pair’s daily close below 100-day EMA level of 0.8950 becomes necessary to eye 50% Fibonacci retracement of April-June upside around 0.8925.

Although odds favor the pair’s weakness below 0.8925, the 0.8900 psychoglical magnet and 61.8% of Fibonacci retracement close to 0.8860 will challenge the Pound bulls afterward.

Alternatively, a clear break of 0.9000 mark will escalate the pullback towards a falling trend line from July 27, at 0.9046 now.

In a case where the EUR/GBP prices remain strong past-0.9045, the monthly high near 0.9070 and a falling trend line from June, currently around 0.9123, will be the key to watch.

EUR/GBP price analysis

Trend: Bearish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.