Aurora Cannabis Stock Price: Debentures, upbeat survey keep it bid, outlook cautiously optimistic

- Aurora's stock price has been recovering from the lows as investors convert debentures.

- Optimism about investment in the sector has been pushing all stocks higher.

- Legalization may be the next substantial driver for pot stocks.

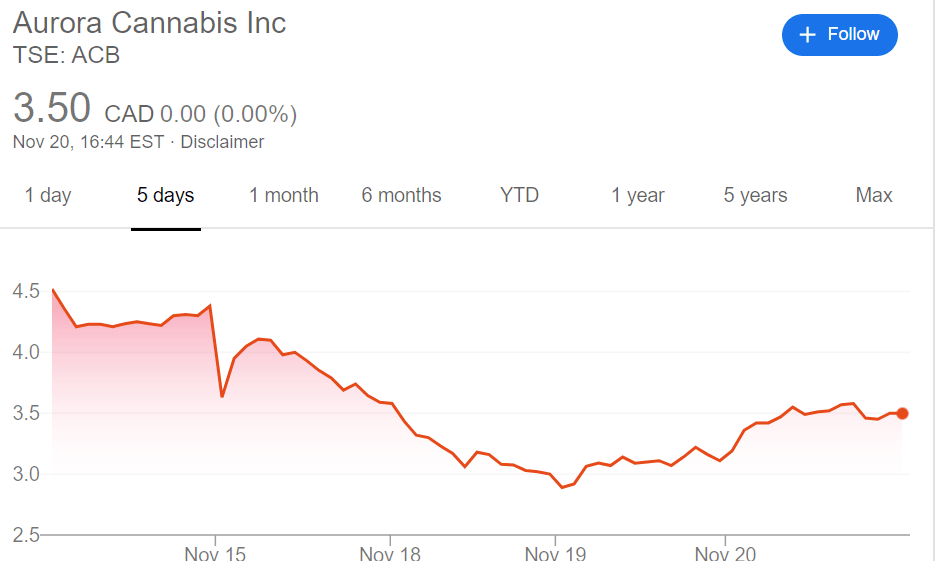

Aurora Cannabis Incorporated (ACB), the Edmonton-based company, has leaped by over 12% on Wednesday and closed at a price of $3.50. Its recent rises defy speculation that placed a $1 target for the Toronto-traded share. The most recent surge came after Aurora announced that 94% of debentures allowed to settle this week.

While some have criticized the highly-dilutive conditions, the quick uptake, coming well before the March 2020 deadline, has encouraged investors. Later this week, the firm will publish a press release by detailing the status of the financial maneuver.

Investing in Marijuana Stocks

The marijuana company has also benefited from optimism about the broader sector. According to a survey by KCSA Strategic Communications, no fewer than 86% of respondents said they are bullish on the pot industry despite substantial falls in equity prices. Even in the face of a potential recession, only 5% said it would cause them to sell off their holdings. However, investments have become smaller, with fewer heavy-weight exposures of over $100,000.

For Aurora and the broader sector to rise, legalizing weed on the federal level in the US is needed. The House of Representatives is advancing legislation that includes expungement, but the road is long until the world's largest economy adopts the Canadian model.

Aurora Stock Price Today

Despite the significant rise on Wednesday, ACB is still down on the week. In order to close the week on a high note, the share price needs to gain another dollar. It closed the previous week around $4.50.

Support awaits at the weekly low of $2.90, but the round level of $3.00 may come into play. Likewise, any further advance may find resistance at $4. These round numbers draw attention and are of psychological importance.

See Marijuana Stocks Price: MORE Act lifts prices from lows, financials still weigh

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.