Reserve Bank of Australia (RBA) Governor Michele Bullock is addressing the press conference following the February monetary policy announcement, responding to media questions.

Bullock is taking questions from the press, as part of a new reporting format for the central bank.

At its February policy meeting, the RBA decided to keep the policy rate steady at 4.35% for the second meeting in a row. The central bank, however, left the door ajar for further tightening.

RBA press conference key quotes

Board understands people are doing it tough, but still more work to do.

Still got a little way to go to get inflation down.

Not ruling anything in or out on policy.

Signs are we are on narrow path to reaching inflation target.

Risks for rates are fairly balanced.

Need to be convinced inflation will get back to range and stay there.

Need to convinced on inflation before thinking of rate cuts.

RBA FAQs

What is the Reserve Bank of Australia and how does it influence the Australian Dollar?

The Reserve Bank of Australia (RBA) sets interest rates and manages monetary policy for Australia. Decisions are made by a board of governors at 11 meetings a year and ad hoc emergency meetings as required. The RBA’s primary mandate is to maintain price stability, which means an inflation rate of 2-3%, but also “..to contribute to the stability of the currency, full employment, and the economic prosperity and welfare of the Australian people.” Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will strengthen the Australian Dollar (AUD) and vice versa. Other RBA tools include quantitative easing and tightening.

How does inflation data impact the value of the Australian Dollar?

While inflation had always traditionally been thought of as a negative factor for currencies since it lowers the value of money in general, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Moderately higher inflation now tends to lead central banks to put up their interest rates, which in turn has the effect of attracting more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in the case of Australia is the Aussie Dollar.

How does economic data influence the value of the Australian Dollar?

Macroeconomic data gauges the health of an economy and can have an impact on the value of its currency. Investors prefer to invest their capital in economies that are safe and growing rather than precarious and shrinking. Greater capital inflows increase the aggregate demand and value of the domestic currency. Classic indicators, such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can influence AUD. A strong economy may encourage the Reserve Bank of Australia to put up interest rates, also supporting AUD.

What is Quantitative Easing (QE) and how does it affect the Australian Dollar?

Quantitative Easing (QE) is a tool used in extreme situations when lowering interest rates is not enough to restore the flow of credit in the economy. QE is the process by which the Reserve Bank of Australia (RBA) prints Australian Dollars (AUD) for the purpose of buying assets – usually government or corporate bonds – from financial institutions, thereby providing them with much-needed liquidity. QE usually results in a weaker AUD.

What is Quantitative tightening (QT) and how does it affect the Australian Dollar?

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Reserve Bank of Australia (RBA) purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the RBA stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It would be positive (or bullish) for the Australian Dollar.

This section below was published at 03:30 GMT to cover the Reserve Bank of Australia's monetary policy announcements and the initial market reaction.

The Reserve Bank of Australia (RBA) board members decided to keep the Official Cash Rate (OCR) unadjusted at 4.35% after its February monetary policy meeting on Tuesday.

The policy announcement met the market expectations. The RBA extended its pause for the second meeting in a row, having lifted the rate by 25 basis points (bps) in November.

RBA’s Governor Michele Bullock presented the monetary policy statement, with the key takeaways noted below.

Board remains resolute in its determination to return inflation to target.

Inflation continued to ease in the December quarter.

Further increase in interest rates can't be ruled out.

Goods price inflation was lower than the RBA’s November forecasts

The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks.

Services price inflation, however, declined at a more gradual pace in line with the RBA's earlier forecasts and remains high.

Higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy.

Returning inflation to target within a reasonable timeframe remains the board’s highest priority.

The board needs to be confident that inflation is moving sustainably towards the target range.

To date, medium-term inflation expectations have been consistent with the inflation target and it is important that this remains the case.

Conditions in the labour market remain tighter than is consistent with sustained full employment and inflation at target.

Wages growth has picked up but is not expected to increase much further and remains consistent with the inflation target.

While there are encouraging signs, the economic outlook is uncertain and the board remains highly attentive to inflation risks.

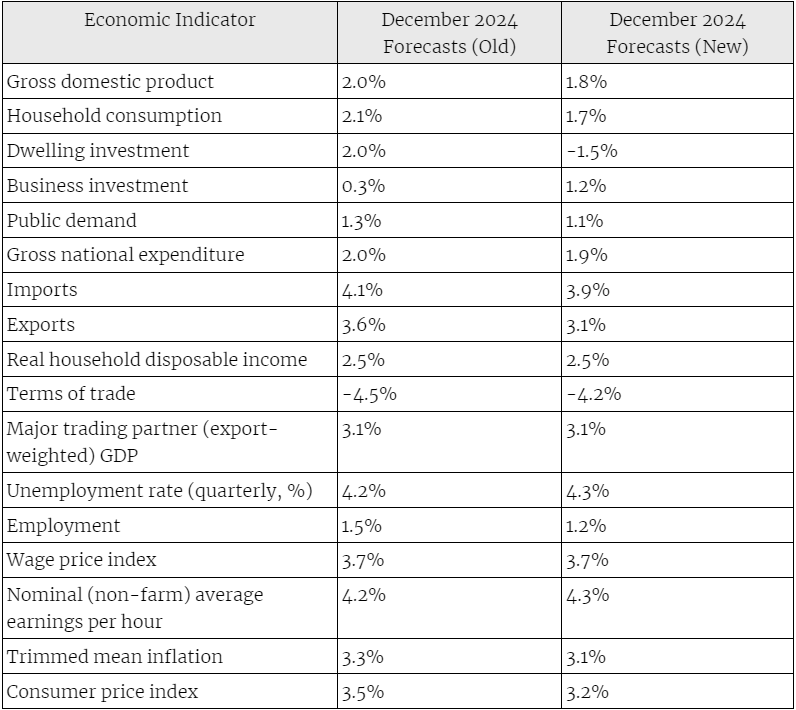

RBA’s latest economic forecasts from the Statement on Monetary Policy

AUD/USD reaction to the RBA interest rate decision

The Australian Dollar is seeing renewed buying pressure in an immediate reaction to the RBA’s expected pause. The AUD/USD pair is adding 0.35% on the day to trade near 0.6510.

