The AUD/USD pair formed a classic Doji candle on Thursday, which indicates indecision in the markets. The two way action and a flat day end close (Doji) on Thursday are being followed by a bearish move this Friday morning in Asia.

As of writing, the spot was down 0.40% at 0.7925.

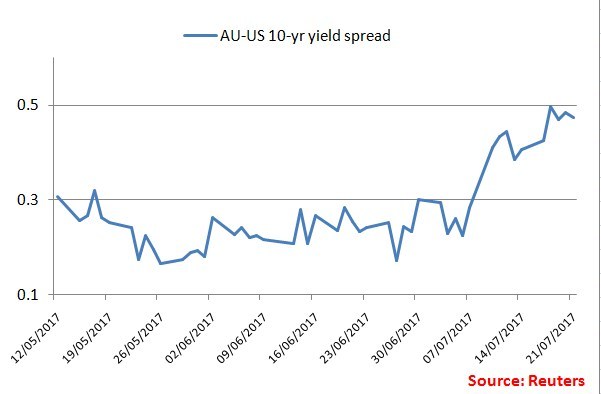

The bearish follow through to Thursday’s Doji candle could be an indication that the spot may have found a top, although yield differential still remains in favor of the Aussie dollar.

The spread or the difference between the Aussie-US 10-year yield currently stands at 0.473; the highest since November. The spread hit a high of 0.498 earlier this week. Thus, the current decline in the AUD/USD could be a technical pullback and may find fresh takers.

AUD/USD Technical Outlook

Jim Langlands from FX Charts sees AUD/USD stuck in a range over the 24-hour period. He writes, "The momentum indicators are now mixed and a session of consolidation, within Thursday’s range would not really surprise although the RBAs Debelle will be speaking today and may attempt to talk the Aud lower. A move back to the 0.7988 high could then see a run towards 0.8000 and then to 0.8015 although I don’t think we are going there today. Minor support now arrives at 0.7935 and at 0.7920 would find stronger bids at 0.7900 and then again at 0.7875 and at 0.7840 although it seems unlikely to be seen down here today."

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.