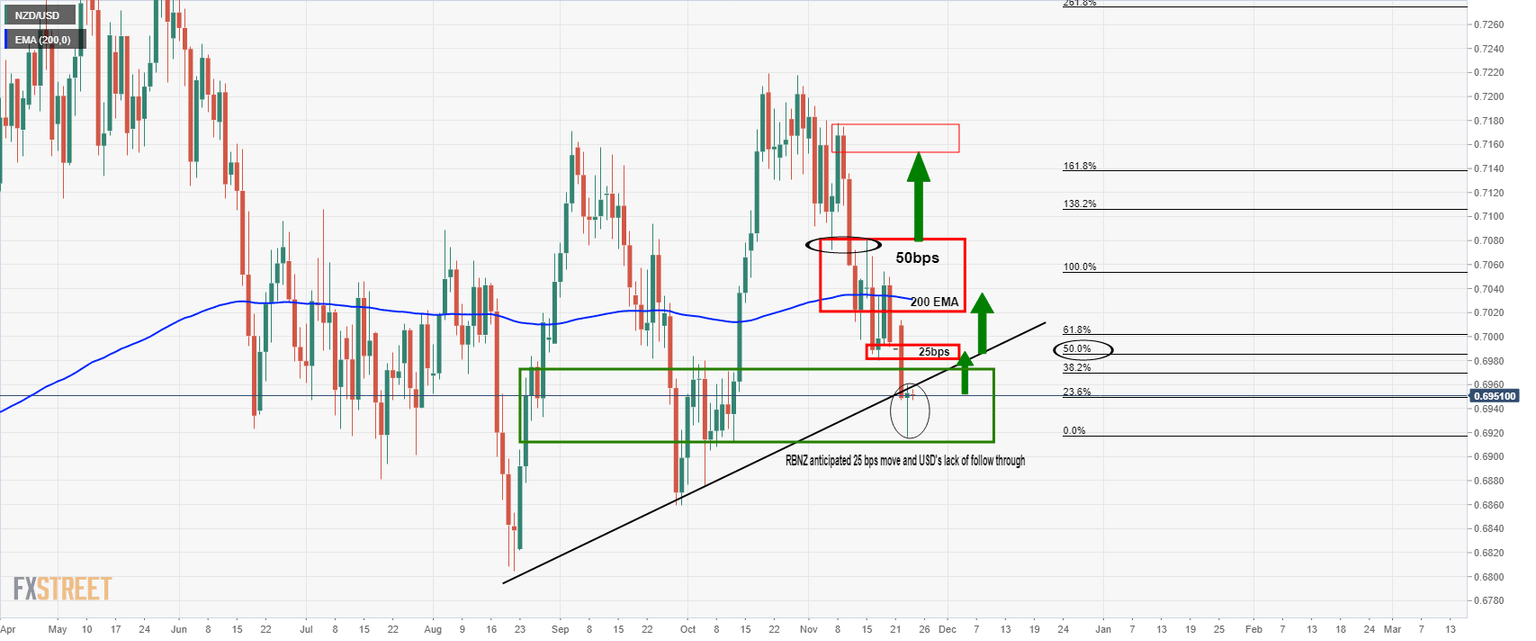

Breaking: RBNZ hikes as expected by 25bps, NZD/USD undecided

The RBNZ has hiked the OCR by 25bps and sees headline inflation above 5% in the near term with the projections showing the cash rate rising to 2% by end of 2022.

Key takeaways from the statement

The statement also said that it would be appropriate to continue reducing stimulus.

Further removal of monetary stimulus is expected and that committee reached a consensus on the policy decision.

The committee also assessed risks to their price stability and maximum sustainable employment objectives as being broadly balanced over the medium term.

RBNZ projections for the path ahead

- Official cash rate at 0.94% in March 2022 (previously 0.86%).

- This moves to 2.14% in December 2022 (vs the prior 1.62%)

- Then 2.3% in March 2023 (prior 1.77%)

- Then 2.61% in December 2024.

These are not the kind of projections the bulls were hoping for and hence the kiwi is lower. Bulls were looking for rate hikes in the region of clips of between 50 and 25bps towards a 3% target.

However, the RBNZ does see that annual Consumer Price Index at 3.3% by December 2022 (against a prior outlook of 2.2%. But, overall, the tone of the Statement was balanced, recognising upside risks to inflation but downside risks to growth and thus traders need to weigh that up, which could be damaging to the kiwi in the near term.

Before the RBNZ statement

However, in the technical preview, NZD/USD Price Analysis: Technical observations before the RBNZ, it was stated that the downside risks were as follows:

RBNZ dovish outcome

''The risk to the downside comes on a uber hawkish set of Fed minutes coupled with a dovish hike from the RBNZ. A dovish hike could consist of concern over covid contagion, geopolitical risks, the guidance of incremental 25bps hikes, contingent on various factors. All of the above would catch an already heavily long positioning in the kiwi market offside. 0.6950 is a line in the sand in this regard and a break will open risk to a restest of the 0.6880s and then 0.68 the figure.''

After the RBNZ statement

The bird is a touch lower on the 15-min chart, losing 0.15% on the day so far.

Markets now await the press conference for further clues.

Author

FXStreet Team

FXStreet