AUD/USD Price Analysis: Bulls going against the grain to M-formation neckline target

- AUD/USD bulls step in and target the daily M-formation neckline as the greenback slides.

- DXY is testing 96 the figure ahead of the Fed.

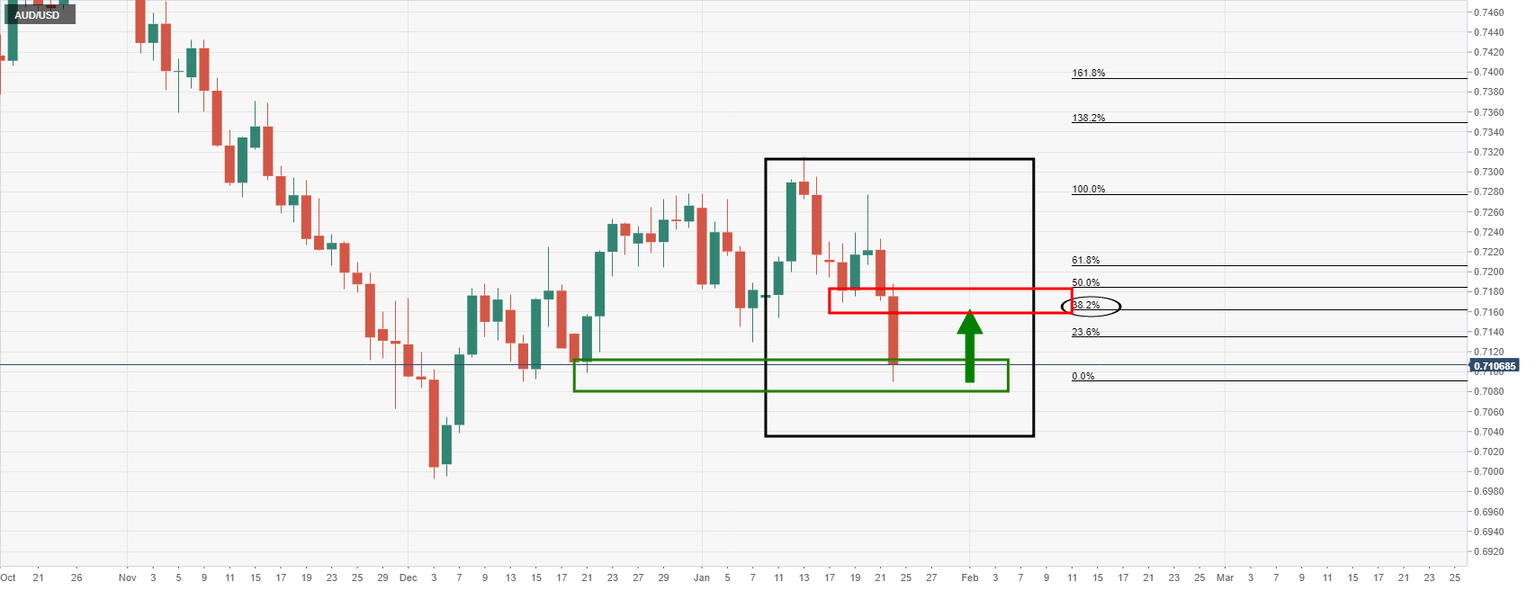

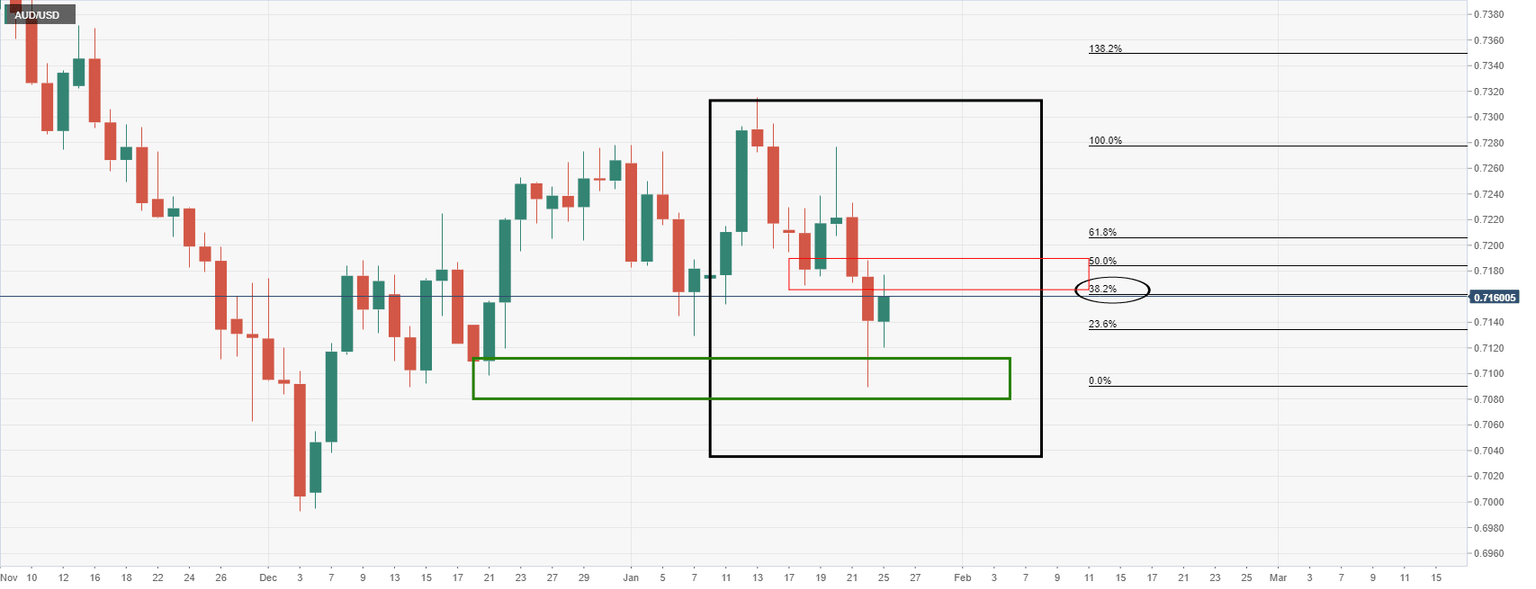

As per prior analysis at the start of the week, AUD/USD Price Analysis: Bears move the Aussie to the edge of the abyss, the price has advanced towards an identified daily target area in recent trade.

AUD/USD, prior analysis

It was started that ''AUD/USD's M-formation on the daily chart is a compelling chart pattern for the week ahead.''

