- Crude oil jumps more than 2% on Tuesday as Middle-East tensions intensify.

- CAD/CHF is finding support at the 0.7250 level.

The CAD/CHF is currently trading at around 0.73169 up 0.63% on Tuesday as the CAD is gaining some strength with crude oil prices soaring more than 2% on Tuesday and breaking out of a triangle pattern which has been more than two months in the makings. Additionally, Canada is not affected by the US tariffs on steel and aluminum which is a relatively favorable point for the currency. Last week, Bank of Canada’s Poloz said that “monetary policy remains particularly data-dependent” and “BoC cannot take a mechanical approach to policy, even though interest rates likely to move higher over time”.

Coming next on the macro front for the CAD is Deputy Governor C. Wilkins scheduled to speak on Thursday at 18.45 GMT. Retail sales and CPI inflation data are due on Friday at 12.30 and the news is likely to generate volatility in the currency markets.

The Swiss National Bank Quarterly Bulleting is scheduled on Wednesday at 14.00 GMT and no big surprises should shake the market accrding to analysts.

Earlier in the European session, the market seemed to have largely ignored the Swiss State Secretariat for Economic Affairs (SECO's) latest quarterly economic forecasts which upgraded 2018 Swiss GDP to 2.4% from 2.3% previously and 2019 GDP seen at 2.0%, prior forecast 1.9.

