Australian Dollar moves below a psychological level amid a stable US Dollar

- Australian Dollar extends losses, possibly influenced by a risk-off sentiment.

- Australian Services PMI rose to a ten-month high of 53.1 in February, against 49.1 prior.

- Chinese Services PMI contracted to 52.5 in February from 52.7 prior.

- US Dollar maintains stability despite lower US Treasury yields.

The Australian Dollar (AUD) continues to lose ground on Tuesday following the losses registered in the previous session, possibly due to prevailing risk-off sentiment amid a stagnant ASX 200 Index. Additionally, China aims for approximately 5% GDP growth in 2024 by focusing on job creation and risk mitigation. Chinese authorities emphasize the importance of continuing proactive fiscal policies and prudent monetary measures.

Australian Dollar remains unaffected by the positive performance of the Judo Bank Services Purchasing Managers Index (PMI), which surged to a ten-month high of 53.1 in February. This increase pushed the index above the 50.0 threshold, indicating expansion, and surpassed the previous reading of 49.1. Additionally, the Composite PMI rose to 52.1 compared to the previous 49.0, marking a nine-month high. Traders are now awaiting the release of the Gross Domestic Product (GDP) data for the fourth quarter of 2023 on Wednesday.

The US Dollar Index (DXY) remains relatively unchanged, displaying a sideways movement amid subdued US Treasury yields. Market participants are closely eyeing crucial United States (US) employment figures scheduled for release this week as they assess the Federal Reserve's (Fed) potential future actions. Fed Chairman Jerome Powell is set to testify before the US Congress' House Financial Services Committee regarding the Fed's Semi-Annual Monetary Policy Report on both Wednesday and Thursday, which could provide further insights into the central bank's stance and upcoming policy decisions.

Daily Digest Market Movers: Australian Dollar depreciates on lower equity market

- Australian Current Account Balance rose to 11.8 billion in the fourth quarter of 2023, against the expected 5.6 billion and 1.3 billion prior.

- ANZ-Roy Morgan Australian Consumer Confidence index declined to 81.0, from the previous reading of 83.2. This latest figure represents the lowest level recorded thus far in 2024.

- Australia Melbourne Institute Inflation for February showed a year-over-year rise of 4.0%, lower than the previous rise of 4.6%.

- Australian Building Permits (MoM) declined by 1.0% in January, contrary to the expected rise of 4.0%. Nevertheless, this figure represented an improvement from the previous decrease of 10.1%.

- Australia’s TD Securities Inflation (MoM) decreased by 0.1% in February, lower than the previous rise of 0.3%.

- Australian Bureau of Statistics released Company Gross Operating Profits (QoQ), rising by 7.4% in the fourth quarter of 2023 against the expected 1.8% increase and the previous decrease of 1.6%.

- Australian Building Permits (YoY) rose by 10% in January, swinging from the previous decline of 24%.

- Judo Bank Manufacturing PMI indicated a slight improvement in Australia's manufacturing sector, with the February reading rising to 47.8 from 47.7 in the previous period.

- The seasonally adjusted Australian Retail Sales (MoM) grew by 1.1% in January, lower than expected 1.5% but swinging from the previous decline of 2.7%.

- Australian Private Capital Expenditure improved by 0.8% in the fourth quarter of 2023, from the expected 0.5% and 0.6% prior.

- According to Matthew De Pasquale, an Economist at Judo Bank, the February Services PMI suggests that the sector has achieved a soft landing in 2023 and is now witnessing a resurgence in activity in early 2024. While the resilience in business activity bodes well for economic growth and employment, it casts doubt on the likelihood of inflation returning to target within the Reserve Bank of Australia's forecast timeline.

- Atlanta Federal Reserve (Fed) President Raphael Bostic made headlines on Monday, expressing uncertainty about achieving a soft landing. He does not foresee consecutive rate cuts when they commence but still expects two 25-basis point rate cuts in 2024. While inflation is expected to return to the 2% target, Bostic believes it is premature to declare victory.

- According to the CME FedWatch Tool, there is a 3.0% probability of a 25 basis points rate cut in March, while the likelihood of cuts in May and June stands at 21.8% and 50.9%, respectively.

- US ISM Manufacturing PMI (Feb) dropped to 47.8 from 49.1, surprisingly missing the market expectation 49.5.

- The US Michigan Consumer Sentiment Index declined to 76.9 in February, falling below the market expectation of remaining unchanged at 79.6.

- US Personal Consumption Expenditure (PCE) Price Index grew by 2.4% YoY in January, against the 2.6% prior, in line with the market expectation. The index increased by 0.3% month-over-month, against 0.1% prior.

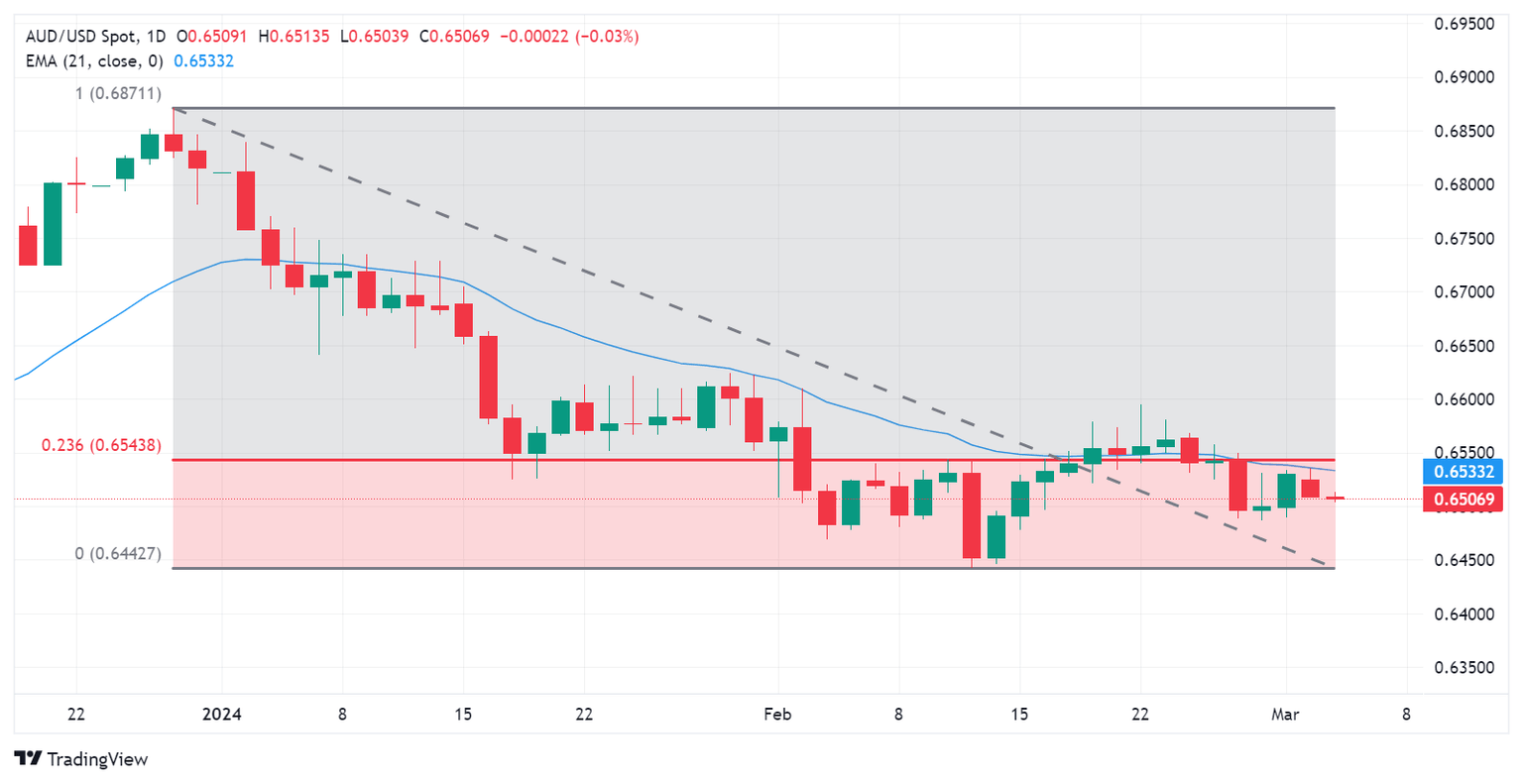

Technical Analysis: Australian Dollar hovers around the psychological level of 0.6500

The Australian Dollar traded around 0.6510 on Tuesday. Immediate resistance is noted near the 21-day Exponential Moving Average (EMA) at 0.6533, followed by the 23.6% Fibonacci retracement level at 0.6543 and the major level of 0.6550. A break above this resistance zone could lead the pair towards the psychological level of 0.6600. On the downside, key support is seen at the psychological level of 0.6500, followed by the previous week’s low at 0.6486. If breached, the pair may target the area around the major support level of 0.6450 and February’s low at 0.6442.

AUD/USD: Daily Chart

Australian Dollar price in the last 7 days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies in the last 7 days. Australian Dollar was the weakest against the Euro.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.03% | -0.02% | 0.56% | 0.55% | -0.03% | 1.27% | 0.59% | |

| EUR | 0.04% | 0.01% | 0.59% | 0.57% | 0.01% | 1.28% | 0.62% | |

| GBP | 0.03% | 0.00% | 0.58% | 0.57% | -0.01% | 1.27% | 0.61% | |

| CAD | -0.55% | -0.59% | -0.59% | -0.02% | -0.60% | 0.71% | 0.03% | |

| AUD | -0.54% | -0.57% | -0.57% | 0.01% | -0.57% | 0.71% | 0.04% | |

| JPY | 0.03% | 0.01% | 0.00% | 0.57% | 0.61% | 1.28% | 0.61% | |

| NZD | -1.29% | -1.29% | -1.32% | -0.72% | -0.72% | -1.32% | -0.66% | |

| CHF | -0.59% | -0.61% | -0.61% | -0.03% | -0.04% | -0.61% | 0.67% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.