DXY: Markets pricing in a Fed rate cut although a EUR/USD correction is on the cards

- DXY sent to a 61.8% Fibonacci retracement golden ratio target,.

- Federal Reserve rate cut expectations rocket and US yields drop to record lows of 1.235%.

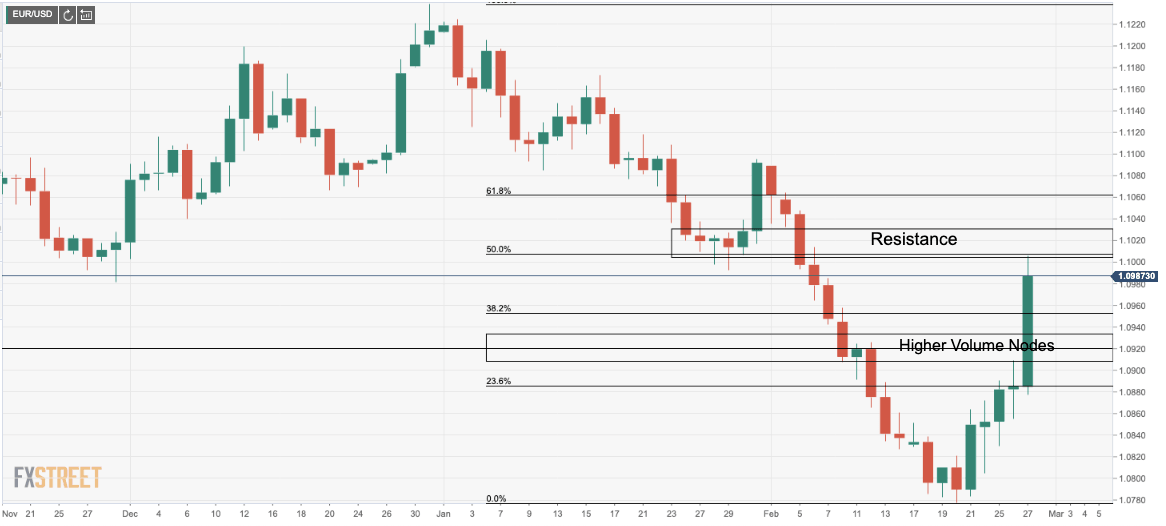

- However, according to volume price analysis (VPA), EUR/USD is overstretched to the upside a mean reversion trade could come into play.

