AUD/USD falls heavily as bears move in towards the 0.6580s target area

- AUD/USD bears move in due to the divergence between the Reserve Bank of Australia and the Federal Reserve.

- Federal Reserve's chairman Jerome Powell strikes an uber-hawkish tone in his testimony to Congress.

- The Reserve Bank of Australia has toned down its rhetoric, leaning more dovish

Risk assets are under immense pressure on Tuesday which is weighing on the high beta currencies such as the Australian Dollar. AUD is down a whopping 2% on the day after dropping like a stone from 0.6661 US session highs to a low of 0.6591 thus far vs. the US Dollar, the lowest since Nov. 22. AUD/USD's high for the day, however, was up at 0.6747 before markets started to position for possible hawkish rhetoric from Federal Reserve Chair Jerome Powell's testimony to Congress in US trade.

Hawkish rhetoric was what the market's got and stubborn investors holding their bets against the US Dollar were taken to the cleaners. The DXY index, a measure of the US Dollar vs. a basket of currencies, vaulted 105 the figure in a move that started out from 104.43 and kept going until 105.435. The trigger?

Reserve Bank of Australia and Federal Reserve divergence

In recent trade, Federal Reserve's chair Jerome Powell said that the US central bank will stay the course until the job is done. However, Fed's Powell added that the ultimate level of interest rates is likely to be higher than previously anticipated. Federal Reserve's chairman Jerome Powell also said that the Fed is prepared to increase the pace of rate hikes if data indicates it is warranted:

"The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes."

Federal Reserve's chairman Jerome Powell's comments come after the bank slowed the pace of its tightening to 25 basis points at its last two meetings, following larger hikes last year. Fed funds futures traders have now raised bets that the Fed will hike rates by 50 basis points at its March 21-22 meeting to 56% and a 25 basis points increase is now seen as just a 44% likelihood. Traders are now also pricing for the rate to peak at 5.57% in September and the US Dollar is firmly bid as result.

Meanwhile, prior to Federal Reserve's chairman Jerome Powell's hawkish testimony, the Reserve Bank of Australia, RBA, had already sawn the seed for a disparity between the Aussie and US Dollar. AUD was the weakest G10-performing currency due to what was perceived as a move towards a more dovish stance from the RBA at Tuesday's interest rate meeting.

The Reserve Bank of Australia's policy-makers hiked interest rates by 25 bps. This was the 10th consecutive tightening but there was a switch up in the language which motivated the market to position for the possibility of a lower peak in rates which in turn weighed on AUD. The RBA has put down the foundations for a forthcoming pause in policy moves.

''In our view, the Fed is set to stick with its hawkish guidance for now suggesting that AUD/USD could remain on the back foot into the middle of the year,'' analysts at Rabobank said.

''That said, on a relative basis, the Australian economy remains fairly well positioned in terms of growth and we expect AUD/USD to pick up some ground in the latter part of the year,'' the analysts argued, adding that this forecast assumes that Fed rates have peaked by then.