15-minutes chart

Australian Dollar price today

The table below shows the percentage change of Australian Dollar (AUD) against listed major currencies today. Australian Dollar was the strongest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.06% | -0.10% | -0.18% | -0.40% | -0.02% | -0.20% | -0.06% | |

| EUR | 0.05% | -0.04% | -0.14% | -0.34% | 0.03% | -0.15% | -0.01% | |

| GBP | 0.10% | 0.04% | -0.09% | -0.30% | 0.07% | -0.11% | 0.03% | |

| CAD | 0.17% | 0.13% | 0.09% | -0.18% | 0.16% | -0.04% | 0.12% | |

| AUD | 0.36% | 0.30% | 0.26% | 0.18% | 0.34% | 0.16% | 0.30% | |

| JPY | 0.02% | -0.03% | -0.07% | -0.16% | -0.34% | -0.19% | -0.04% | |

| NZD | 0.21% | 0.15% | 0.11% | 0.02% | -0.15% | 0.18% | 0.15% | |

| CHF | 0.06% | 0.00% | -0.04% | -0.13% | -0.34% | 0.04% | -0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

This section below was published on February 5 at 18:00 GMT as a preview of the Reserve Bank of Australia (RBA) policy announcements.

- Interest rate in Australia set to remain steady at 4.35%.

- Reserve Bank of Australia Governor Michele Bullock not expected to change the tone.

- The Australian Dollar is poised to extend its slump against the US Dollar.

The Reserve Bank of Australia (RBA) will announce its monetary policy on Tuesday and is widely anticipated to keep the Official Cash Rate (OCR) unchanged at a 12-year high of 4.35%.

The RBA has changed the number of monetary policy meetings in 2024, reducing the number of the Board’s meetings from eleven to just eight times a year. Officials decided to cut back the number of meetings so the Board could have more time to assess economic developments.

Incoming data since the December decision has shown inflation retreated sharply while growth remains tepid, justifying market expectations of a no-chance in the OCR.

Reserve Bank of Australia to stand pat as inflation eases, growth weakens

With the OCR seen steady at record highs, the focus will be on the accompanying statement and Governor Michele Bullock's press conference. Back in December, the RBA statement noted: “Inflation had continued to decline but remained high. Wages growth had reached 4 per cent a little sooner than had been expected but the staff judged that wage growth was unlikely to rise much further. Output growth had continued below trend and the labour market was tight but easing gradually. Members agreed that financial stability considerations were not a constraint on monetary policy at the current meeting.”

Australian policymakers maintained the wording related to additional rate hikes amid expectations inflation would remain above target for a prolonged period. However, the latest figures were quite encouraging. The Consumer Price Index (CPI) rose 0.6% in Q4, easing from 1.2% in the previous quarter and below the 0.8% expected, according to the Australian Bureau of Statistics (ABS). The central bank’s favorite gauge, the RBA Trimmed Mean CPI rose 0.8% in the same period and 4.2% from a year earlier, the latter easing from 5.1% in Q3. Finally, the Monthly Consumer Price Index was up 3.4% YoY in December after printing at 4.3% in the previous month.

The RBA then has easing inflation but also softening economic activity as the base case for the January decision. In such a scenario, most economists expect no changes to the statement wording, with policymakers maintaining the door open for additional hikes if needed. Rate cuts will most likely remain out of the table. Money markets are not looking into a pivot in monetary policy in the first half of the year.

The Australian Dollar (AUD) may come under selling pressure if policymakers choose a more dovish tone to express their view of the future of monetary policy. Yet retaining the hawkish stance may not give fresh impetus to the Aussie, as lately, investors prefer to bet on rate cuts and ignore central bankers.

Governor Bullock has warned about the upside risks of inflation and may ease the tone there, but given the labor market remains tight, she most likely will maintain the cautious tone. Recent data showed a sharp slide in the number of employed individuals, with the monthly report indicating a 65.1K decline in job positions in December, while the Unemployment Rate held steady at 3.9%. Also, the Participation Rate slid from 67.3% to 66.8%.

How will the RBA interest rate decision impact AUD/USD?

The AUD/USD pair trades at its lowest since last November on Monday, amid broad US Dollar demand. The Australian Dollar (AUD) has fallen against its American rivals in the last five weeks, and started this one by extending its slump. The pair trades below the 0.6500 threshold, and in the long run, it has room to extend the slide.

Valeria Bednarik, Chief Analyst at FXStreet says: “The bearish momentum is evident in the daily chart, as the pair finally slid below its 100 SMA (Simple Moving Average) for the first time since mid-November, and after buyers battled throughout January to defend the area. At the same time, the 20 SMA accelerated its decline above the longer one, reflecting persistent selling interest. Finally, technical indicators suggest bears are willing to keep selling, as per aiming south within negative levels.”

Furthermore, Bednarik notes: “The current price zone seems lacking a relevant level that could provide support. Sellers will be looking for a downward extension towards 0.6450, aiming then to reach the 0.6370/80 area. Given the US Dollar’s broad strength, AUD/USD could extend its slide towards 0.6300/30 following the event. To the upside, the level to watch is the aforementioned daily 100 SMA, currently at around 0.6530. Once above the latter, the recovery could continue towards 0.6600, where sellers are expected to jump back in.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.