Canadian Dollar remains offered below 1.3600, looks at US CPI

- Canadian Dollar gives away gains with investors increasingly cautious ahead of US CPI release.

- From a wider perspective, CAD continues searching for direction within previous levels.

- US Inflation and the BoC monetary policy decision, due on Wednesday, are likely to set the USD/CAD’s near-term direction.

The Canadian Dollar (CAD) is trading lower on Tuesday, giving back all the ground taken on Monday. A somewhat more sour market sentiment is boosting the US Dollar across the board, with equities dipping into negative territory and investors focusing on Wednesday’s US Consumer Prices Index (CPI) data.

US inflation is expected to show mixed readings with headline inflation ticking up on the back of higher energy prices. The core CPI is expected to have slowed down, yet at levels well above the Fed’s 2% target for price stability. Investors will analyze these figures with particular attention and, in that sense, an upside surprise might trigger a risk-averse reaction, sending the Loonie to fresh lows.

Shortly afterward, the Bank of Canada (BoC) will release its monetary policy decision. No changes are expected on the benchmark rate, although the soft inflation and employment levels seen last week might prompt the bank to hint toward a rate cut, probably in June. This might add negative pressure to the CAD.

Daily digest market movers: USD/CAD keeps trading back and forth, awaiting US CPI data

- Canadian Dollar pares gains with risk appetite fading as investors prepare for Wednesday’s US CPI release.

- Oil prices are retreating from the multi-month highs at 87.60, adding some pressure on the commodity-sensitive Canadian Dollar.

- US headline inflation is expected to have increased by 0.3% and 3.4% from a 0.4% monthly increment and a 3.2% annual reading in February.

- Core CPI is seen easing to 0.3% in March, from 0.4% in February, with the yearly rate cooling from 3.8% to 3.7%.

- Also on Wednesday, the BoC is expected to leave its benchmark index unchanged at 5%. The main interest will be on any hints toward the timing of the first rate cut.

- Later on Wednesday, Fed Bowman is expected to meet the press. She is a notorious hawk, and last Friday she warned about the likelihood of another rate hike.

- The release of the minutes of the last Fed meeting will close an eventful calendar on Wednesday. In the context of a recent CPI release, Fed policymakers’ comments might have an additional impact on USD crosses.

Canadian Dollar price today

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies today. Canadian Dollar was the strongest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.09% | -0.09% | 0.10% | -0.21% | -0.10% | -0.30% | -0.15% | |

| EUR | -0.09% | -0.17% | 0.01% | -0.30% | -0.19% | -0.38% | -0.24% | |

| GBP | 0.08% | 0.18% | 0.19% | -0.13% | -0.01% | -0.19% | -0.06% | |

| CAD | -0.10% | -0.01% | -0.19% | -0.31% | -0.20% | -0.39% | -0.26% | |

| AUD | 0.21% | 0.31% | 0.13% | 0.31% | 0.12% | -0.08% | 0.07% | |

| JPY | 0.10% | 0.18% | 0.00% | 0.19% | -0.10% | -0.20% | -0.06% | |

| NZD | 0.29% | 0.38% | 0.21% | 0.39% | 0.08% | 0.20% | 0.13% | |

| CHF | 0.15% | 0.25% | 0.08% | 0.26% | -0.05% | 0.07% | -0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

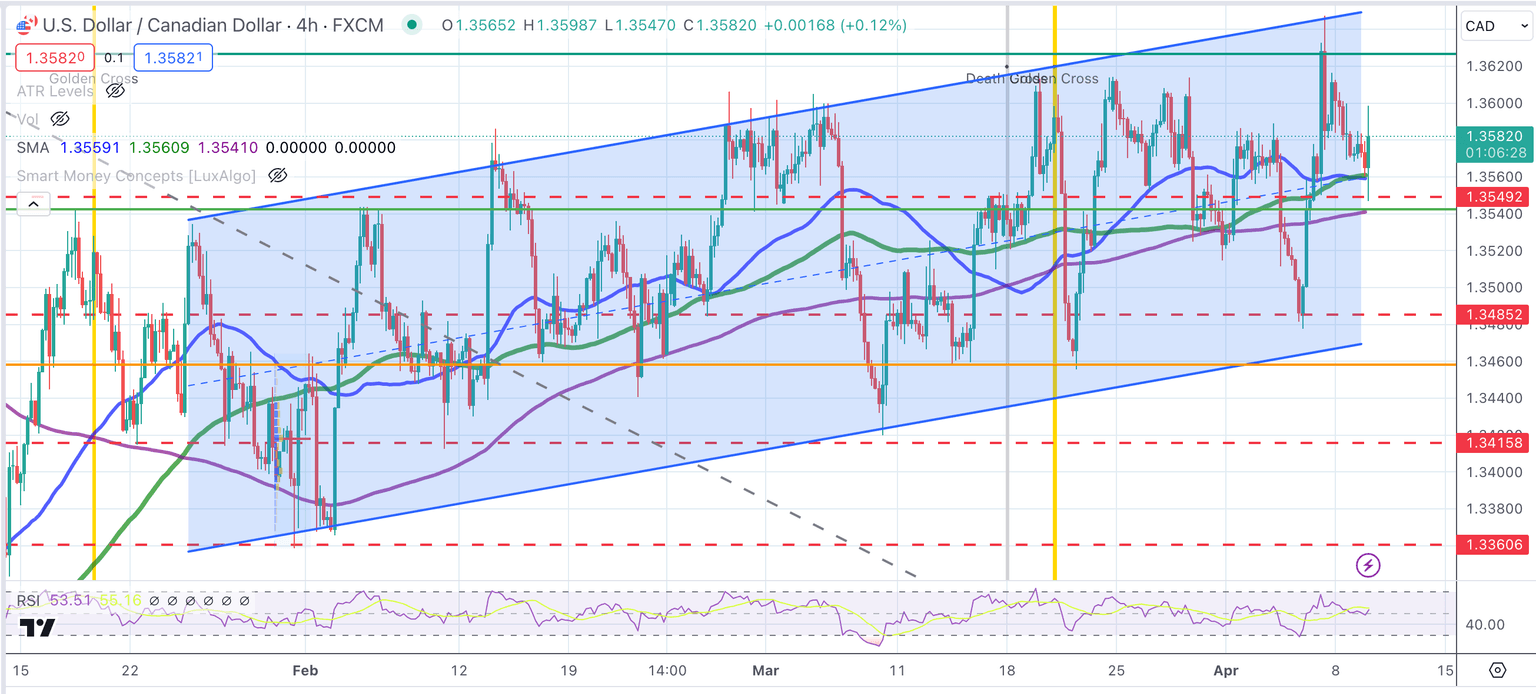

Technical analysis: USD/CAD’s broader bias remains positive, with a key resistance area at 1.3645

The US Dollar has bounced up from the support area at 1.3555. This level is coincident with the US Dollar Index (DXY) support area at 193.90. Investors are cutting back their exposure to risky assets as we head into the US CPI release, returning to the safe-haven US Dollar.

The broader trend remains positive, and the pair has scope for another test at the 1.3645 trendline resistance. Above here, the next target would be the 1.3680-1.3700 area. Support levels remain at 1.3555, the confluence of the 4-hour 50 and 100 SMAs, followed by 1.3480 and 1.3415.

USD/CAD 4-Hour Chart

Canadian Dollar FAQs

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.