AMD Price Prediction: Advanced Micro Devices Inc stock falls despite stellar earnings, chart looks bearish

- AMD released strong earnings on April 27 beating EPS.

- The manufacturing giant's shares have fallen sharply since releasing strong results.

- AMD also lifted outlook for the year ahead.

AMD posted strong results last week on April 27 which comfortably beat analyst expectations. Earnings per share for Q1 2021 were forecast by Wall Street analysts to come in at $0.44 but instead, AMD posted EPS of $0.52. Revenue was forecast to be $3.21 billion but the reported number again comfortably beat the forecasts, hitting $3.45 billion. Topping this, AMD also raised its guidance for the year ahead. AMD raised revenue growth forecasts to 50% from a previous 39%. AMD's CEO said the company was confident that it could source semiconductor chips to maintain growth despite a global shortage.

After the release of earnings, various analysts rushed to upgrade their forecasts and numbers. Bank of America, UBS, Raymond James, Truist, Mizuho, Susquehanna, Summit and JPMorgan all raised their price targets for AMD.

However, the shares have not responded to the positive newsflow as worries over the semiconductor sector feeding through. Intel also reported reasonable but not as strong numbers but its shares also suffered post earnings release.

Stay up to speed with hot stocks' news!

AMD is one of the largest semiconductor manufacturers and is focused on the computing and graphics sector. Advanced Micro Devices is one of Intel's main competitors in the desktop and laptop chip market. The company's new Ryzen chips have become a serious option and challenge to Intel. The sector is the subject of much focus as numerous companies complain of semiconductor chip shortages. President Biden has set up a task force to help deal with global supply problems.

AMD stock forecast

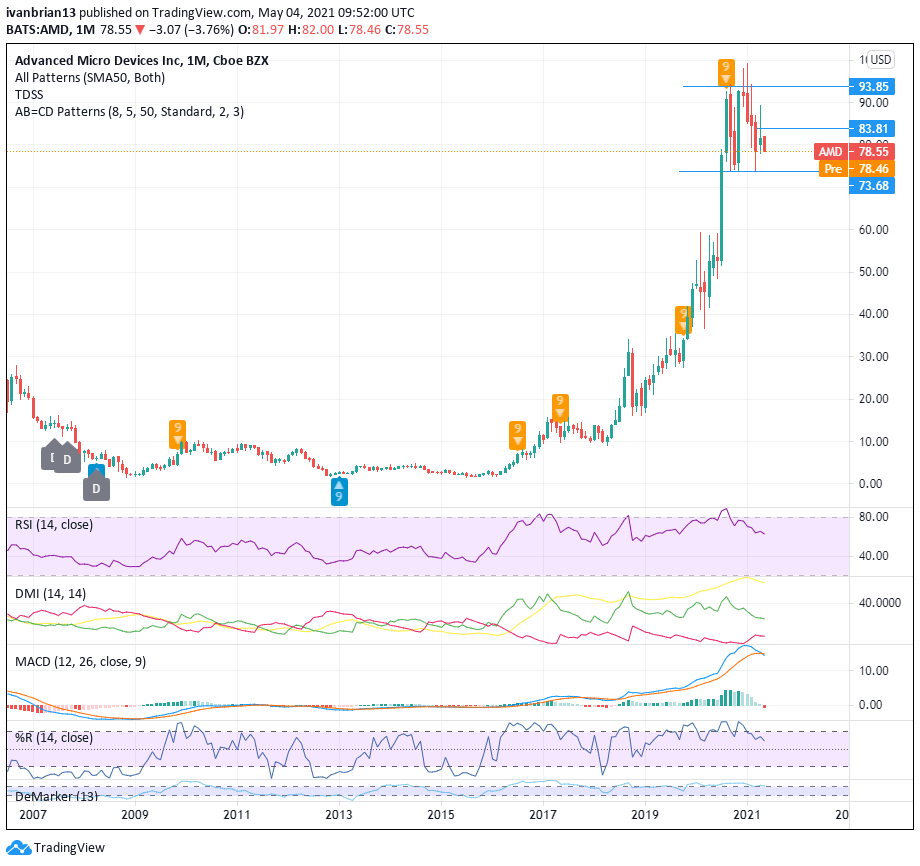

AMD is in a long-term bullish trend as can be seen from the monthly chart going back to before 2003. We have recently flagged a Tom DeMark sell signal on the monthly chart. Looking back we can see these sell signals have worked quite well in identifying sell opportunities against the overall bullish trend. Drilling down the chart shows that this sell signal is from August 2020, so we can take it as finished now. AMC did actually sell off from $93 to $73 between August 2020 and October 2020.

