Breaking: Gold Price soars to $1,974, its highest since September 2020

- Gold Price outperforms as risk-aversion remains at full steam.

- Ukraine’s Pres. Zelenskyy’s comments triggers a fresh leg up in XAUUSD.

- Western response awaited, as Russia goes into a war with Ukraine.

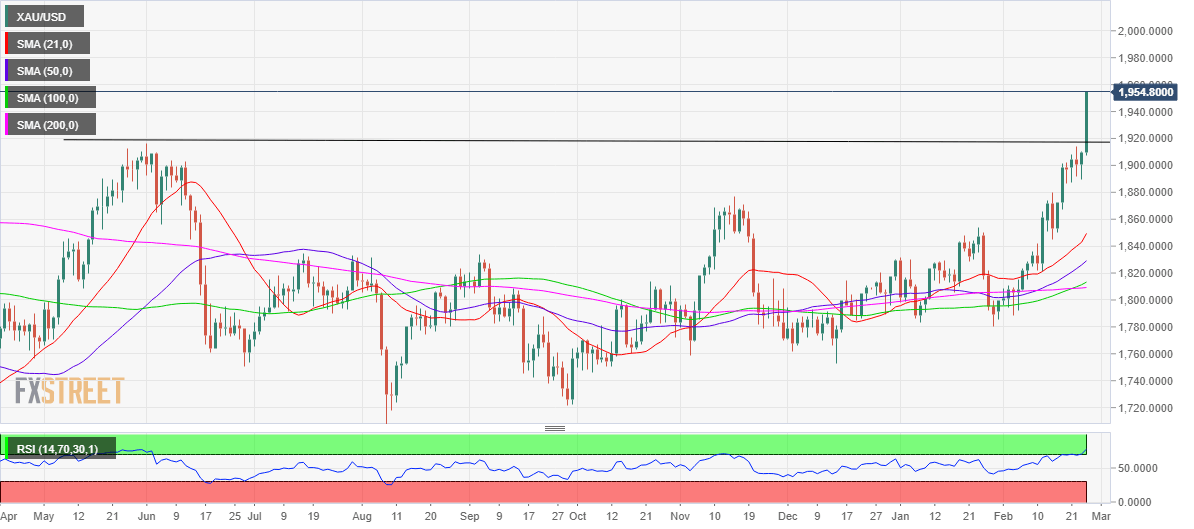

Update: Financial markets entered panic mode with news today of war undergoing Eastern Europe and Gold prices seem to have no ceiling. After breaking through the $1,950 level, it quickly added another 24 bucks to its price, to trade at levels that were last seen in September 2020. Back in August 2020, the bright metal hit a record high of $2,075.19 a troy ounce. Gold Price is up over $60 per troy ounce this Thursday, and from a technical point of view, XAUUSD is extremely overbought, although there are no signs of bullish exhaustion in a risk-averse environment.

Meanwhile, global stocks are in sell-off mode, as investors run away from high-yielding assets. Finally, demand for safe-haven US government bonds have pushed the yield on the 10-year note down to 1.85%. Panic will likely continue to favor Gold Price, as things are far from over, potentially targeting $2,000. NATO has just announced that “We have decided, in line with our defensive planning to protect all Allies, to take additional steps to further strengthen deterrence and defence across the Alliance.”

Also read: Germany's Scholz: Putin must fully withdraw his troops from Ukraine

Previous update: Amidst intense flight to safety, gold price keeps pushing higher, as it surpasses the critical $1,950 psychological barrier amid a renewed buying wave in the European session.

The latest spell of risk-aversion is triggered by the bold comments from Ukrainian President Volodymyr Zelenskyy, as he said that “we broke off diplomatic relations with Russia,” adding, “we will issue weapons to everyone who wants them.”

The bright metal will remain the market’s favorite in times of panic and market unrest, as it is considered as an ultimate store of value.

The risk-off sentiment-led sell-off in the US Treasury yields has also collaborated with the upside in gold price.

Gold Price: Key technical levels to consider

The metal hit the triangle target at $1,935 and rallied further amid intensive buying pressure.

If the corrective downside picks up pace, then gold price could look to test the triangle resistance now support at $1,907.

Ahead of that level, the $1,930 and $1,920 round numbers will help limit the pullback.

However, buying resurgence could see a retest of the 13-month highs of $1,949, above which doors will open up towards the $2,000 level.

Author

FXStreet Team

FXStreet