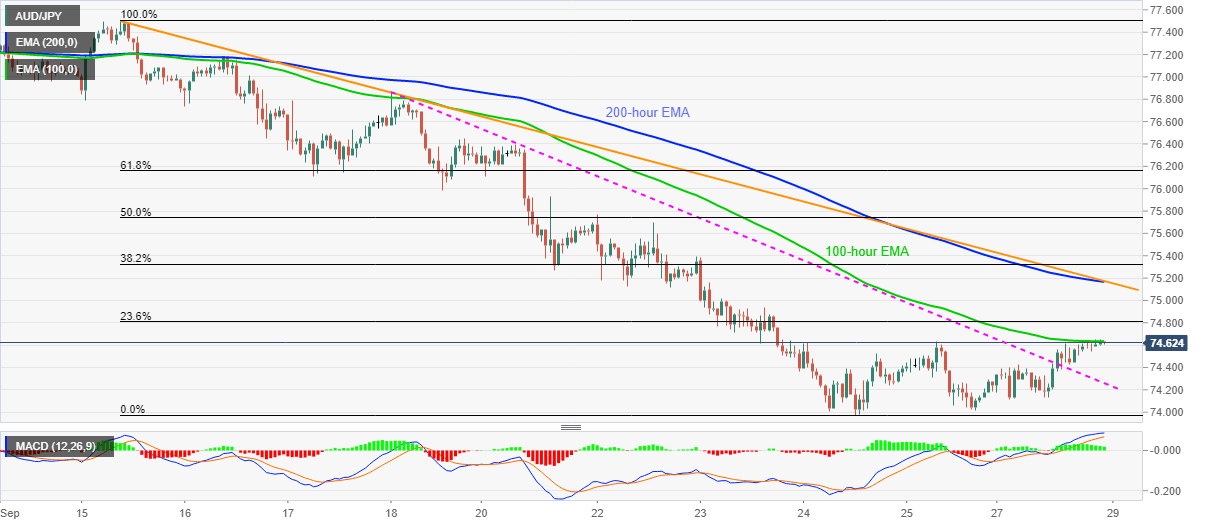

AUD/JPY Price Analysis: Bulls attack 100-hour EMA, 75.20 be the key resistance

- AUD/JPY keeps upside break of a seven-day-old falling trend line.

- Bullish MACD favors extra run-up but 200-hour EMA, a fortnight old resistance line will question the buyers.

- Sellers can retake entries below the previous resistance line but 74.00 will be the tough nut to crack.

AUD/JPY picks up bids near 74.60 during the early Tuesday morning in Asia. The aussie cross broke a descending trend line from September 19 the previous day and is currently combating 100-hour EMA.

Considering the pair’s ability to stay past the short-term resistance line, now support, coupled with the bullish MACD, AUD/JPY buyers are likely to stay happy for a bit more beyond the 74.65 immediate upside barrier.

While the anticipated strength can direct the bulls towards the 75.00 threshold, a confluence of 200-hour EMA and a downward sloping trend line from September 15, near 75.20 will be the crucial resistance to watch as a break of which will push AUD/JPY further north towards 76.00.

Alternatively, 74.40 can act as the nearby support for the pair during its pullback, a break of which will highlight the previous resistance line, at 74.25 now.

It should, however, be noted that the bears will remain cautious unless breaking the monthly low of 74.00 that holds the gate to further declines targeting the late-June lows near 73.30.

AUD/JPY hourly chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.