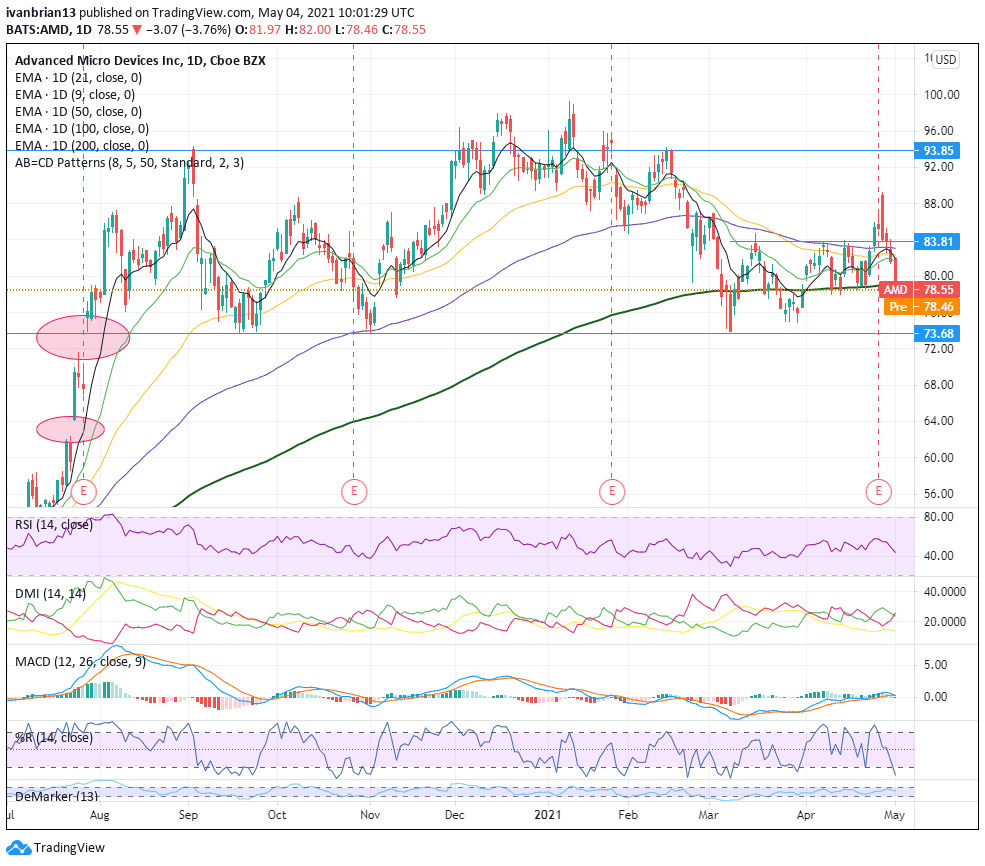

This post-earnings move is troubling for bulls, as AMD has broken through the 9 and 21-day moving averages. The price action itself is bearish. A strong positive catalyst in earnings rebuffed by the price action moving sharply lower is certainly a strong bearish signal.

The bigger problem is AMC now sits on the cusp of breaking below the long-term 200-day moving average. Currently, in such a bullish market there are not many stocks trading below their 200-day moving average. The S&P 500 and Nasdaq continue to make record highs or in the Nasdaq's case sit just below.

A break of this 200-day moving average will bring the lower end of the longer-term range at $73.68 into focus. The daily chart has two gaps to fill below $73.68 from ironically gap-opening post previous results releases. The ultimate target to close both gaps is $62.33.

The Moving Average Convergence divergence (MACD) is also looking to a potential crossover sell signal so keep an eye on this.

A bounce from the 200-day support will target the 9-day moving average at $81.91. On breaking that level, AMD should then test previous highs from April 28 at $89.20 and $93.85.

The overall trend is bearish until resistance at $89.20 is broken.

At the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

This article is for information purposes only. The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice. It is important to perform your own research before making any investment and take independent advice from a registered investment advisor.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to accuracy, completeness, or the suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The author will not be held responsible for information that is found at the end of links posted on this page.

Errors and omissions excepted.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.