- CCIV still suffering after-effects of the Lucid Motors merger.

- Electric Vehicle (EV) sector to face growing competition.

- CCIV shares still hold strong retail interest.

Update March 4: Churchill Capital Corp IV (NYSE: CCIV) has been on the back foot on Thursday, falling below $24. Competition in the EV sector, a reality check following the SPAC merger with Lucid Motors and rising bond yields are weighing on shares. Investors seem unimpressed with a potential deal with Dolby – due on March 17. In the short-term, re-evaluating the merger, a "sell the rumor" effect and rivals in China weigh on CCIV shares.

Another day another loss for CCIV shares as the post-Lucid Motors hangover continues. Granted it cannot all be put on CCIV shares shoulders as the broader market also looks to be struggling for momentum.

Stay up to speed with hot stocks' news!

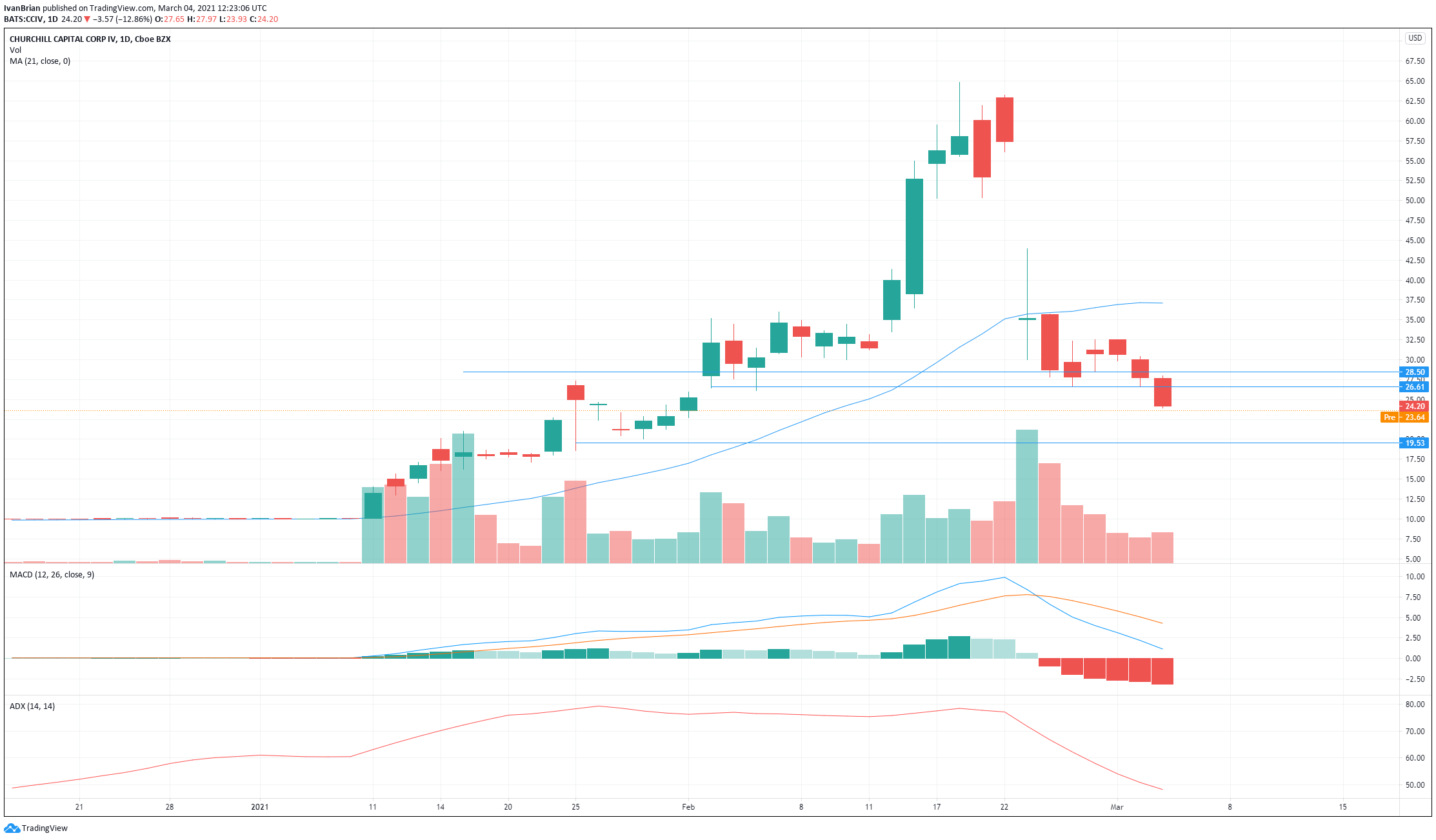

CCIV Stock Price

Churchill Capital IV shares fell to their lowest level since February 1 as investors continue to reevaluate the merger deal. Weakness in the broader market may have led to exacerbated losses for CCIV shares. Some profit taking by early investors may be hitting, now that losses from other investments are feeding through portfolios.

CCIV shares closed on Wednesday at $23.02 for a loss of 4.8%. CCIV shares peaked at $64.86 on February 18.

Late-stage investors are the ones suffering the most, as peak Lucid Motors merger fever hit social media. Despite CCIV shares launching at $10, traders bid CCIV stock up to beyond $60. The hype of Lucid being the next Tesla, and the new equity market phenomenon of Fear Of Missing Out (FOMO) appear to have been the main factors behind the spike.

While the debate over whether indeed Lucid does manage to become the next Tesla may or may not prove correct, timing still plays a key role in markets. Markets rarely go up in straight lines indefinitely and an appreciation of that magnitude requires careful analysis and risk management.

The other factor of course which was a definite influence on the CCIV collapse was the PIPE transaction being priced at $15 per share, a significant discount to $60. $15 was actually higher than the IPO launch price of CCIV at $10 which is where a further capital raise through a PIPE transaction would normally have taken place.

CCIV Stock Forecast

So where to from here. Well, now it starts to look slightly more attractive. The worries over FOMO trading at $60 have evaporated. So it is just a case of trying to value what you are left with, which is Lucid. Delivery delays have hit the newswires recently which may be behind some of the sell-off. Lucid now expected to begin deliveries in the second half of 2021 and not Spring 2021 as initially hoped. This would hopefully create a nice catalyst for the shares, assuming all goes well. Certainly, initial pictures of the car are impressive and with a former Tesla Chief Engineer at the helm, one would expect the technology to be sound.

Lucid Motors has a limited timeframe to launch and gain traction with consumers. The competition will increase for all EV manufacturers as more and more legacy automakers commit to going fully electric. Recent comments from Volvo about being fully electric by 2030 and Ford that it will be fully electric in Europe by 2030 are evidence of that.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.