AUD/USD technical analysis

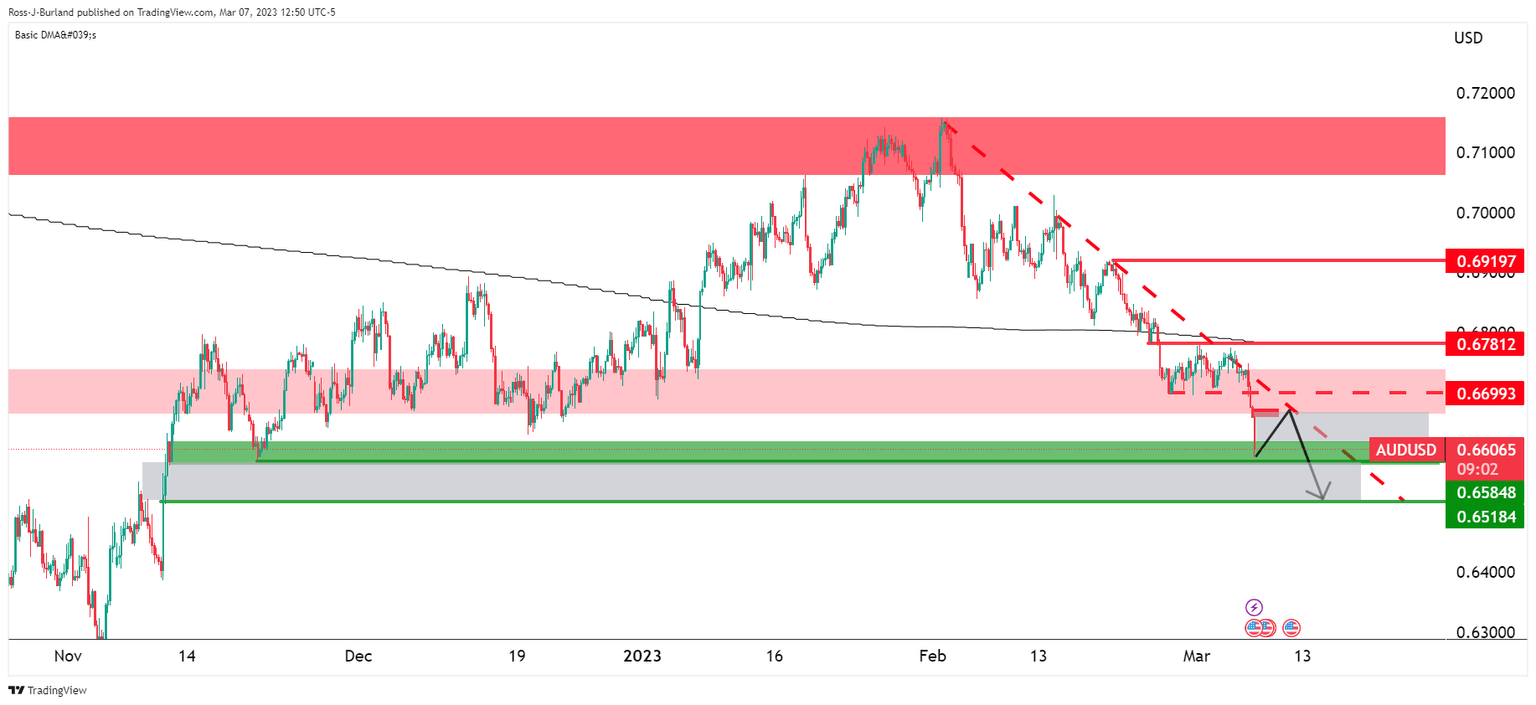

In prior AUD/USD analysis, it was explained that the downside scenario in a break of AUD/USD support opened risk to a test of the 0.6580s and then the 0.6520s:

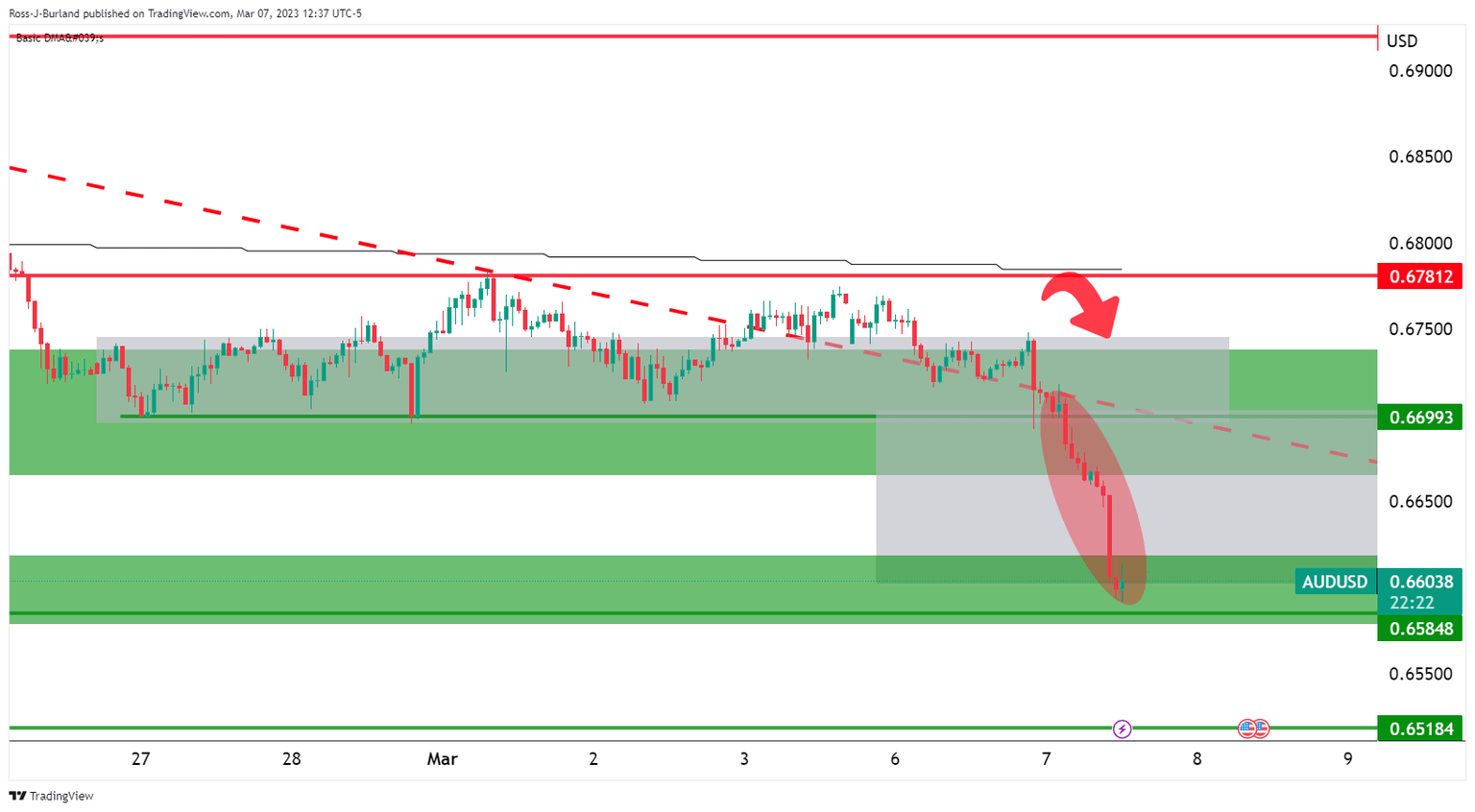

AUD/USD update

AD/USD was coiled below the 200 DMA and on the break of support near 0.6700, the bears moved in and ground into 0.6650 orders that made way for a strong impulse down into the 0.6590s that guards the 0.6580s.

From here, we may see a correction in AUD/USD into the shorts before further downside:

AUD/USD H4 & H1 charts

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.