AUD/USD Price Analysis: Drops to five-week-old support line, sellers have bumpy road

- AUD/USD faces early Asia’s corrective pullback while retesting the key support.

- Australia’s Preliminary Trade Balance for December marked $8,956m surplus, exports jumped heavily by 16%.

- Bearish MACD suggests further weakness but key support lines, horizontal area probe sellers.

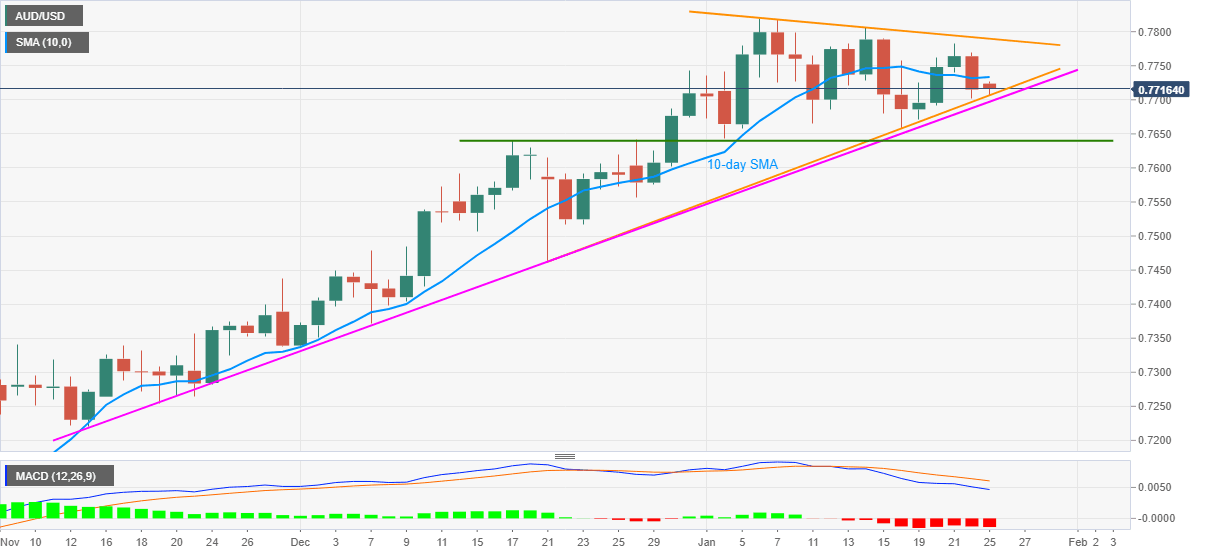

AUD/USD stays depressed near 0.7715 while teasing the intraday low of 0.7707 during early Monday. That said, the quote’s downside break of 10-day SMA battles an upward sloping trend line from December 21 to challenge the bears.

Also likely to challenge the quote’s further downside is the upbeat export data for December. As per the latest flash readings, per the Australia Bureau of Statistics, there is a goods trade surplus of $8,956m. Further details suggest exports increased $4,901 million (16%) to $34,927 million whereas imports decreased $2,521m (-9%) to $25,971 million per the data.

Talking about technical details, a multi-day-old support line from late-December, around 0.7695, adds to the downside filter, in addition to the immediate rising trend line support near 0.7705.

However, a downside break of 0.7695 will not hesitate to drag the quote towards a horizontal area comprising December 17 top and January 04 bottom around 0.7645/40.

Meanwhile, a 10-day SMA near 0.7735 guards the quote’s immediate upside ahead of a falling trend line from January 06, at 0.7790 now.

AUD/USD daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.