Aussie Q4 CPI beats estimates, AUD/USD bid to fresh impulse highs

The major release of the day has just arrived in Australia's 4th quarter Consumer Price Index.

The data has arrived as follows:

- RBA Trimmed-Mean CPI +0.4 pct QoQ (Reuters poll +0.4 pct).

- CPI (all groups) +0.9 pct QoQ (Reuters poll +0.7 pct).

- RBA Weighted Median CPI +0.5 pct QoQ (Reuters poll +0.4 pct).

- RBA Trimmed-Mean CPI +1.2 pct YoY (Reuters poll +1.2 pct).

- CPI (all groups) +0.9 pct YoY (Reuters poll +0.7 pct).

- RBA Weighted Median CPI +1.4 pct YoY (Reuters poll +1.2 pct).

As for the Aussie's reaction, AUD/USD has popped to fresh highs of 0.7763 in an extension of the daily impulse.

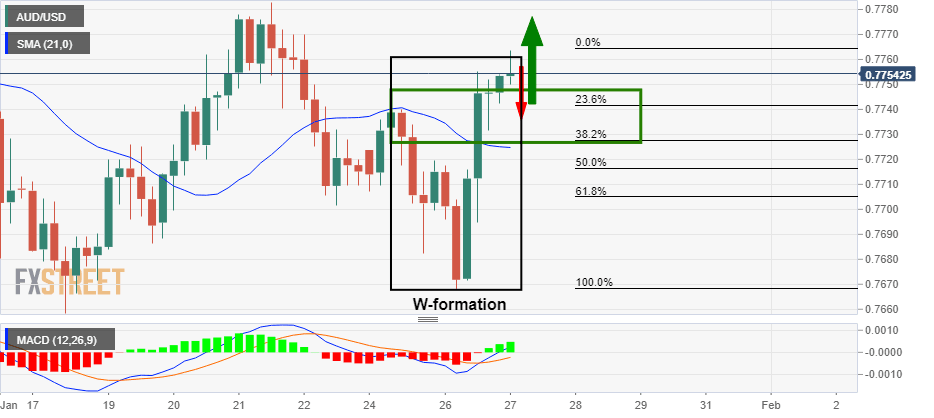

However, the overextended W-formation's bullish impulse could be due for a correction, a thesis illustrated in the following article and prior analysis from the New York session:

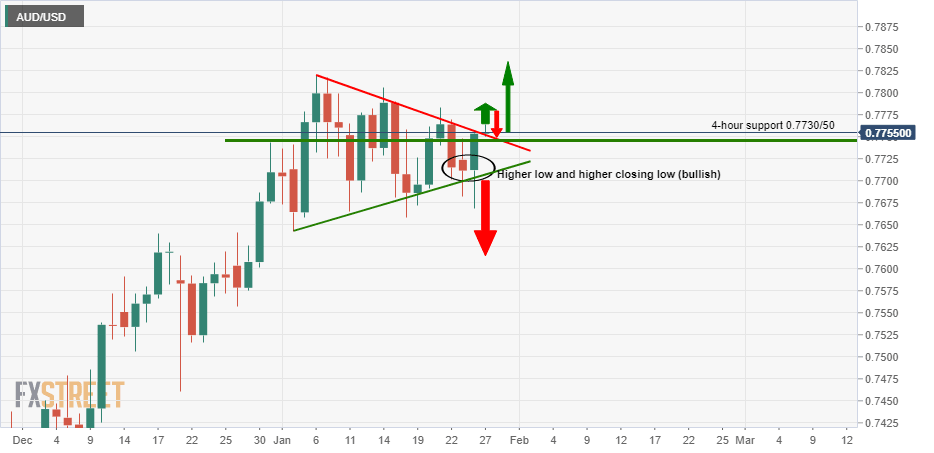

AUD/USD Price Analysis: Bulls counting on a break of symmetrical triangle resistance

Given the extension since the analysis, a correction may only make it as far as the nearest level of the support structure, if indeed the dynamic resistance of the trendline of the symmetrical triangle pressures the price lower.

If the structure breaks, then the bulls will be expected to take charge and only give back some ground to the prior trendline resistance that will instead turn to support.

Daily chart

4-hour chart

Description of CPI

The Consumer Price Index released by the RBA and republished by the Australian Bureau of Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services.

The trimmed mean is calculated as the weighted mean of the central 70% of the quarterly price change distribution of all CPI components, with the annual rates based on compounded quarterly calculations.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.