Stocks news and Forecast: Earning reports from household names– Part 3

Another day, another set of earning reports.

Wednesday’s focus is on McDonald’s (NYSE: MCD), Facebook (NASDAQ: FB), Shopify (NYSE: SHOP), PayPal (NASDAQ: PYPL), and Spotify (NYSE: SPOT).

As these earning reports are coming in halfway through the week, it would be interesting to note each Company’s stock price movements since Monday. Investors can be fickle, and last-minute adjustments may be seen in these trendy household names.

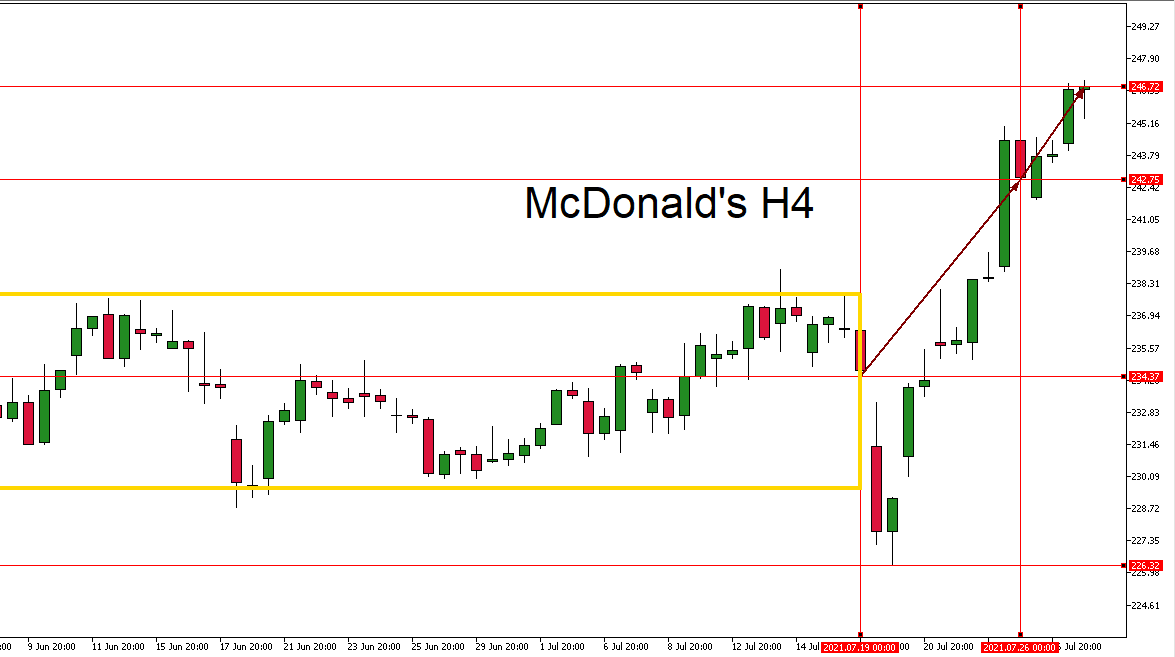

McDonald’s breaks out of its range in time for earning report

Investors have been upsizing their orders for McDonald’s stock in the past week and a half. The price movement is in stark contrast to the ranging the stock has experienced since May. The price of MCD has grown from a 4-month low of US ~$226 up to an all-time high of US ~$246. In the two days of this week, investors are dieting, and the price growth has slowed. On Tuesday trading, McDonald’s stock rose 0.99% and then an additional 0.11% in after-hours.

McDonald’s is anticipated to report revenue of US $5.6B before the bell on Wednesday. Investors expect the Company to continue recovering its sales, a trend suggested in the Company’s last quarterly report. There has been no indication that this might not be so. The only great barrier to the Company’s recovery is the Delta variant of Covid spreading in America. Although, this concern is too recent to have likely interfered with McDonald’s 2Q report.

