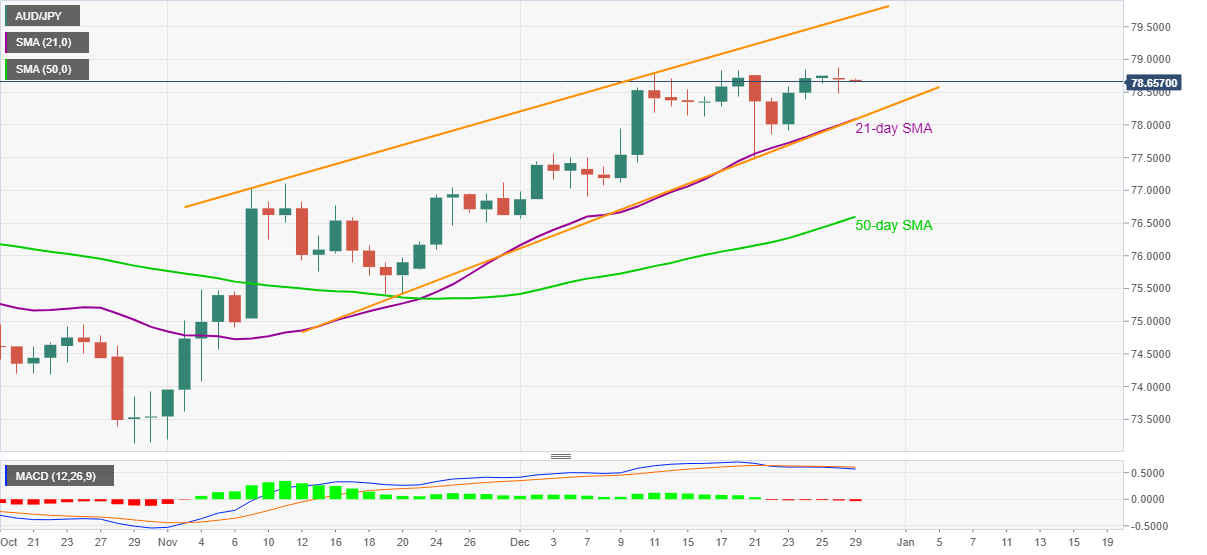

AUD/JPY Price Analysis: Sluggish inside seven-week-old rising channel

- AUD/JPY wavers in a choppy range above 78.50.

- MACD dwindles inside a bullish chart pattern, 21-day SMA adds strength to the channel’s support.

AUD/JPY seesaws in a five-pip range near 78.70 during the early Tuesday morning in Asia. The quote refreshed the highest levels since late-April 2019 the previous day before stepping back from 78.88.

Although holiday-thinned trading weighs on the MACD signals, an upward sloping trend channel formation since November 09 keeps the AUD/JPY buyers hopeful.

It should, however, be noted that the 79.00 becomes the tough nut to crack for the bulls ahead of confronting the early 2019 tops near 79.80 and the 80.00 psychological magnet.

Meanwhile, the support line of the stated channel joins 21-day SMA to stop the bears around 78.10. Also acting as the strong downside support is the December 21 low near 77.50.

In a case where the AUD/JPY sellers dominate past-77.50, a 50-day SMA close to 76.60 should gain the market’s attention.

AUD/JPY daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.