- The week has started on a sharp risk-off tone as worries about the Delta variant spread.

- The US dollar smile theory seems to be in play.

- AUD crosses trampled on fear and dovish RBA prospects, corrections on the cards.

- AUD/JPY meets projected weekly targets, bears now taking profits.

At the time of writing, AUD/USD is treading water near the lows of the day, 0.7326, losing some 0.85% at 0.7329 after collapsing from a high of 0.7402.

A sharp risk-off tone sent the Aussie off a cliff at the start of the week as worries about the Delta variant spread, a theme forecasted in the following early Asia article that can be read here:

AUD has been significantly impacted for its proxy status to emerging Asia with the rising delta variant fears.

Moreover, the currency is under pressure due to the extended lockdowns on home soil in the country’s two most populous cities and their surrounding areas, in the state of Victoria and its capital Melbourne.

Overall, cross-market implied volatility measures continue to reflect growing concerns about the impact of the variant.

AUD is closely correlated to the fear gauge, the Vix, and the performance of US and global equities.

Today, the Vix is back above 20, soaring to a fresh daily high of 24.78 from 19.27 the low. The S&P 500 is down over 2% at the time of writing.

Overall, such currencies as the Aussie will be undermined in an environment hampered by the fear of the delta variant.

''We are concerned that fears of the delta variant could scuttle confidence in the outlook — at a time when the global growth is peaking,'' analysts at TD Securities said. ''This would undermine currencies where hawkish pivots have occurred more acutely, we think.''

USD smile theory in play

Meanwhile, all of this has supported the greenback which is benefitting from a two-fold fundamental basis, aka, the smile theory.

Analysts at Brown Brothers Harriman described the theory as ''strong US data are feeding into increased dollar bullishness as the Fed continues to take tentative steps towards tapering... On the other hand, growing risk-off impulses are helping the dollar recently. This supports the view that the greenback is likely to benefit in either situation. Hence, the smile as the dollar turns up at both ends of the risk spectrum.''

DXY is up for the third straight day and it has traded at its highest level since April 5 near 93, not far off the March 31 and YTD high near 93.437.

US dollar positioning

Net USD longs in the futures markets are reaching their highest levels since May 2020.

''The move follows the trend that has been in evidence since mid-June and the hawkish tilt from the FOMC,'' analysts at Rabobank explained.

''Gains for the greenback in the spot market have been more recently been associated with safe-haven demand as stocks wobble due to worries about the Delta variant.''

As for the Aussie's positioning, ''net AUD short positions rose further and are at their highest levels since June 2020. The RBA is maintaining a dovish tone,'' the analysts said.

RBA minutes under the spotlight

The week's main events include the European Central Bank CB on Thursday, PMI data at the end of the week, and Reserve Bank of Australia Minutes tonight.

For the RBA Minutes, the focus will be on the lockdown and parameters around tapering.

''Credible media reports today are suggesting that the RBA is likely to rethink its proposed QE taper in light of the current lockdowns,'' analysts at Westpac said.

''The longer the lockdowns continue, the more damage to the economy, and the more likely that the current $5bn per week run-rate will be kept beyond the end of QE2 in a couple of months.''

''Given that the RBA would prefer to give market participants plenty of advanced warning, the decision may need to be made and announced following the August Board meeting.''

''Under that timeframe, and on current expectations for the length of the lockdowns, the odds are definitely growing that the RBA will move away from the initial taper.''

The move in the Aussie at the start of the week likely already reflects the market presumption that the RBA will be dovish for longer and the minutes could well confirm the move, rather than fan those flames.

Therefore, from a technical perspective, there could be corrections on the cards in the days to follow as profit-taking ensues from within monthly support.

With that being said, the price can still easily move lower from here and pressure 0.73. But selling at support is not the most favourable strategy.

AUD/USD technical analysis

As per the start of the week's analysis, ''from a longer-term perspective, the price is headed into a monthly and weekly structure as follows:''

Since yesterday's analysis, AUD/USD has indeed moved into the support structure and is testing the base of the structure:

From a daily perspective, considering that there is little in the way of new fundamentals behind the moves at the start of the week, other than FEAR, there are prospects of profit-taking.

