AUD/USD Price Analysis: Pair trims a part of its modest intraday gains, plods near 0.6480

- AUD/USD trades higher due to upbeat Australia’s Private Capital Expenditure.

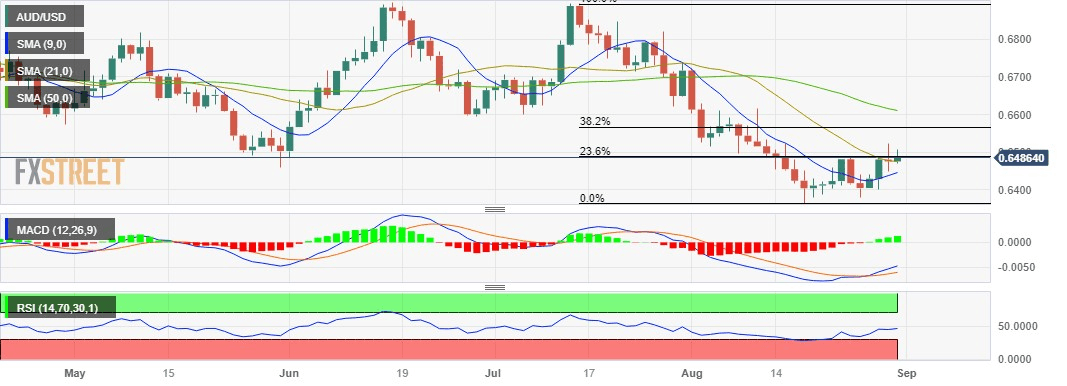

- 23.6% Fibonacci retracement appears to be a barrier following the three-week high at 0.6522.

- MACD indicates improvement in the recent momentum but the pair remains bearish as long as stays below the 50-day SMA.

AUD/USD retraces from the previous day’s losses, trading higher around 0.6480 at the time of writing during the Asian session on Thursday. The pair is experiencing upward support due to the downbeat US Treasury yields and disappointing US economic data.

Additionally, Australia’s upbeat Private Capital Expenditure (Q2) was released on Thursday, contributing support to the AUD/USD pair. The data reported that capital expenditure intentions improved to 2.8%, better than the expected 1.2% figure and 2.4% prior.

The 23.6% Fibonacci retracement at 0.6488 emerges as the immediate resistance, followed by the 0.6500 psychological level. A firm break above the latter could support the AUD/USD pair to explore the area around a three-week high at 0.6522, followed by the 38.2% Fibonacci retracement at 0.6565.

On the downside, the pair could meet the key support around the 21-day Simple Moving Average (SMA) at 0.6474, followed by the nine-day SMA at 0.6445. A break below that level could put pressure on the AUD/USD pair to navigate the region around the 0.6400 psychological level.

The 14-day Relative Strength Index (RSI) remains below 50, which suggests a bearish bias of the AUD/USD traders. The Moving Average Convergence Divergence (MACD) line remains below the centerline; however, it indicates a divergence above the signal line. This divergence indicates an improvement in recent momentum.

In the short term, the underlying trend exhibits a bearish outlook as long as the AUD/USD pair stays below the 50-day EMA at 0.6610.

AUD/USD: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.