AUD/USD retains second place on the leader board ahead of key jobs data

- AUD/USD continues its northerly trajectory supported by higher energy and covid vaccinations optimism.

- China remains a significant risk to Australia's export-dependent economy.

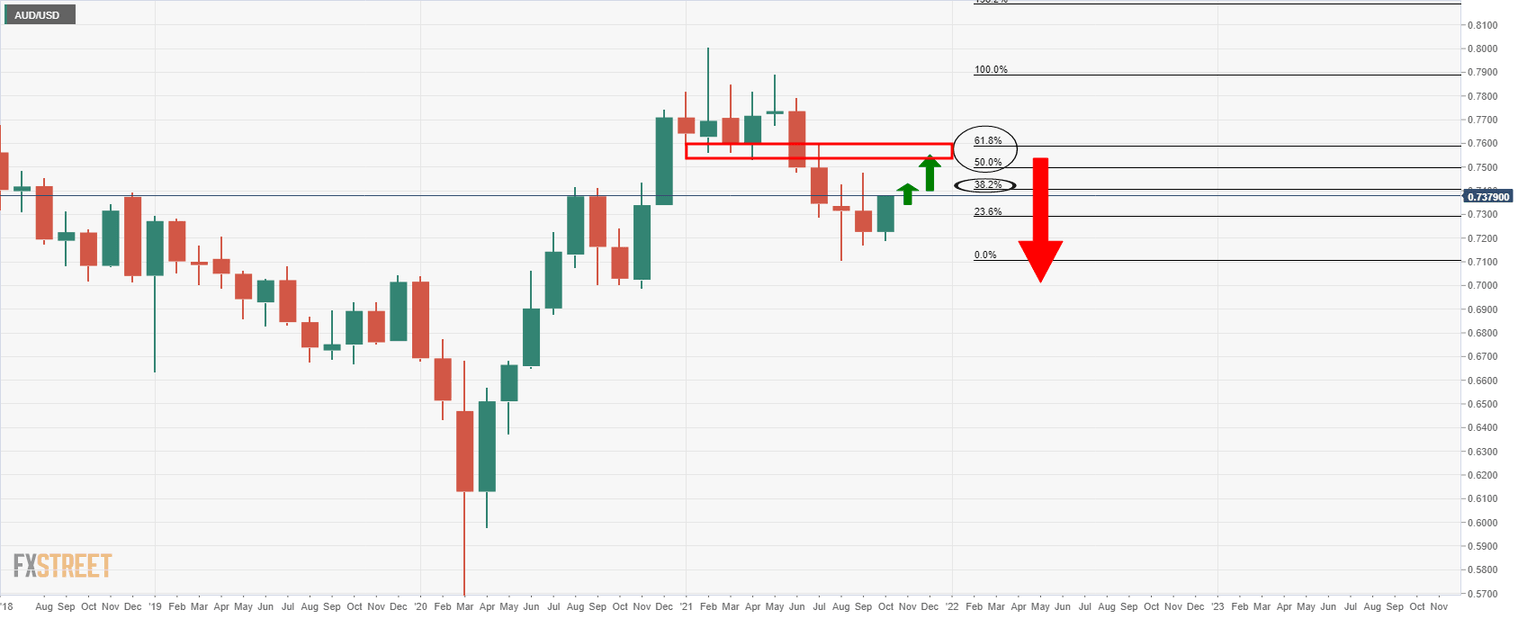

AUD/USD is second to only the Canadian dollar on Wednesday in New York closing in the cunt down to Thursday's Asian session's key event that will reveal Australia's jobs data for September. At the closing bell on Wall Street, AUD/USD was 0.45% higher on the day at 0.7380 after travelling from a low of 0.7323 to a high of 0.7381. The pair is just 24 pips off a 38.2% Fibonacci retracement of the 2021 uninterrupted monthly bearish trend. See below for more on the technical picture.

Meanwhile, AUD is picking up a bid as investors seek out commodities as a hedge against inflation and prospects for rising prices in Iron Ore, and even higher LNG and other energy-related exports such as coal are going to serve the nation's surplus balance and currency well.

Additionally, news flow has the potential to be constructive as markets focus on reopening and on high energy costs. However, analysts at Credit Suisse argued that, ultimately, ''the bar for an improvement in the data sufficient to move the dial in a meaningful way on RBA policy is quite high, especially with the Reserve Bank of Australia outlook already priced fairly hawkish, and the likely outcome on the China front still far from clear.''

AUD/USD short squeeze has room to go

On the other hand, it is worth noting that over the course of the past month, net AUD positioning has collapsed to 2015 levels. That leaves the market vulnerable for a continued squeeze on short positioning, especially if unexpected changes in external drivers come about. For instance, Australia is highly dependent on China's business in iron ore.

The Evergrande Gray Rhino event has shaven the prices of Australia's number one export in what was already in a downtrend amidst trade tensions between the two nations. Iron ore prices sat just over $US120 ($164) per tonne of 62 per cent iron ore at the end of last week, well below the prices reached in mid-July this year, when they topped $US200 per tonne. However, they have started to recover from the Sep lows of $106, but considering the Chinese property shake-out, the fastest and largest iron ore crash in history would be expected to resume its southerly trajectory.

UBS estimates there are 10 developers with potentially risky positions with combined contract sales of 1.86tn yuan – or 2.7 times Evergrande’s size. In other words, Evergrande is only the tip of the iceberg. As things stand, Chinese construction is likely to fall over the next year and that would be expected to equate to hundreds of millions of tonnes of less steel that will be needed.

This would equate to hundreds of million tonnes of iron ore equivalent also. This puts iron ore on track to fall below $100 a tonne and perhaps to even match its 2015 price crash to somewhere below $50 in the near future. If prices were to somehow not fall further and continue to recover significantly higher, then AUD would become even more attractive that has so far been protected by the unexpected energy crisis that has driven coal and LNG prices wild in Asia.

However, China has already commissioned oodles of new coal mines to resolve the issue by the northern Spring. So, if the reopening of the economy in Australia is already priced in and should we see a continuation of the route in iron ore prices followed by falling coal and LNG prices, as well as domestic housing collapse, then AUD could be in for a very rough ride. With respect to housing, Chinese investment is expected to drop out at the same time that the Reserve Bank of Australia and APRA are tightening credit availability for its property market.

All of this means that the risk to reward to being short could start to be attractive again from a fundamental basis, while technically, as the analysis below will show, there could still be room left in this correction yet to go.

Aussie jobs data coming up

Meanwhile, the Australian Employment data is the key focus in Asia today.''We expect employment will have fallen -120k in August, which is slightly below consensus. But we expect the unemployment rate will only rise to 4.7%,'' analysts at ANZ Bank said. We also see China’s Consumer Price Index later in the day.

AUD/USD technical analysis

AUD/USD has started to correct five months of an uninterrupted bearish trend and the price is en-route to the 38.2% Fibonacci retracement of the impulse as illustrated above, near 0.7410. However, it may not be long before the bears re-engage once the positioning equilibrium levels out and the price starts to look rich again. On the other hand, that may not be for a while and until the April lows are tested again near to a 61.8% Fibo retracement near 0.7600.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.