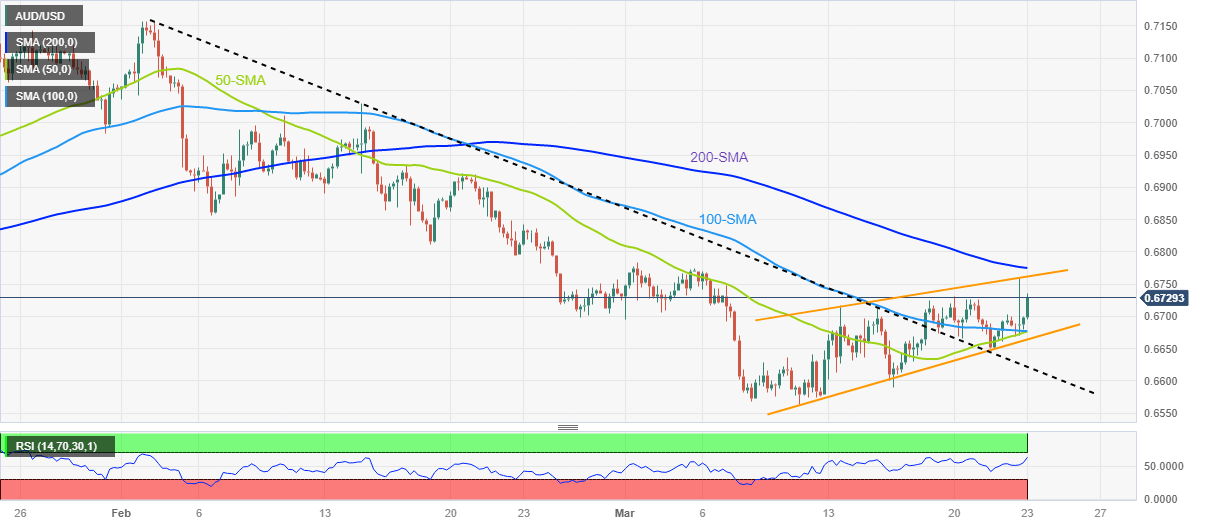

AUD/USD Price Analysis: Bulls brace for bumpy road past 0.6700, 200-SMA in the spotlight

- AUD/USD picks up bids to renew intraday high near 0.6730.

- Bulls keep reins inside two-week-old rising wedge, 200-SMA adds to the upside filters.

- Upbeat RSI, sustained trend line breakout keeps buyers hopeful.

- Key SMA confluence puts a short-term floor under Aussie price.

AUD/USD extends the post-Fed run-up towards refreshing the intraday top near 0.6730 amid early Thursday morning in Europe. In doing so, the Aussie pair grinds higher within a two-week-old rising wedge bearish chart formation.

It’s worth noting, however, that the quote’s successful break of the previous key resistance line from early February, around 0.6620 by the press time, joins the upbeat RSI (14) line to keep the AUD/USD pair buyers hopeful.

However, the stated wedge’s top line, near 0.6760 by the press time, can challenge the Aussie pair’s immediate upside.

Even if the quote manages to cross the 0.6760 hurdle, the 200-SMA level of 0.6775 can challenge the AUD/USD bulls before giving them control.

On the flip side, a convergence of the 100-SMA and 50-SMA appears short-term strong support, around 0.6675 at the latest.

Following that, the stated wedge’s lower line and the resistance-turned-support can please the bears near 0.6660 and 0.6620.

It should be observed that the AUD/USD pair’s sustained break of 0.6660 would confirm the rising wedge bearish chart pattern suggesting the theoretical target of 0.6460.

Overall, AUD/USD is likely to remain firmer but the upside room appears limited.

AUD/USD: Four-hour chart

Trend: Limited upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.