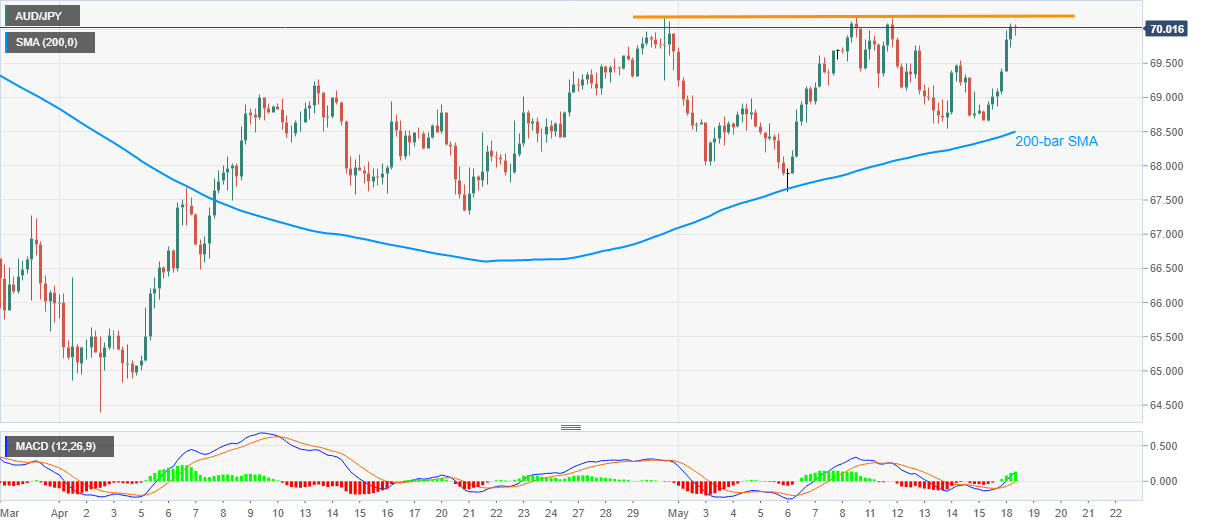

AUD/JPY Price Analysis: Buyers look for entry beyond 70.20

- AUD/JPY holds onto previous day’s strong recovery from 68.65, nears one-week top.

- A horizontal line comprising highs since April 30 checks buyers.

- 200-bar SMA offers strong downside support amid bullish MACD.

AUD/JPY seesaws around 70.00, near the highest since May 12, amid the initial Asian session on Tuesday. In doing so, the pair remains firm above 200-bar SMA but still below 13-day-old resistance including highs marked in April and so far during the current month.

As a result, buyers will wait for entries beyond 70.20 to aim for 71.00 round-figure and March month high of 71.52.

Though, January month near 72.45 could question the bulls during the further upside.

Meanwhile, Friday’s top near 69.54 can offer immediate support to the pair during its pullback ahead of Thursday’s bottom close to 68.55.

Should the pair drops below 68.55, 200-bar SMA level of 68.50 will be the key to watch as a break of which can refresh the monthly low under the previously flashed 67.63 figures.

AUD/JPY four-hour chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.