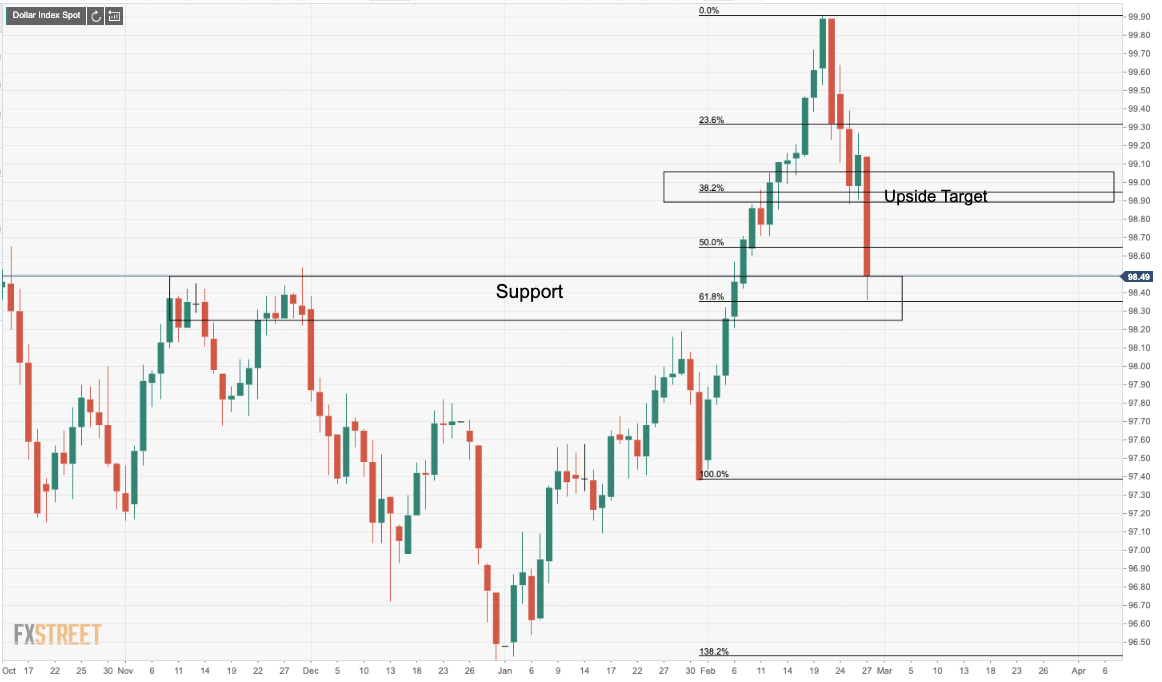

With fears of the coronavirus spreading, markets are now pricing in roughly three rate cuts from the Fed in 2020. The DXY is extending its downside correction on Thursday to complete a 38.2% Fibonacci retracement of the 2020 rally to a key support structure in the midpoint of the 98 handle. At the time of writing, DXY trades at 98.54 between a low of 98.36 and a high of 99.05, -0.62% on the day, so far.

The coronavirus has sent a shock wave of risk-off in global markets heavily impacting the US stock market, US yields and the exodus from Wall Street has impacted the US dollar. In the past five days, the S&P 500 has been down by around 8%. In comparison, equities tanked around 14% in the fourth quarter of 2018. However, the US 10-year yields are sliding deeper into the record territories well below 1.30% (to a low of 1.2350% today, -4.12%).

Jitters around the coronavirus spreading within the US, knocking positions out of US stocks with money flowing into safe-haven assets including US bonds. There are risks of further slides in the stock markets should the coronavirus spread advance at a faster pace than the government has presumed, either on the domestic scale or globally, by impacting global economic supply chains and growth. This is raising prospects for a Federal Reserve rate cut.

Fed rate cut on the cards

Weighing on the dollar further today, in the latest CME FedWatch Tool, the count down to the next Federal Open Market Committee (FOMC) rate hike with the CME FedWatch Tool, based on the Fed Funds target rate, shows a 70% probability of a rate cut as soon as March compared to 33% on Wednesday.

"The market pricing can be attributed to an “asymmetric risk outcome” in the sense that the bar for a rate hike in the coming years appears to be set at an unprecedented high level, a rate cut has moved closer," analysts at Norda argued.

"In our view, the arguments are in place for the Fed to act soon. On several economic key metrics (PMIs, ISM, wages etc), the economy looks more gloomy than, for instance, prior to the July 2019 rate cut decision. Furthermore, we do not see the upcoming election as a real barrier to a rate cut."

However, the analysts at Nordea are not of the opinion that rate cut will come as soon as March. "If the coronavirus is not soon contained, we think a rate cut in April could be on the cards."

DXY levels

Looking to the charts, the DXY has dropped to a key support structure and is leaving a larger monthly bearish pin bar in. The price has completed a 38.2% Fibonacci retracement of the 2020 range and a 61.8% retracement of the late Jan and early Feb daily lows -YTD highs. Reinforced by November resistance, this could be a strong level of support and a subsequent correcting back to the 99 handle for a test could be on the cards, especially when factoring overbought conditions in EUR/USD.

EUR/USD daily chart

EUR is weighed to the DXY by 57.6% and EUR/USD has rallied to a strong resistance structure, breaking through sell stops at 1.0880/20 all the way to the 1.10 handle for a 50% mean reversion of the 2020 downtrend. Bears will be looking for opportunities here and profit-taking for month-end could well be the catalyst for a correction back to higher volume nodes of price (according to VPA), with a target back towards 1.0920. This would likely boost the DXY back towards 98.90.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.