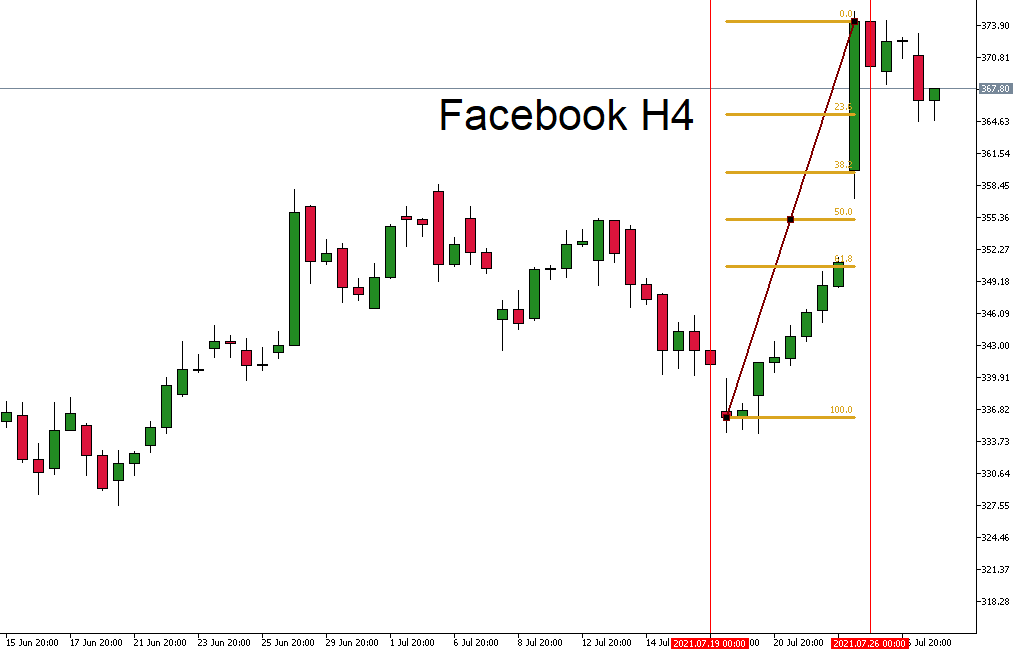

Does Facebook have enough room to move upwards after a positive earning report?

Now, looking at Facebooks share price movement in the same calendar period as McDonald’s paints a slightly different picture. Last week was kind to FB, with a 4% price jump occurring on the final day, closing the stock at US $374.88. Investors appear to believe that this last jump was a little too ambitious and has since retraced to US $367.80. Although, it is safely above the 23.6% Fib level.

At the close of Wednesday trading, Facebook is expected to report revenue of US $27.9B. Bear in mind, Facebook’s peers have all beat their earnings forecasts this week and last, and the market would hardly be surprised if it were to follow suit. However, the positive news may not translate to a lift in share price. This is a misfortune that befell Apple on Tuesday after its earnings report came back exceedingly positive. In after-hours trading, APPL was trading down 2.1%. Perhaps FB slight retracement on Tuesday will mean there is room for growth if Facebook massively beats its estimate.

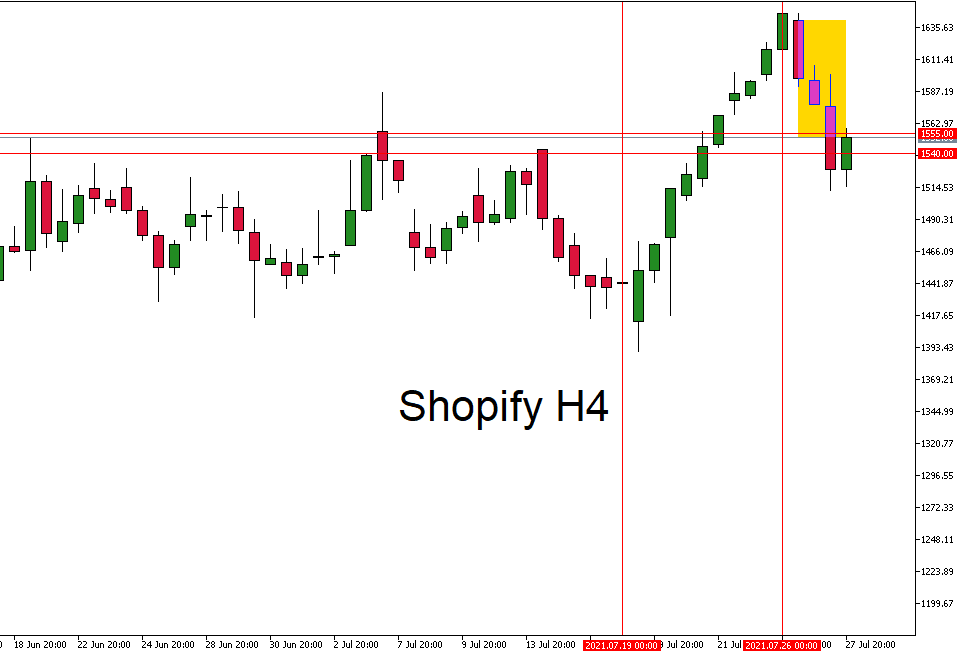

Will Shopify stick to brand and smash revenue estimates?

Shopify has had a more dramatic retracement this week in the lead up to its earnings report. Falling from US $1,640 to US $1,553, or approximately 5.3%.

The stock price has found resistance around US $1,540 – 1,555 price several times in the past month and a half. The share price is, of course, currently just below the upper bound of this range.

Shopify has a custom of radically surpassing its estimated quarterly revenue. In its past four quarterly reports, SHOP has exceeded its estimated revenue by an average of 39%.

SHOP is likely to beat its estimates again in Q2, as several of the Company’s cash-generating payment features start to carve out a more prominent presence on the Company balance sheet.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Mark O’Donnell

Blackbull Markets Limited

Mark O’Donnell is a Research Analyst with BlackBull Markets in Auckland, New Zealand.