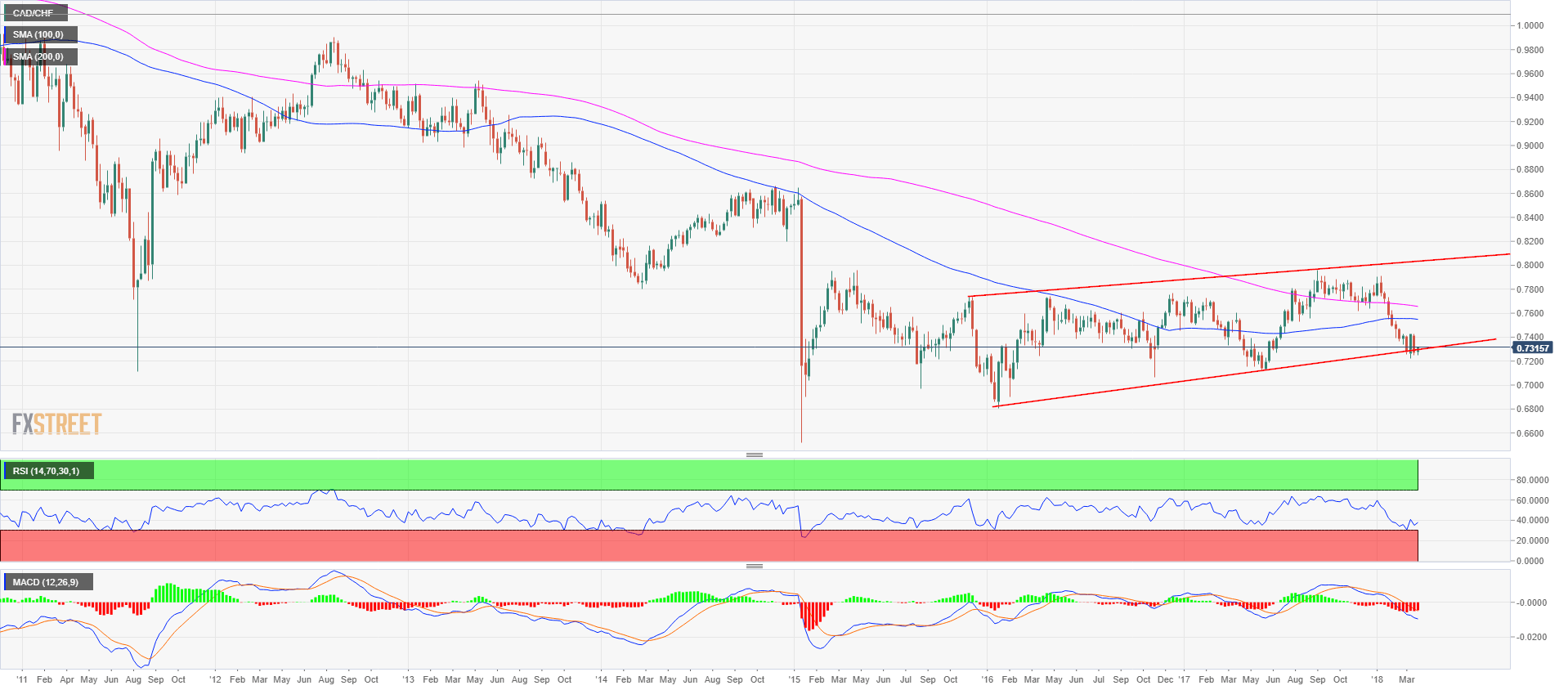

CAD/CHF weekly chart

The CAD/CHF cross is now in its fourth week of trading range bouncing between the 0.7200 and 0.7400 figures. While the RSI is showing some positive divergence the MACD is still indicating a bearish trend.

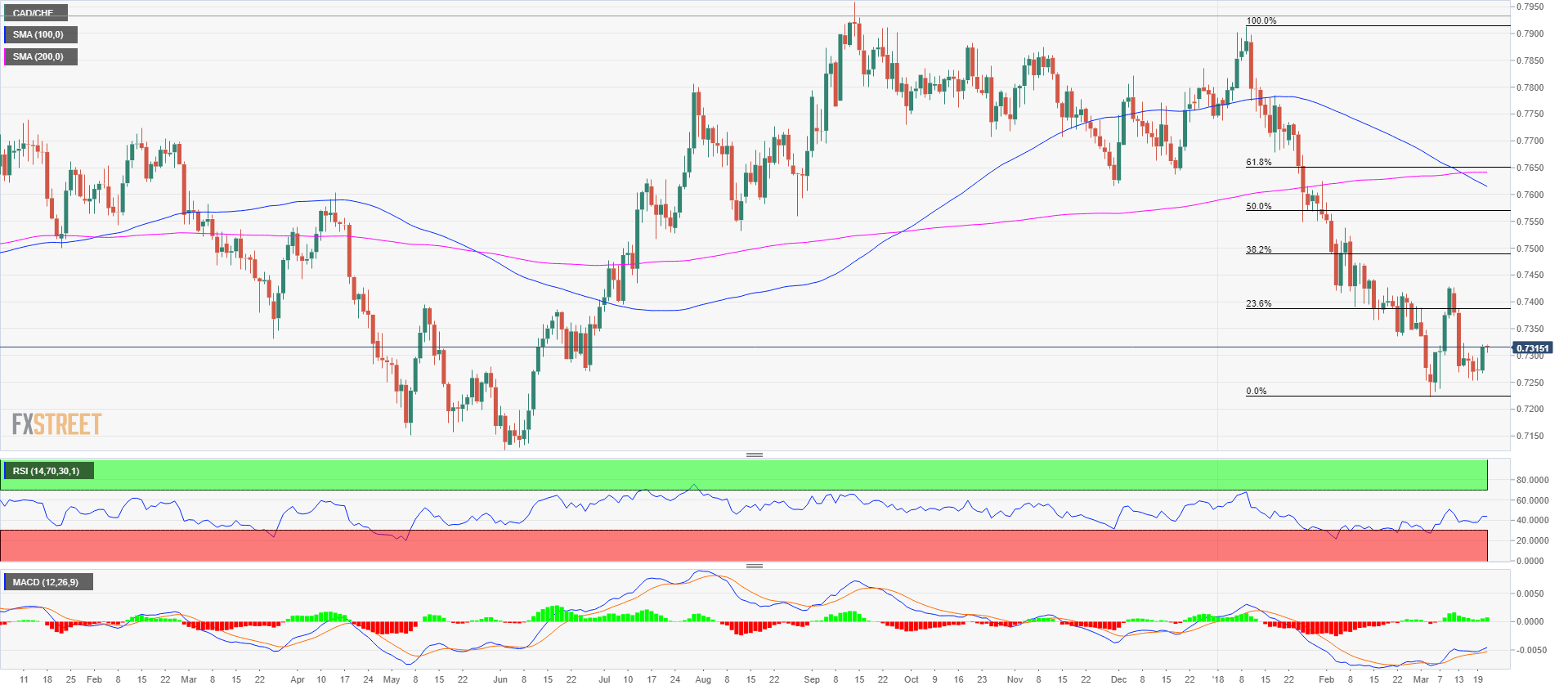

CAD/CHF daily chart

The daily picture offers a drastically different view with the both the RSI and MACD showing positive divergence as the CAD/CHF is consolidating. Support is seen at 0.7250, which is the low of last week, followed by 0.7220 cyclical low. Resistance is seen initially at the 0.7350figure, followed by the 0.7380-0.7400 region with the 23.8% Fibonacci retracement level from the January-March down move.