AUD/USD live chart

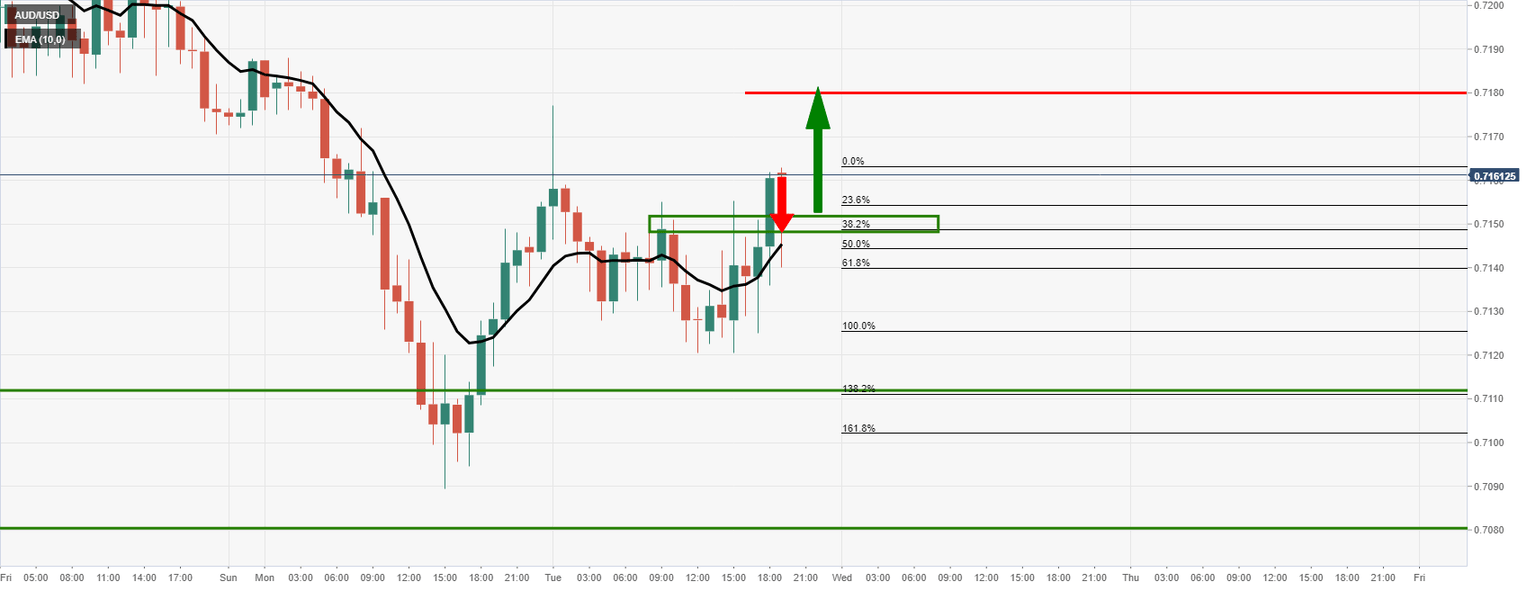

As illustrated, the bulls have homed in n the neckline of the M-formation in trade today. This has occurred in a sharply hourly bullish impulse as follows:

The bullish impulse may not be over yet, but a correction could be in order back towards the prior resistance that has a confluence with the 38.2% Fibonacci retracement of the recent rally that meets with the 10-EMA.

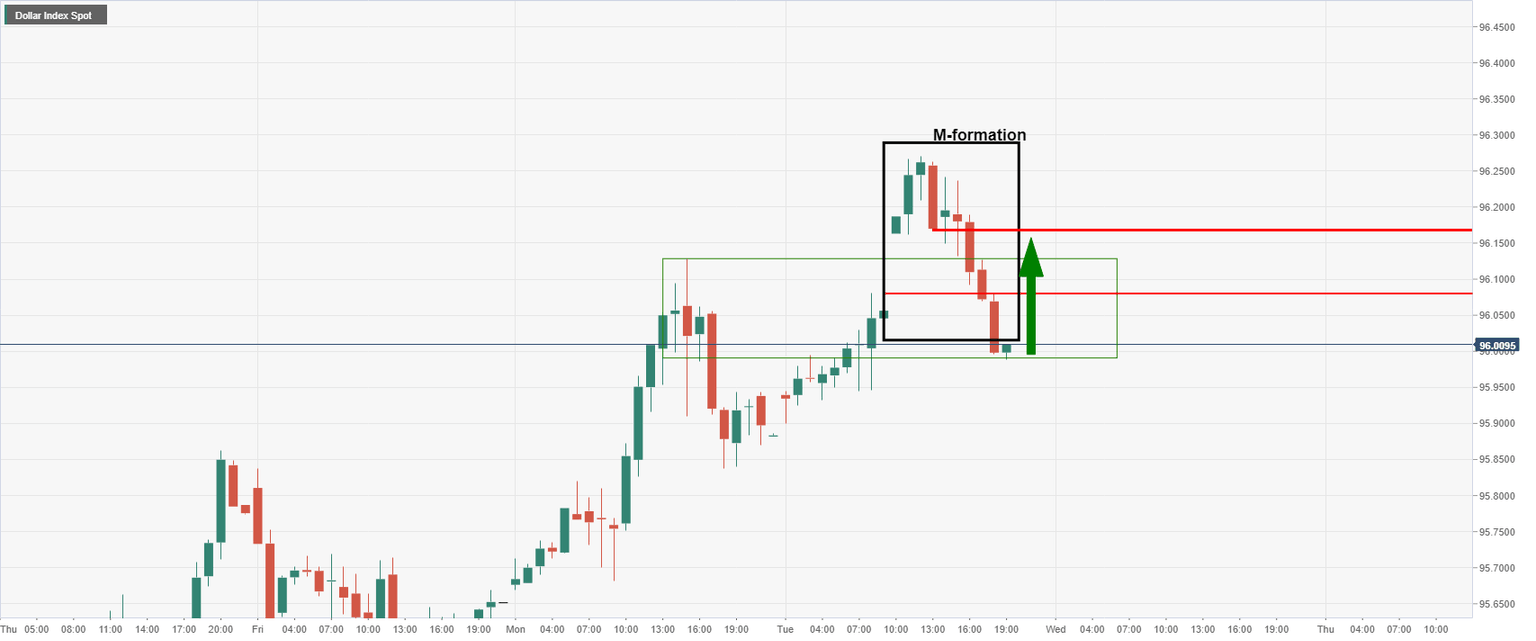

The move has occurred as the US dollar sinks to test deeper liquidity and 96 the figure in the DXY index, breaking prior resistance and support as follows:

However, considering how fluid geopolitics are, if there is a Russian invasion of Ukraine, the US dollar would be expected to continue higher. In turn, this would be taking the Aussie down with it for a test of bullish commitments in the lower end of the 0.70 areas.

Additionally, the M-formation is a reversion pattern, so a move higher in the greenback could infold in coming hours as markets get set for the Federal Reserve.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.