Cannabis Stock Price: Have Aurora, Canopy Growth, and Tilray bottomed out?

- Marijuana stocks have suffered on Tuesday after a warning from the FDA.

- Other headwinds may be starting to fade for Aurora Cannabis (ACB).

- Canopy's Canadian license may help it recover as well.

- Tilray's (TLRY) low price may help it recover from the lows.

The US Food and Drug Administration (FDA) has been weighing on cannabis stocks with fresh guidance. The might regulator has said that CBD products may cause liver injury and other damages. The news came as another blow to the marijuana sector which has been struggling with a slow Candian blowout and financial issues.

Prices of pot stocks declined across the board, extending their climbdown after rising last week on hopes for US legalization.

However, some positive news may help individual stocks.

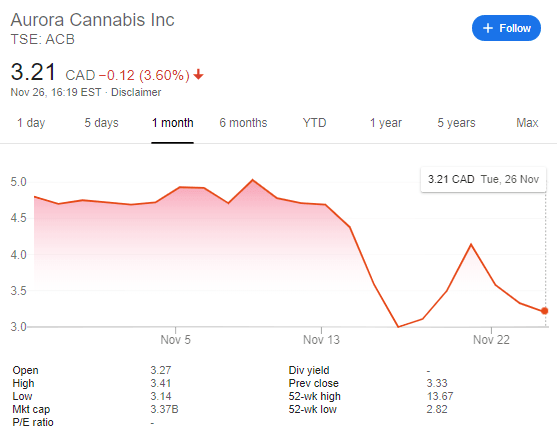

Aurora Cannabis (ACB) Stock Price

Aurora has neared the recent cycle lows of $3 per share but may find buyers after announcing a new deal. The Edmonton-based company will develop CBD topicals with UFC and is set open a flagship WEM store, which will be Canada's largest retail space for marijuana products.

ACB's stock price may rise after it will save some C$190 by abandoning the construction of two facilities. The news comes after the company concluded its convertible debentures swap.

Overall, the firm may enjoy a better financial footing.

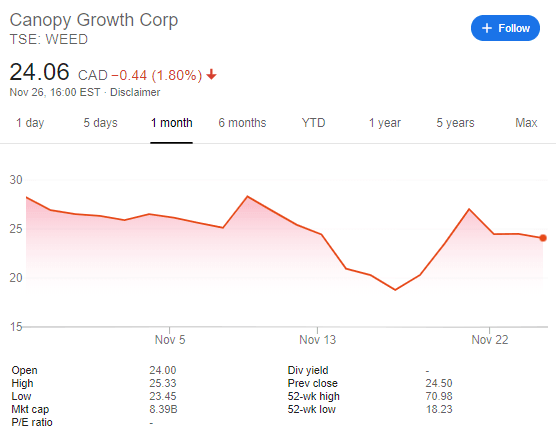

Canopy Growth Corp (CGC) Stock Price

Canopy Growth Corporation (CGC) has managed to weather the storm may be ready for a recovery. The firm invested in hemp assets in the state of New York. Moreover, CGC has a massive war chest of funds that could help it survive in case of a downturn, while its competitors are weeded out.

The Smiths Falls, Ontario based firm has also enjoyed an upgrade from Bank of America, which may convince institutional investors to jump in.

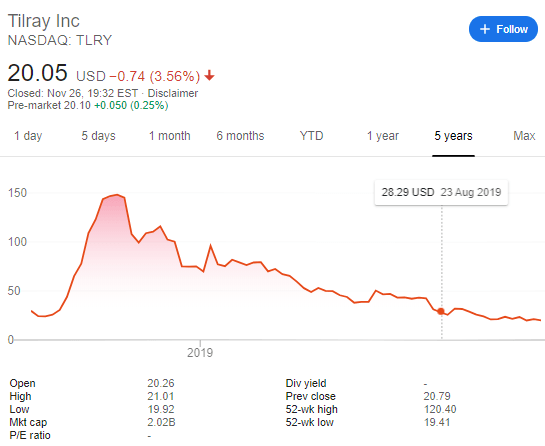

Tilray (TLRY) Stock Price

Tilray Inc. based in Nanaimo, on Vancouver Island, was one of the darlings of the stock markets in 2018, when interest in marijuana stocks went sky-high. After a peak near $150, Tilray's price has been declining.

Tilray (TLRY) is trading around $20, a massive downfall, but that may be an attractive price. The firm, which has operations in Australia, New Zealand, Portugal, Germany, and also Latin America, may enjoy bargain seekers.

While the company lost some C$47 million, its revenue soared to $68.

Investing in Cannabis Stocks

Since Canada fully legalized marijuana in late 2018, weed shares have been on a roller coaster ride. Similar to the dot-com bubble, the potential is always there, but the hype proved exaggerated.

As the industry matures, investors are crunching companies' finances and health regulators are also stepping in. Many companies that tried to ride the tide may find themselves out of business, while

More Top 3 Cannabis Stocks: Aurora(ACB), Canopy(CGC), New Age(NBEV), high volatility, different directions

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.