AUD/USD Price Analysis: Bearish bias persits as bears take control at key daily support

- AUD/USD bears seeking a break of 0.67 the figure.

- Meanwhile, the US dollar is stuck in a range, breakout traders are on alert.

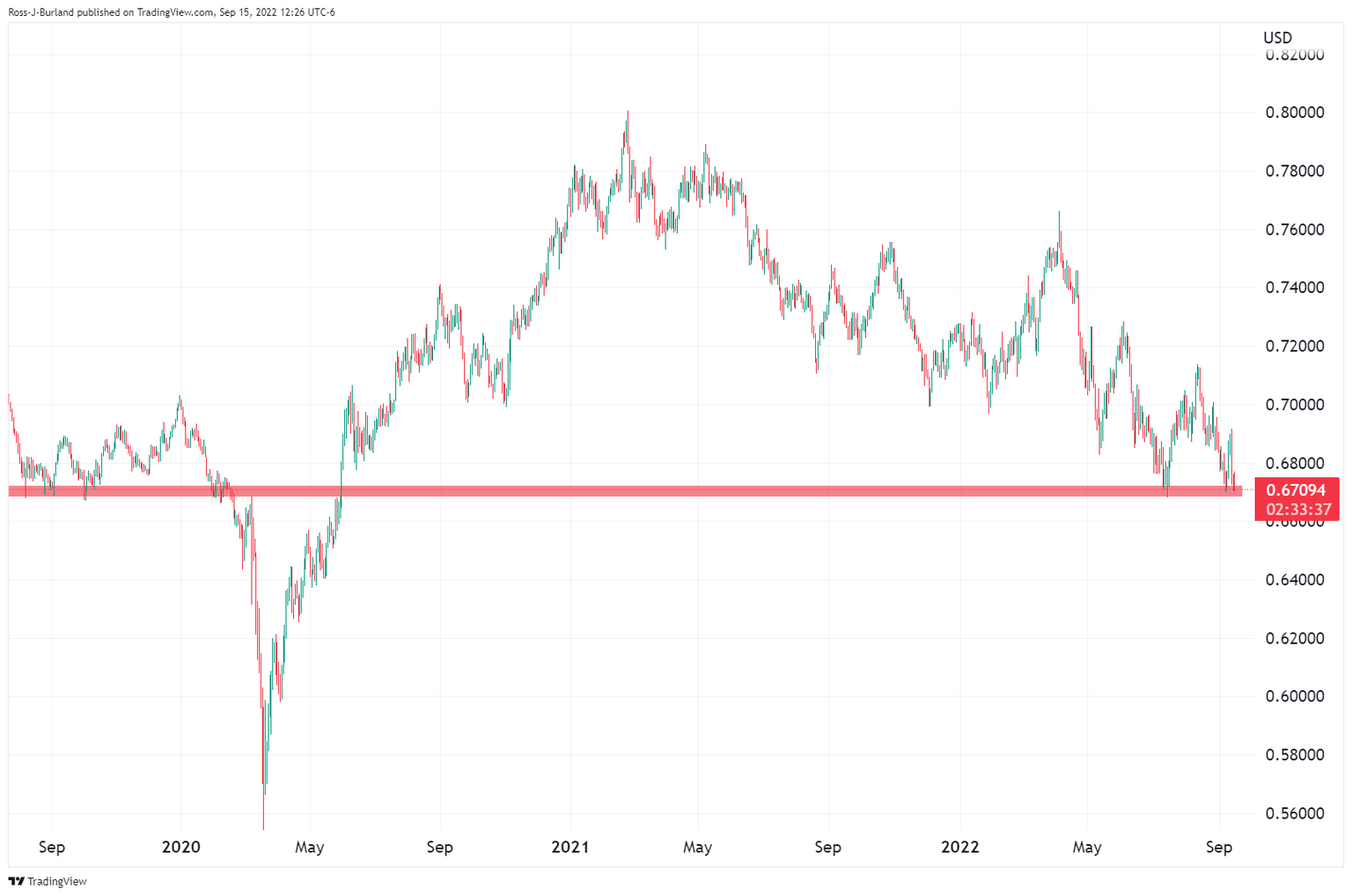

AUD/USD shows no sign of correcting at this stage on a longer-term time frame basis, as illustrated below and threatens a break of key support in the following analysis:

AUD/USD daily chart

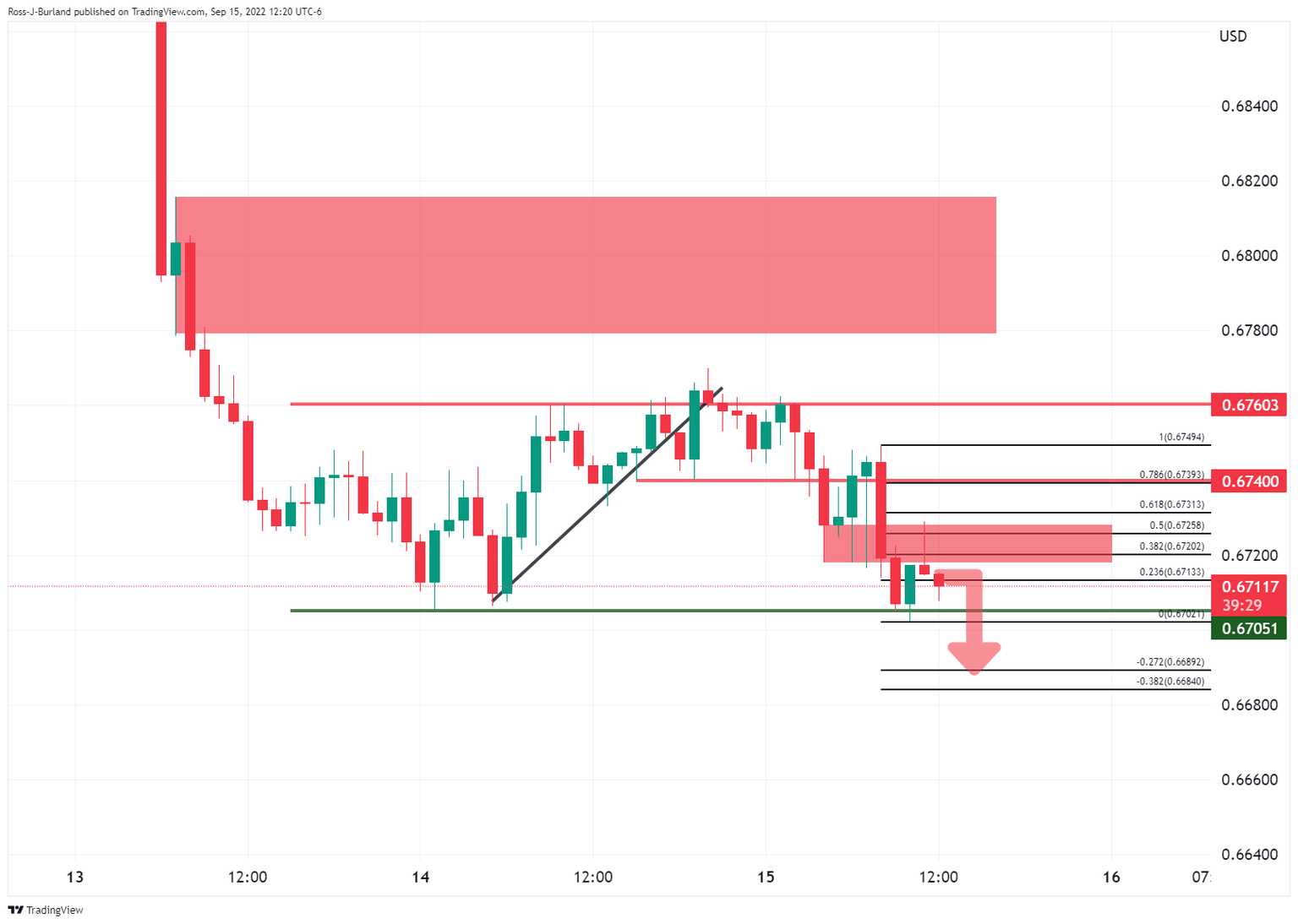

AUD/USD H1 chart

Meanwhile, the bears will be looking for an engulfing formation below the pin bar that has tapped the lower quarter of the 0.67 area that has pierced the 50% retracement of the latest bearish impulse on the hourly time frame. This is an area of confluence as per the wicks there and the bias is to the downside below 0.6750 tops.

Meanwhile, however, while the US dollar consolidates, it could be sideways action until a break of either 109.80 or 109.25 as per the DXY index that measures the greenback vs. a basket of currencies:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.