AUD/USD Price Analysis: Sellers attack 0.7720 support confluence

- AUD/USD fails to extend previous day’s bounce, stays pressured near intraday low.

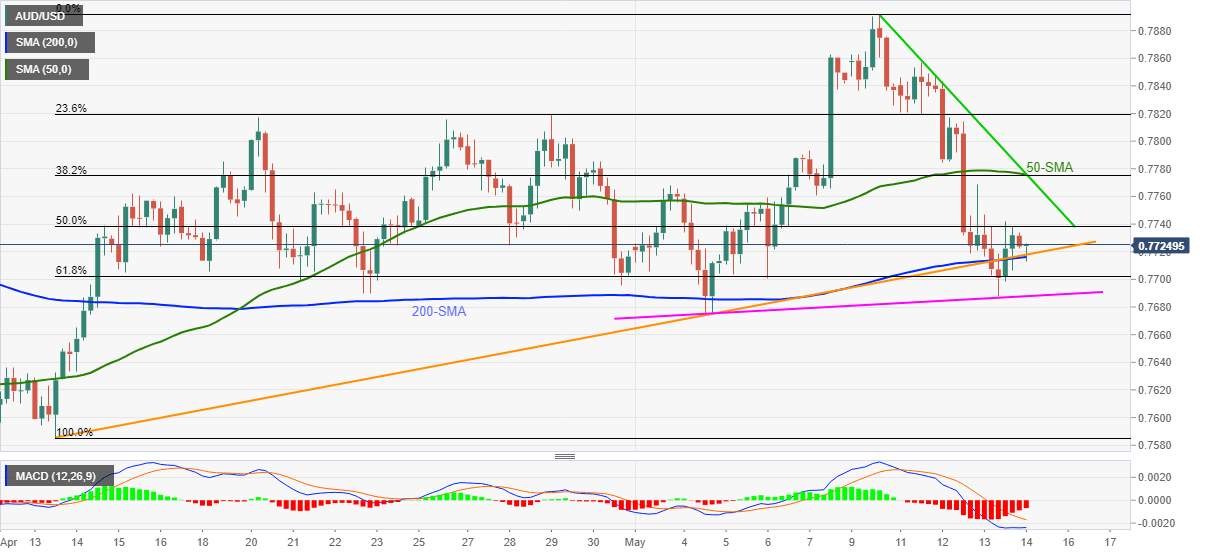

- 200-SMA, one-month-old ascending trend line form immediate key support.

- 61.8% Fibonacci retracement level, weekly support line add to the downside filters.

- 50-SMA, near-term resistance line guard recovery moves below 0.7800.

AUD/USD battles the 0.7720 key support during early Friday. In doing so, the pair refrains from extending the previous day’s recovery moves while bears attack 200-SMA and an ascending support line from April.

Given the bearish MACD and the pair’s inability to cross 50% Fibonacci retracement of April-May upside, AUD/USD becomes liable to break the 0.7720 immediate support.

However, 61.8% Fibonacci retracement level and a bit shorter support line, respectively near 0.7700 and 0.7685, could test the bears before directing them to April’s low surrounding 0.7585.

On the flip side, a clear break above 50% Fibonacci retracement level of 0.7738 should propel the AUD/USD prices towards a confluence of 50-SMA, weekly resistance line and 23.6% Fibonacci retracement near 0.7775-80.

Overall, AUD/USD stays on the bears’ radar but the bulls aren’t ready to give up easily.

AUD/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.