AUD/USD bears are eyeing a correction from lofty US session highs

- Bulls run up to a key level on the charts and a correction could be in order.

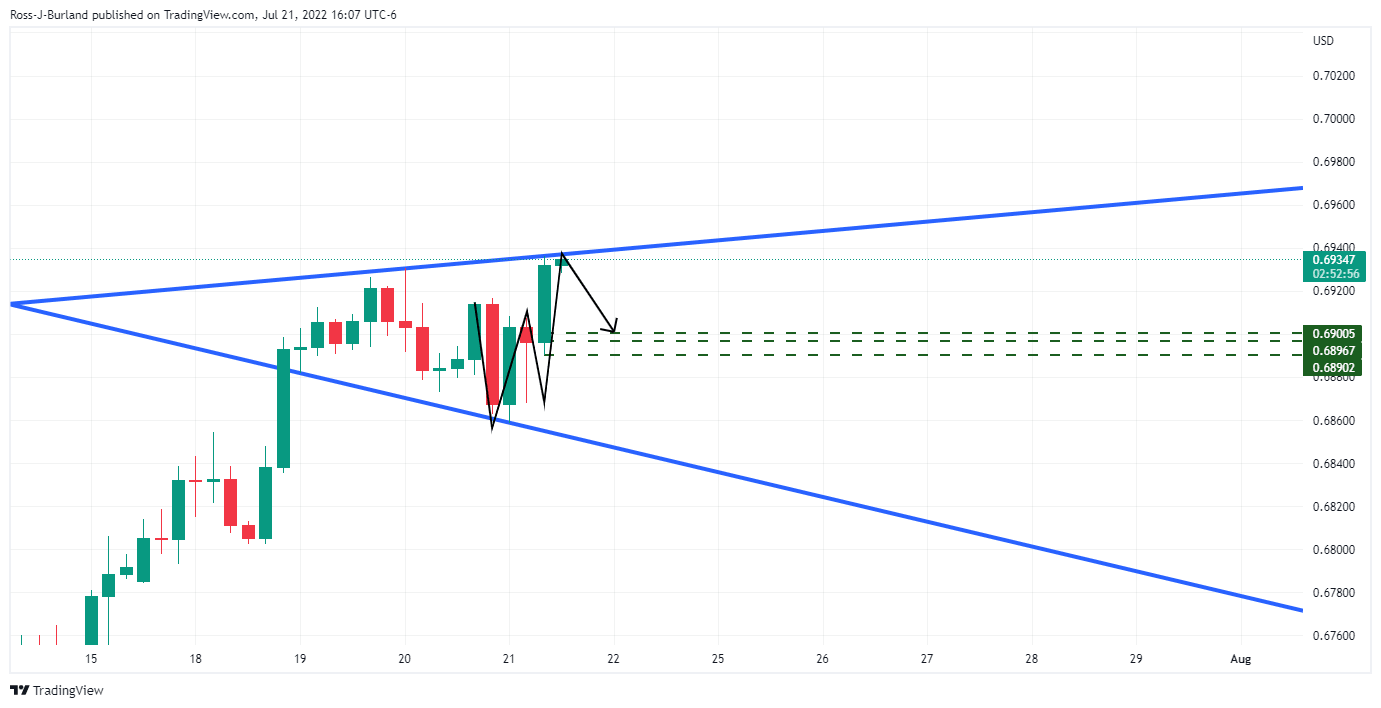

- AUD/USD W-formation on the 4-hour time frame is a compelling feature.

AUD/USD is flat in the first hour of Asian trade on Friday as it moves in on extremes of a broadening formation on the charts, but fundamentally, the stock markets o Wall Street and a softer US dollar have been a driver as well as a hawkish central bank. AUD/USD rallied to 0.6937 from a session low of 0.6858.

On Wednesday Reserve Bank of Australia, (RBA) Governor Philip Lowe emphasised higher rates with the Australian government bond futures have also started to price in higher rates. Yields on most government bonds up about 10 basis points since the start of the week.

Global stock markets are also supportive of the Aussie and are on track for a fifth straight session of gains. The euro was up in and the greenback down in choppy trading after the European Central Bank raised interest rates for the first time in more than a decade as it tries to combat inflation. The ECB rose by 50 bps and it also introduced a bond protection plan, called the Transmission Protection Instrument (TPI), that is designed to cap borrowing costs across the region.

Another thorn in the side of the US dollar, Wall Street's main indexes climbed on Thursday boosted by a late-afternoon rally and gains in heavyweight growth stocks, including Tesla. The tech-heavy Nasdaq added 1.4% to lead the gains while the S&P 500 closed at its highest level since June 9. The Dow Jones Industrial Average climbed 0.5%.

Meanwhile, despite a risk on tone in financial markets, the concerns over Europe's gas supply, fresh wobbles in China's property market and the detection of foot-and-mouth viral fragments in imported meat products in Australia could be a weight going forward.

Additionally, traders will wait anxiously for the US Federal Reserve meeting next week where policymakers are expected to raise interest rates by 75 basis points to curb runaway inflation. There will also be a focus on crucial second-quarter US Gross Domestic product data, which is likely to be negative again. Two-quarters of negative GDP growth would mean the United States is in a recession, which has been a supportive factor for the greenback for its safe haven qualities. If stocks stumble on a bad outcome, the Aussie will potentially follow suit.

AUD/USD technical analysis

The price is meeting a broadening formation extreme and the W-formation on the 4-hour time frame is a compelling feature as well which could see the price revert to test the neckline and 15-min price bar lows if bears stay committed. 0.6890 is eyed in that regard.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.