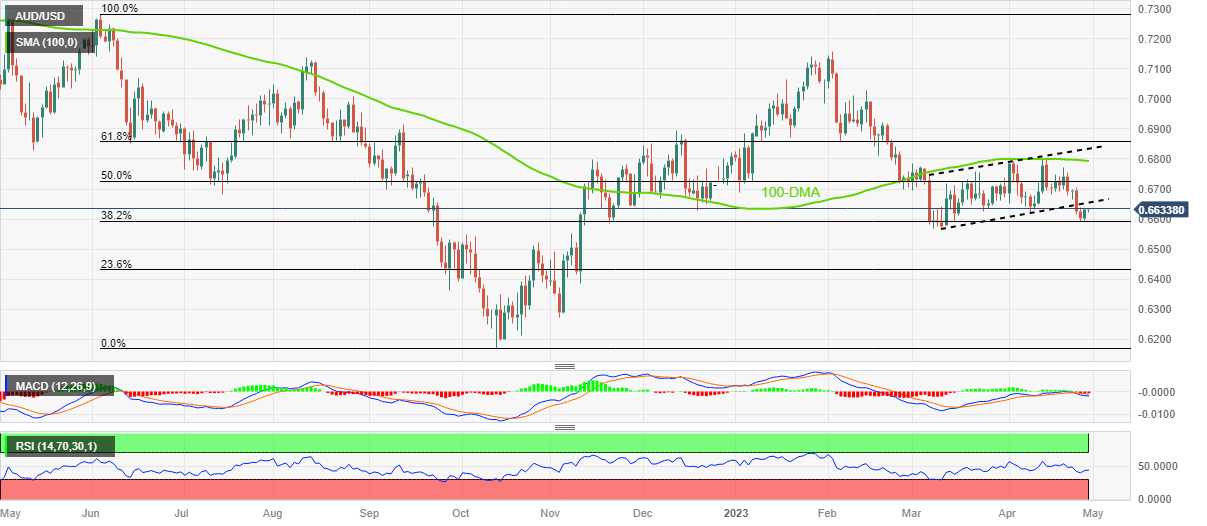

AUD/USD Price Analysis: Marches towards previous support near 0.6650

- AUD/USD picks up bids to refresh intraday high, extends the previous day’s rebound.

- Downbeat oscillators fail to back Thursday’s U-turn from 38.2% Fibonacci retracement.

- Bottom line of bullish channel prods Aussie pair’s immediate upside.

AUD/USD stays on the front foot around 0.6640 as it defends the previous day’s gains after bouncing off a six-week low. In doing so, the Aussie pair approaches the support-turned-resistance line stretched from early March, forming part of the previous bullish channel.

It’s worth noting, however, that the bearish MACD signals and sluggish RSI (14), can challenge the AUD/USD bulls around the 0.6655 previous support.

In a case where the Aussie buyers manage to cross the 0.6655 hurdle, its run-up towards the 50% Fibonacci retracement level of the June-October 2022 downturn, near 0.6725, can’t be ruled out.

However, the 100-DMA and the top line of the aforementioned channel, respectively near 0.6795 and 0.6835, can challenge the AUD/USD bulls afterward.

Should the Aussie pair buyers manage to keep the reins past 0.6835, they can retake the driver’s seat.

Meanwhile, the 38.2% Fibonacci retracement level of 0.6595 restricts the immediate downside of the AUD/USD pair. Following that, the yearly low marked in March around 0.6565 will be in the spotlight.

If the AUD/USD bears manage to conquer the 0.6565 support, multiple levels near 0.6530-25 can challenge the Aussie pair’s downside before giving control to the sellers.

Overall, AUD/USD remains on the bear’s radar even if the upside room appears limited.

AUD/USD: Daily chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.