In such a scenario, this would be expected to equate in corrections:

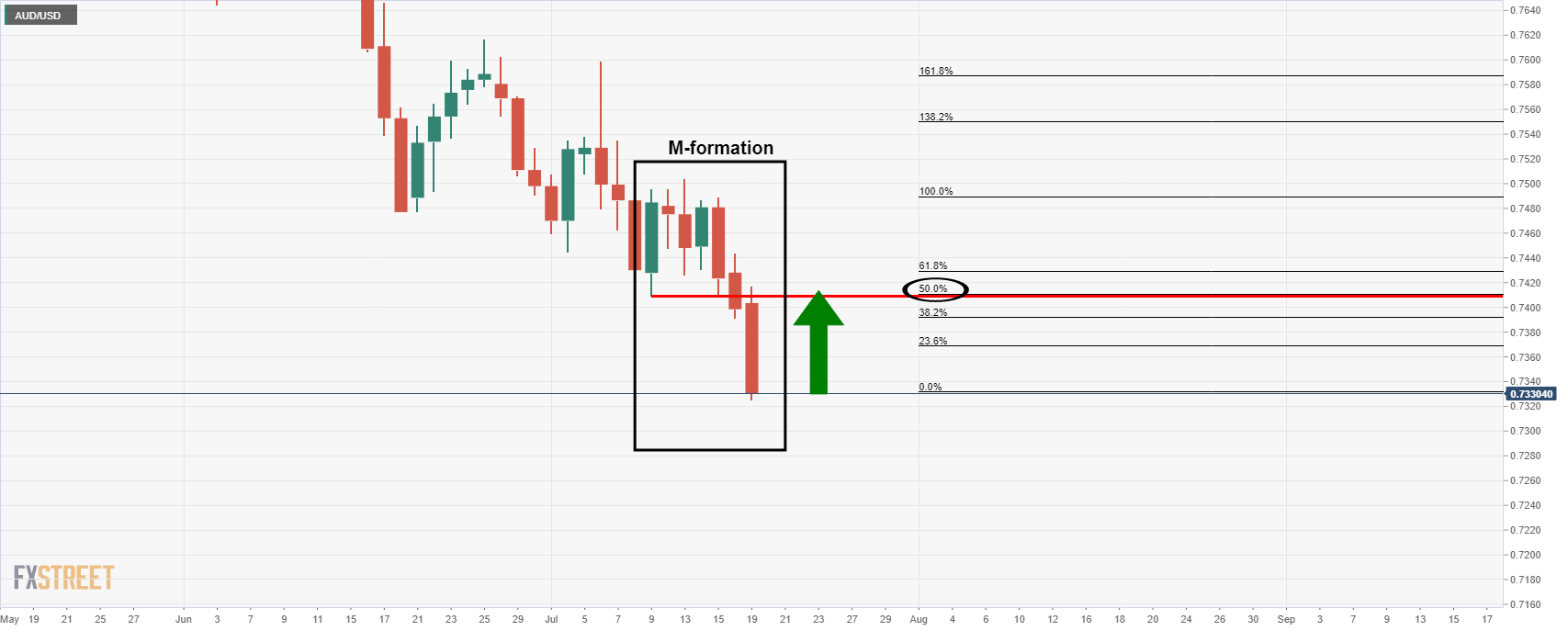

Zooming in, we can see that the 50% mean reversion, near 0.7410, aligns with the prior lows within the M-formation, a bullish pattern that has a high completion rate:

Meanwhile, the real action has been in the AUD crosses and the market's risk barometer, AUD/PY as follows:

AUD/JPY technical analysis

As per the prior analysis, AUD/JPY Price Analysis: Bears in control, eye daily extension, the cross is back under pressure and heading towards weekly support structure as per technical analysis below.

Prior analysis, AUD/JPY daily chart

The price is in a bearish trend and given the recent correction that has started to run out of momentum, there are prospects of a continuation to the downside.

Start of the open's update in early Asia

The above chart illustrates the progress made since the original article on the 15 July.

Bears will eye between the 80.90 and 80.50 weekly target area at this juncture following the prior week's bearish weekly close.

Live market update, target achieved

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.

-637619112244998276.png)

-637622335757360536.png)

-637622339079204643.png)

-637623124264382288.png)