- Venezuela economic crisis combined with potential further US sanctions can lead to a big oil supply squeeze.

- Earlier in the day, the Energy Information Administration reported a lower crude oil stockpile than anticipated at -1.404M versus -0.763M.

Crude oil West Texas Intermediate (WTI) is trading at around $71.47 a barrel up 0.78% on Wednesday.

The economic crisis in Venezuela is hitting its crude oil production which in recent months dropped to 1.4 million barrels a day (bpd) which represent almost a 40% drop since 2015. Creditors are closely monitoring the country’s assets and the US is considering to impose further sanctions on Venezuela. The critical situation in the country can lead to a supply squeeze and potentially send oil prices even higher.

Referring to the upcoming election in Venezuela, Tamas Varga, analyst at PVM Oil Associates commented: "Maduro will win as the election is rigged and it won't be fair. The more important question is how the US will react after the official results. If US refineries are forbidden from buying Venezuelan crude then you'd have to imagine the country is in trouble."

Meanwhile, the OPEC (Organization of the Petroleum Exporting Countries), in its April report, raised their demand forecast by 25,000 bpd to 1.65 million bpd. Reason for the upward revision was attributed to better-than-expected economic data in OECD countries (Organization for Economic Cooperation and Development). OPEC added that better economic data in China, India and Latin America would likely push oil demand higher. OPEC said that they were convinced that the biggest oil glut in history has been virtually eliminated.

Crude oil prices are also on the rise because the US has recently withdrawn from the Iran nuclear deal which can potentially put at risk up to 500,000 bpd, according to analysts.

Meanwhile, earlier in the day, the Energy Information Administration reported a lower crude oil stockpile than anticipated at -1.404M versus -0.763M which is seen as bullish.

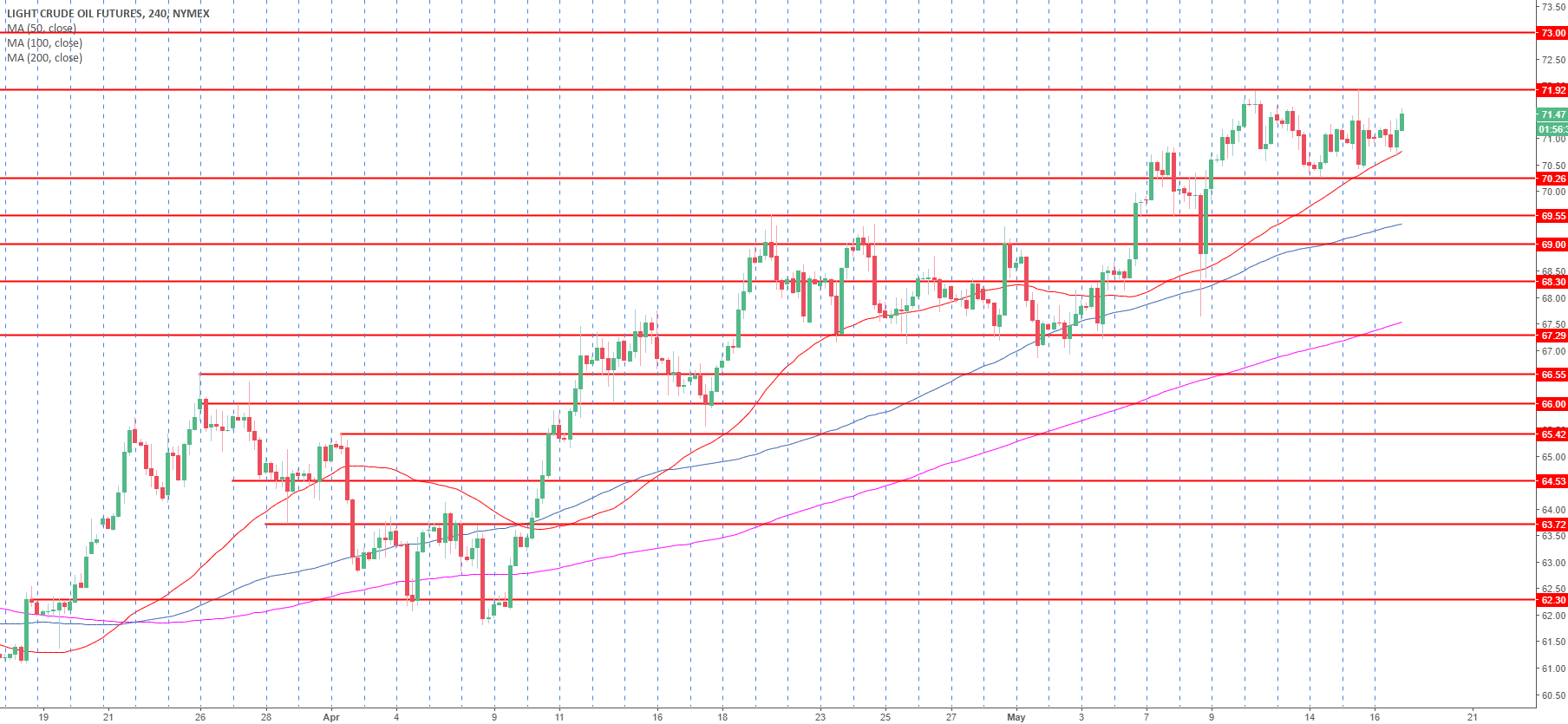

Crude oil WTI 4-hour chart

Crude oil is in a strong bull trend, resistances are seen at the 71.92 swing high, 72.00 and 73.00 psychological levels. To the downside, bears will likely meet support at the 72.26 and 69.55 swing lows followed by the 69.00 psychological level. The market is trading above its 50, 100 and 200-period simple moving averages on the 4-hour time-frame suggesting a strong upward momentum.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

GBP/USD recovers to 1.3300 ahead of UK Retail Sales data

GBP/USD trades with a positive bias for the third straight day on Friday and hovers near the 1.3300 mark in the European morning on Friday. Traders digest the BoE and Fed policy decisions, awaiting the UK Retail Sales data for further trading impetus.

USD/JPY keeps BoJ-led losses below 142.50, Ueda's presser eyed

USD/JPY remains in the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

Gold consolidates weekly gains, with sight on $2,600 and beyond

Gold price is looking to build on the previous day’s rebound early Friday, consolidating weekly gains amid the overnight weakness in the US Dollar alongside the US Treasury bond yields. Traders now await the speeches from US Federal Reserve monetary policymakers for fresh hints on the central bank’s path forward on interest rates.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.