ATNX Stock Price: Athenex Inc plunges following FDA rejection letter

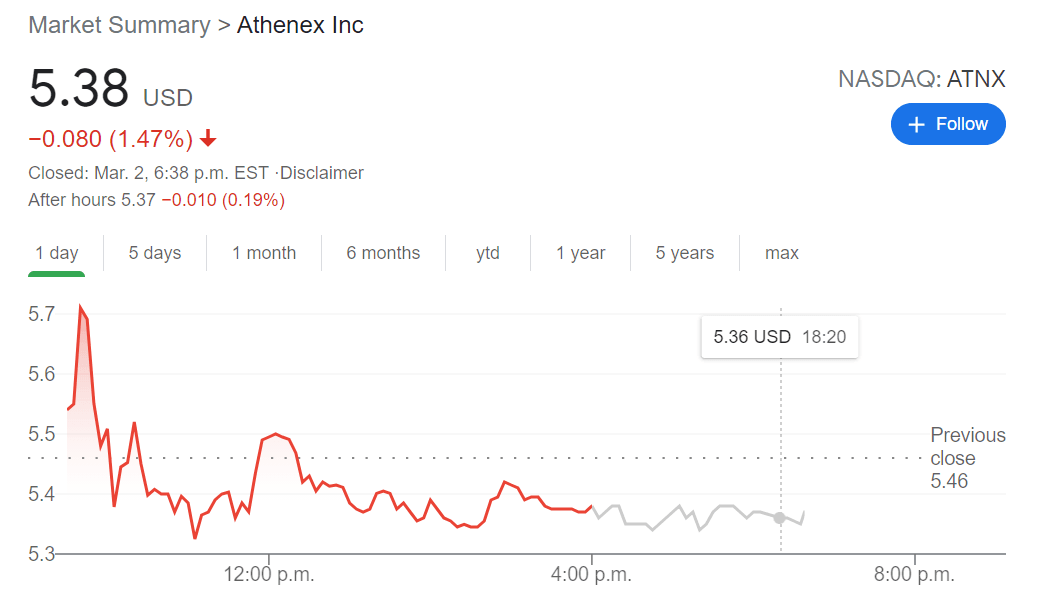

- NASDAQ:ATNX fell a further 1.47% on Tuesday as the markets pulled back from Monday’s rally.

- Athenex received a dreaded FDA letter asking for further clinical trial evidence.

- Following the report on Monday, Athenex dropped by 51% during the trading session.

NASDAQ:ATNX is showing just how risky clinical stage biotech companies can be as an investment when much of the firm’s focus lies in one treatment. On Tuesday, shares of Athenex extended their losses and shed 1.47% as the broader markets retreated from the rebound to start the week on Monday. Athenex saw ten times the average trading volume on Tuesday as investors continued to sell off after the stock hit a new 52-week low price of $5.24 on Monday.

Stay up to speed with hot stocks' news!

The catalyst for Athenex’s freefall is of course the dreaded FDA letter that companies receive when applying for regulatory approval of its NDA or New Drug Application. The FDA rejected Athenex’s breast cancer treatment based on the recent clinical trial results, and recommended that Athenex start a brand new clinical trial before applying again. The letter outlines concerns that the FDA had in relation to patient safety regarding the oral medication in comparison to its IV treatment. The FDA also had concerns with Athenex’s trials not being representative of metastatic breast cancer patients in the United States, which may mean Athenex will need to shift its focus to a stateside trial. Athenex has said they will be scheduling a meeting with the FDA to figure out a response and next steps for a new clinical trial.

ATNX stock forecast

Not surprisingly, Athenex dropped 51% on Monday after the report of the letter, which also coincided with its quarterly earnings call. The news prompted some analyst downgrades of Athenex, including one from Truist Securities which downgraded ATNX from a buy to a hold. It should be noted that the FDA has not rejected the treatment forever, so if Athenex is able to put together a successful clinical trial, the current price levels could be seen as a value play.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet