- EUR/AUD trades little changed around 1.5825 during the initial hours of Asian trading on Thursday.

- January month Australian jobs report, to be released on 00:30 GMT, will become immediate focus of the pair traders.

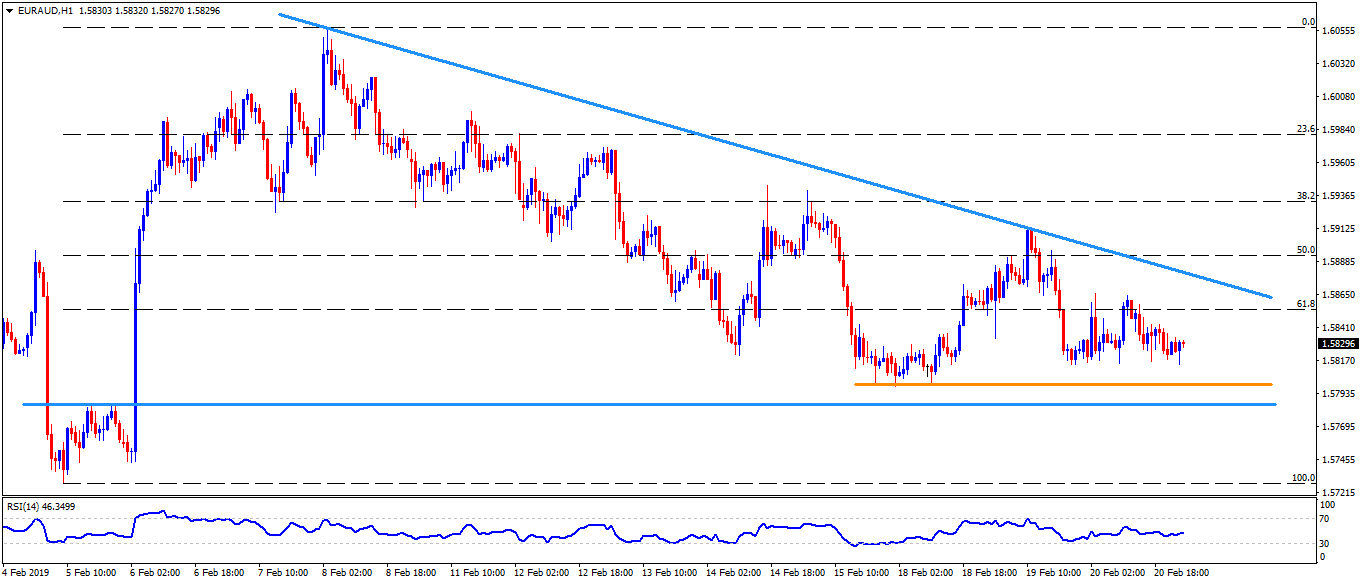

- Nearly three-week-old descending trend-line portrays the pair’s gradual declines since early-month.

- However, horizontal-line connecting lows marked on Friday and Monday, followed by late highs of February 05, could offer immediate support to the pair around 1.5800 and then near 1.5785.

- In case prices refrain to respect 1.5785 support, 1.5740 and 1.5725 are likely following numbers to gain market attention.

- On the contrary, 1.5865 could restrict the pair’s immediate upside ahead of highlighting the 1.5885 trend-line resistance.

- Should the quote rallies past-1.5885 then 1.5920 and 1.5970 can offer intermediate halts during the upward trajectory to 1.6000 round-figure.

EUR/AUD hourly chart

Additional important levels:

Overview:

Today Last Price: 1.5831

Today Daily change: 5 pips

Today Daily change %: 0.03%

Today Daily Open: 1.5826

Trends:

Daily SMA20: 1.5892

Daily SMA50: 1.5965

Daily SMA100: 1.5924

Daily SMA200: 1.5856

Levels:

Previous Daily High: 1.5919

Previous Daily Low: 1.5815

Previous Weekly High: 1.6

Previous Weekly Low: 1.5803

Previous Monthly High: 1.6914

Previous Monthly Low: 1.5721

Daily Fibonacci 38.2%: 1.5855

Daily Fibonacci 61.8%: 1.5879

Daily Pivot Point S1: 1.5788

Daily Pivot Point S2: 1.5749

Daily Pivot Point S3: 1.5684

Daily Pivot Point R1: 1.5892

Daily Pivot Point R2: 1.5957

Daily Pivot Point R3: 1.5996

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.