Breaking: Coca-Cola (KO) Earnings Q4 Results release, EPS beats but sales miss

Coca-cola NYSE (KO) announces fourth-quarter earnings. Earnings per share (EPS) beat Wall Street analyst expectations. EPS comes in at $0.47 versus the expected $0.42. Sales of $8.6 billion slightly missing expectations for $8.63 billion result.

Coke is seen as a benchmark for the broader economy and delivered some reassuring macro-economic news. Coke reinstated earnings guidance.

Coke (KO) has been involved with ongoing litigation with the IRS, in November 2020 the US Tax Court sided with the IRS.

Coke believes "that it will ultimately prevail in the litigation based on the technical and legal merits of the company's position, its consultation with outside advisors, and the company's belief that the IRS' retroactive imposition of tax liability is unconstitutional". Coke (KO) also stated during results "the company recorded a tax reserve of $438 million for the year ended Dec. 31, 2020. While the company disagrees with the IRS' position and intends to vigorously defend its position, it is possible that some portion or all of the adjustment sustained by the U.S. Tax Court could ultimately be upheld. The company has therefore calculated the potential liability of approximately $12 billion that could result from the application of the IRS' proposed transfer pricing methodology to relevant foreign licensees, including taxes and interest accrued through Dec. 31, 2020. The company would also have an incremental annual tax liability for future years that would increase its underlying effective tax rate (non-GAAP) by approximately 3.5%".

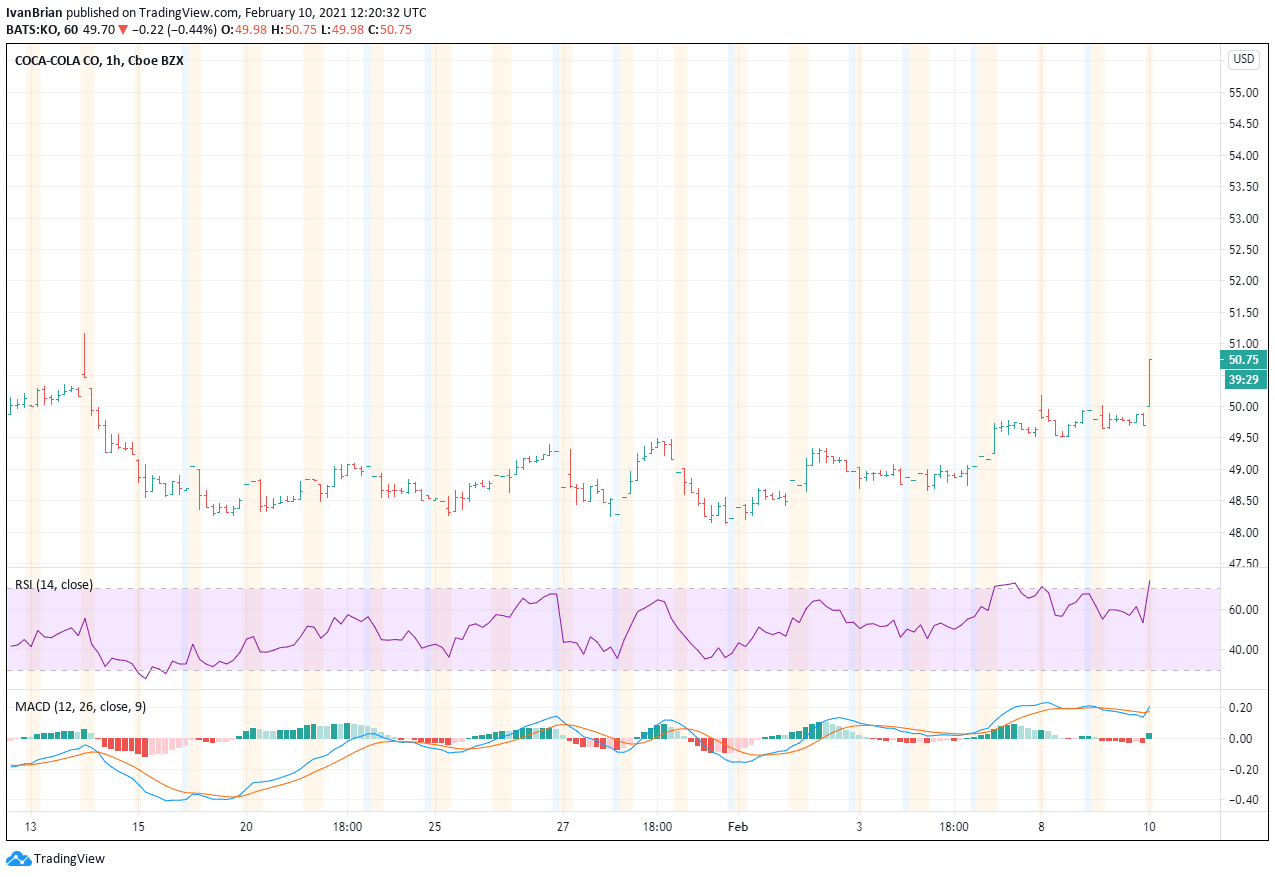

Market Reaction

Shares in Coca-Cola (KO) are trading at $50.76, up 2% during Wednesday's pre-market.

The author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.