EU Commission to mobilize EUR750 billion for the coronavirus recovery fund – DPA

Ahead of the European Union (EU) Summit aimed to unveil a post-COVID-19 recovery plan, the Deutsche Presse-Agentur GmbH (DPA) came out with headlines, reporting that the EU Commission is likely to mobilize EUR750 billion for the fund.

The German media outlet added that the proposal contains EUR500 billion grants and EUR250 billion loans.

Market reaction

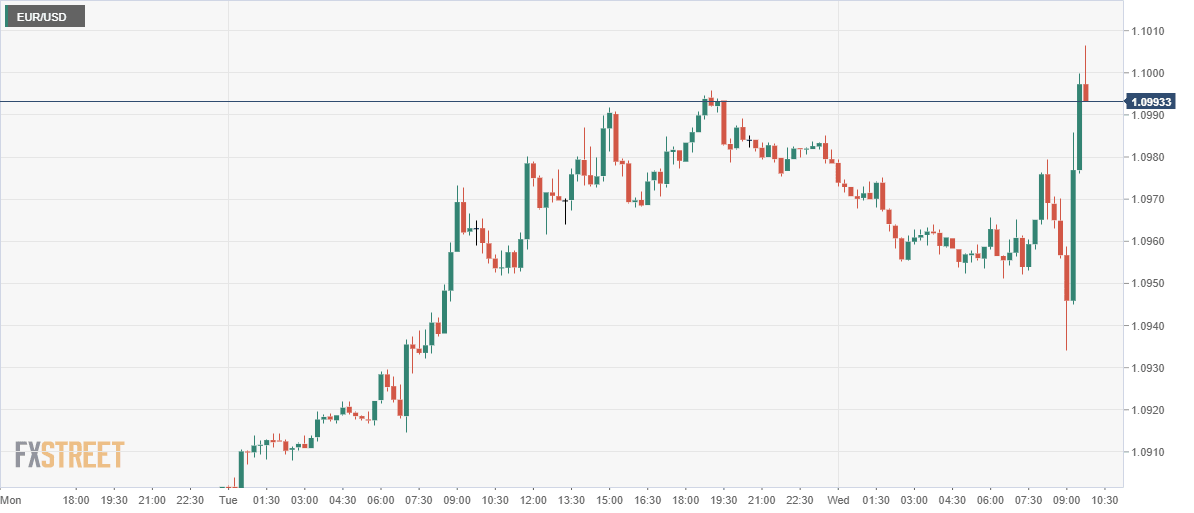

The above report rescued the EUR bulls, as EUR/USD swung back higher to conquer the 1.1000 barrier. At the press time, EUR/USD trades 0.20% higher at 1.1000.

In response, the Italian 10-year bond yields tumbled to fresh seven-week lows, with Italy-Germany 10-year yield differentials tightening the most since early April, at around 190 pips.

The risk sentiment got a further boost, as the pan-European benchmark index, the Euro Stoxx 50 rallied 1.70%.

EUR/USD 15-minutes chart

EUR/USD Technical levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.