AUD/USD Price Analysis: Bulls firm at critical support area, but bears eye test of 0.6700/6680s

- AUD/USD point of control eyed near 0.6680.

- Bulls step in at key support area vs. heavily bearish price action.

As per the prior analysis, AUD/USD Price Analysis: Bears eye a break below key 0.6750, we have seen this play out. The bears moved in and took out the 0.6750s, printing a low of 0.6722, with last week's lows down in the 0.6620s on a break of 0.6700, 0.6690.

AUD/USD prior analysis

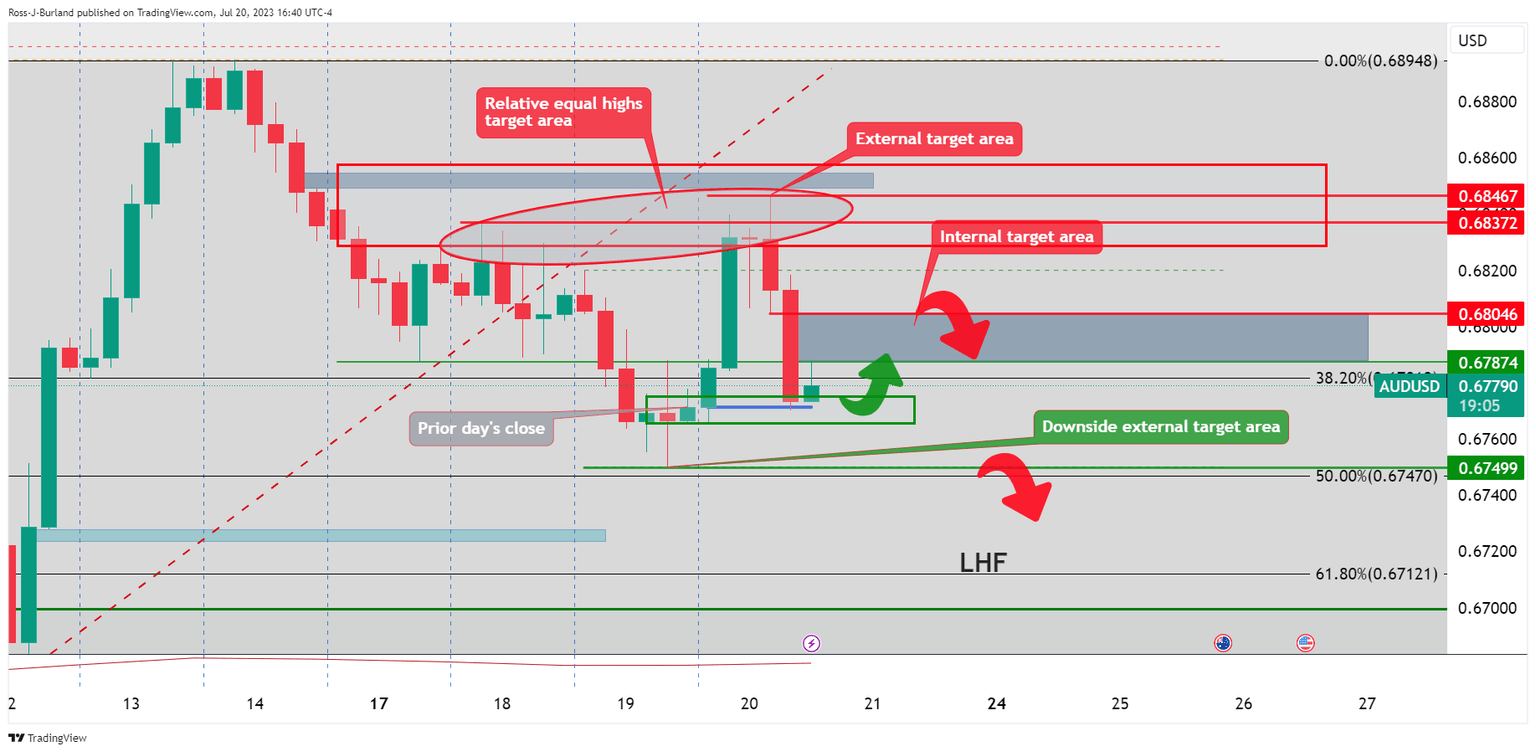

''The market has been giving two-way business and what we might see now is a downside continuation as follows:

AUD/USD H4 chart

The bears are lurking to fade rallies in the internal and external target areas. A downside target of 0.6750 is eyed that guards low-hanging fruit, LHF, below.''

AUD/USD updates

The daily chart is showing bearish momentum in the price action.

AUD/USD H1 chart

The bears moved in on the target area but there could be more to come and the hourly chart offers an insight to the bearish bias as per critical levels drawn above. A break beyond 0.6700 while below the significant levels opens risk towards last week's lows.

However, we the higher volumes below will not make life easy for the bears. The path of least resistance may turn out to be to the upside on failed attempts to the point of control near 0.6680.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.