Australian Dollar retraces gains ahead of US PCE Price Index

- Australian Dollar rebounds from the yearly lows as the US Dollar corrects.

- Australia's central bank is expected to increase interest rates; supporting Aussie Dollar.

- US Dollar faced pressure as downbeat Core PCE contributed to increasing demand for US bonds.

The Australian Dollar (AUD) rebounds from the yearly lows, extending gains for the second successive day on Friday. The pair recovers on the back of the correction of the US Dollar (USD) and the likelihood of another rate hike from the Reserve Bank of Australia (RBA) on November 7.

Australia's Producer Price Index (PPI) displayed a year-over-year decline in the third quarter on Friday, while the PPI on a quarter-over-quarter basis showed improvement. However, the recent inflation data has introduced the possibility of a 25 basis points rate hike by the Reserve Bank of Australia (RBA) in the upcoming meeting. The Australian Bureau of Statistics (ABS) revealed on Wednesday that the Consumer Price Index (CPI) experienced an upswing in the third quarter of 2023.

RBA Governor Michele Bullock remarked on Thursday that the Consumer Price Index (CPI) was slightly higher than anticipated but fell within the expected range. Bullock emphasized the central bank's goal of slowing down the economy without pushing it into a recession.

The US Dollar Index (DXY) navigates to sustain its gains, buoyed by the expansion of the United States (US) economy in the third quarter. The data also unveiled a preliminary core Personal Consumption Expenditures (PCE) that was lower than expected, sparking increased demand for bonds.

The upcoming Federal Open Market Committee (FOMC) meeting next week is anticipated to bring no changes to interest rates, as per current market expectations. Furthermore, on Friday, the US is set to release the monthly core Personal Consumption Expenditure (PCE), a pivotal measure of inflation. The report will encompass data on personal spending and income, offering insights into the US economic overview.

Daily Digest Market Movers: Australian Dollar gains ground on the possibility of another rate hike by the RBA

- Australia’s Producer Price Index (PPI) showed a slight easing to 3.8% on a yearly basis in the third quarter (Q3), compared to the 3.9% recorded in the previous quarter. On a quarterly basis, the nation's PPI increased to 1.8%, a notable rise from the previous reading of 0.5%.

- Australian Consumer Price Index (CPI) reached 1.2% in the third quarter of 2023, surpassing the 0.8% uptick in the previous quarter and the market consensus of 1.1% in the same period.

- Australia's S&P Global Composite PMI in October slipped to 47.3 from the prior reading of 51.5. The Manufacturing PMI experienced a slight easing to 48.0 compared to the previous figure of 48.7, and the Services PMI regressed into contraction territory, dropping to 47.6 from the previous month's reading of 51.8.

- Australia's RBA expressed heightened concern about the inflation impact stemming from supply shocks. Governor of the Reserve Bank of Australia, Michele Bullock stated that if inflation persists above projections, the RBA will take responsive policy measures. There is an observable deceleration in demand, and per capita consumption is on the decline.

- The announcement of Israel Prime Minister Benjamin Netanyahu on a potential ground assault in Gaza is likely to fuel safe-haven investments. In addition, Iranian Foreign Minister Hossein Amir-Abdollahian's arrival in the USA for talks on the situation between Hamas and Israel, as reported by Iranian media, adds another layer of complexity to the geopolitical landscape.

- The preliminary US Gross Domestic Product (GDP) Annualized showed growth in the third quarter, expanding by 4.9%, a notable improvement from the previous reading of a 2.1% expansion and surpassing the market expectation of 4.2%. However, there was a decline in US Core Personal Consumption Expenditures, declining to 2.4% in the third quarter from the 3.7% recorded previously.

- In terms of employment, the weekly Initial Jobless Claims for the week ending October 21 totaled 210K, up from 200K in the previous reading, and slightly higher than the market consensus of 208K.

- US S&P Global Composite PMI reported an increase in October, reaching 51.0 from 50.2. The Services PMI experienced growth, reaching 50.9, while the Manufacturing PMI rose to 50.0.

- Investors will likely shift their focus on the US Core PCE Price Index on Friday.

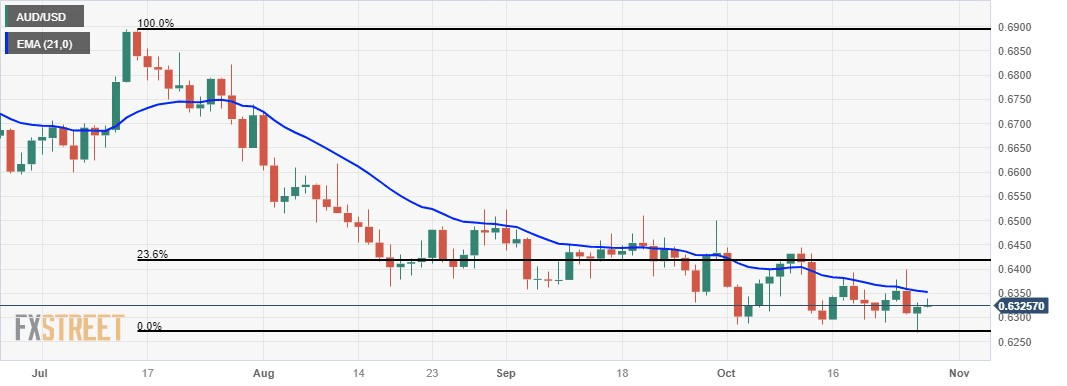

Technical Analysis: Australian Dollar hovers below the major resistance at 0.6350

The Australian Dollar trades higher around 0.6330 on Friday aligned with the major barrier at the 0.6350 level, rebounding from the yearly low at 0.6270 followed by the key support around the 0.6250 major level. The 21-day Exponential Moving Average (EMA) at 0.6352 emerges as the key resistance, following the 0.6400 major level. A breakthrough above this resistance can reach around the 23.6% Fibonacci retracement level at 0.6417.

AUD/USD: Daily Chart

Australian Dollar price in the last 7 days

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies in the last 7 days. Australian Dollar was the strongest against the Canadian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.23% | 0.14% | 0.77% | -0.15% | 0.25% | 0.49% | 0.75% | |

| EUR | -0.23% | -0.11% | 0.54% | -0.42% | 0.03% | 0.26% | 0.52% | |

| GBP | -0.13% | 0.11% | 0.64% | -0.29% | 0.14% | 0.36% | 0.64% | |

| CAD | -0.76% | -0.50% | -0.65% | -0.92% | -0.51% | -0.29% | -0.01% | |

| AUD | 0.17% | 0.42% | 0.31% | 0.96% | 0.45% | 0.66% | 0.94% | |

| JPY | -0.25% | -0.02% | -0.13% | 0.49% | -0.40% | 0.22% | 0.50% | |

| NZD | -0.47% | -0.23% | -0.34% | 0.32% | -0.62% | -0.18% | 0.30% | |

| CHF | -0.76% | -0.52% | -0.65% | 0.01% | -0.94% | -0.50% | -0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.