- Crude finds support at $70.52 a barrel after losing more than $2 in the last two days.

- Oil has been easing from its 2018 top as OPEC says it intends to raise production to compensate the potential loss from Venezuela and Iranian output.

Crude oil slides for the third day in a row and finds support at $70.52 a barrel. Indeed, oil has retreated from its 2018 high at 72.83 on talks that OPEC could raise its oil production to compensate the potential loss from Venezuela and Iranian output.

Venezuela is in the midst of a deep crisis and its oil output is at a 70-year low while impending sanctions on Iran can materialize in a supply squeeze of up to 500,000 barrels per day, according to analysts.

Meanwhile, it has been reported that the International Maritime Organization (IMO) will enforce new emissions standards in order to reduce the pollution from ships. It is set to enter into effect on January 1, 2020, and according to analysts, this can be another major driver for oil prices over the next two years as the energy and shipping industries are not quite ready for the incoming change.

More specifically, the IMO is looking to cut sulfur emissions which are found in acid rain which damage wildlife, vegetation and is also responsible for respiratory illnesses.

Looking further investors will pay attention to the weekly rig count on Friday at 17:00 GMT which can provide short-term trading opportunities but is highly unlikely to provide any long-term directional clues.

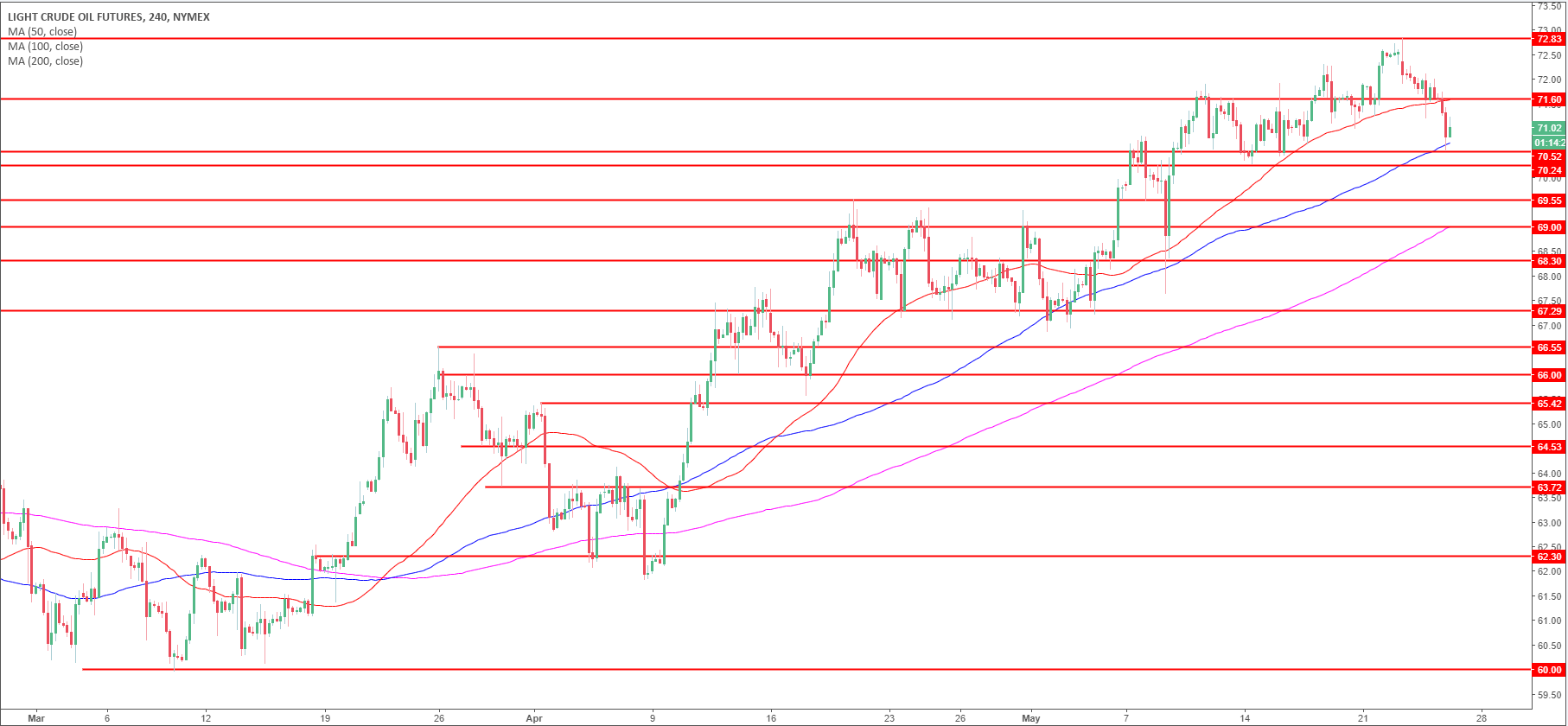

WTI crude oil 4-hour chart

Oil is trading above its 100 and 200-period simple moving averages (SMA) on the 4-hour time-frame while it is trading below the 50-period SMA. Although black gold fell for the last two days, the trend remains strong and the market is back into familiar ranges. Bulls will try to keep the market above the 70.24 swing low and if they fail the next support is seen at 69.55 swing high. Bulls are also finding support at the 100-period SMA and will try to drive the market back to the 71.60 resistance and possibly to the 72.83 level which is the high of 2018.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.