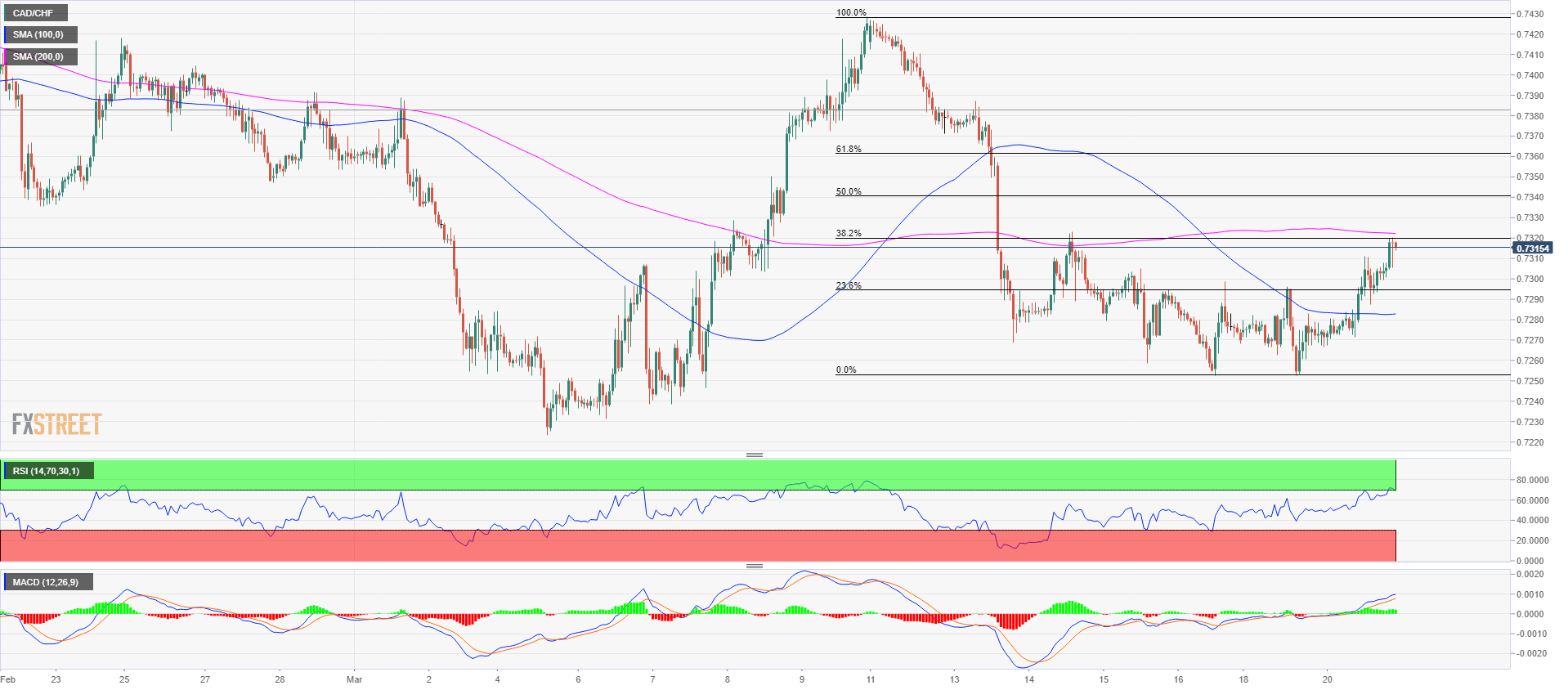

CAD/CHF 1-hour chart

Equally interesting is the 1-hour chart which is pointing out the RSI and MACD positive divergence. If the 0.7320 is broken by the bulls, then next resistance is seen at 0.7340 50% Fibonacci retracement from the March 9-16 bear move; followed by the 0.7360 level at the 61.8% Fibonacci retracement level. To the flip side, if the bulls fail, near-term support is seen at 0.7294 with the 23.6% Fibonacci retracement level; followed by the 0.7250 last swing low.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.