- NYSE:AMC falls nearly 2% in early trade on Wednesday.

- AMC faces chart resistance from converging moving averages.

- Meme stocks suffer on Wednesday despite indices being green.

Update April 2: AMC Entertainment Holdings Inc (NYSE: AMC) has kicked off Thursday's trading session with a significant drop below $10. At the time of writing, shares of the movie theater firm are down some 4.5% to $9.75. This decline contrasts the bullish market mood. However, while America's vaccination campaign continues, so do increases in cases. That implies fewer people going to see films.

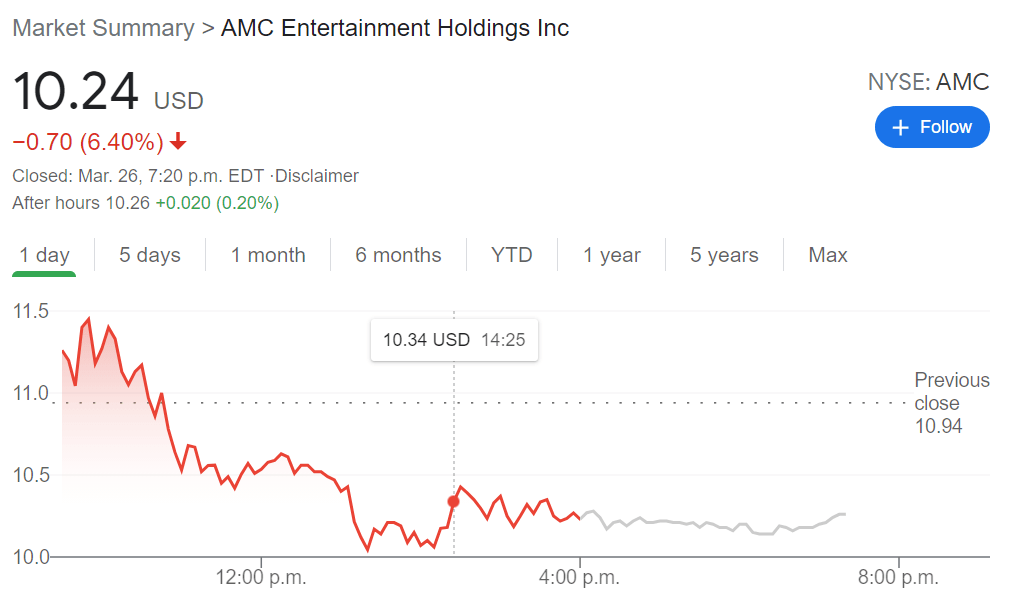

NYSE:AMC investors thought that the stock’s price would be heading back to the moon after nearly every state-issued reopening orders for its theaters. But shares have seen continued volatility as it becomes increasingly clear that returning to watch movies is not at the top of everyone’s post-COVID list of things to do. On Friday, despite a broader market rally to the closing bell, AMC fell by 6.40% to close the trading week at $10.24. AMC is now down nearly 30% since last week when shares surged on the news of states like California reopening its doors.

Stay up to speed with hot stocks' news!

Despite the fact that nearly all of AMC’s locations are once again open to the public, albeit in limited capacities, some film companies are hesitant to return to how things were. Earlier in the week, Walt Disney (NYSE:DIS) reported that it would be delaying the much anticipated release of its upcoming film Black Widow, and preparing it for a simultaneous launch on its streaming platform Disney+. These multi-platform releases are devastating for theaters like AMC as staying at home to watch movies is not only safer, but for families with children, is easier on the wallet as well.

AMC Stock forecast

The king of the meme stocks, GameStop (NYSE:GME) had another tumultuous week following its March 23rd earnings call where a corporate reshuffling was announced. GameStop’s behavior always sends ripple effects to the other meme stocks like AMC, so this week’s volatility should come as no surprise. Although the Reddit effect and Wall Street short squeeze is losing its momentum, there are still a large legion of Reddit investors who are heavily invested in GameStop and AMC, months after the initial event.

Previous updates

Update April 1: AMC Entertainment Holdings Inc (NYSE: AMC) has closed Wednesday's session with a drop of 1.35% to close at $10.21. Those following shares of the movie theater firm closely may have become familiar with these ranges. Another minor slide to $10.16 is on the cards on Thursday. However, as a "meme stock" prone to enthusiasm on Reddit's WallStreetBets forum, trading may turn wild. It is also essential to remember that as the Easter holiday approaches, liquidity in markets is thinning out and that may cause volatility to surge.

Update 2 March 31: AMC is one of the few stocks in the red so far on Wednesday as shares also struggle with resistance. The 9 day moving average provides the first resistance to be tackled at $10.88 and next $10.96 is the 21 day moving average. The 9 day is close to breaking below the 21 day moving average which is a bearish signal.

.png)

Update March 31: AMC Entertainment Holdings Inc (NYSE: AMC) has ended Tuesday's session at $10.35, unchanged from Monday as investors await President Joe Biden's infrastructure spending plan. For the firm's cinema business, the rapid pace of US vaccinations is encouraging, but the recent surge in virus cases is worrying. That may explain the recent stability. Wednesday's session could be different – end-of-quarter flows are set to cause high volatility in markets.

Update March 30: AMC Entertainment Holdings Inc (NYSE: AMC) has kicked off Tuesday's trading session with a swing to the downside. While prospects of vaccination and reopening remain elevated, stock markets fear inflation and are heading lower. Concerns that President Joe Biden's infrastructure plan would trigger substantial debt issuance is causing a sell-off in US bonds. In turn, higher returns on Treasuries make shares less attractive. This broader narrative does not spare the movie theater behemoth. At the time of writing, AMC is changing hands at $10.20, paring Monday's gains with a slide of 1.50%.

Update March 30: AMC Entertainment Holdings Inc (NYSE: AMC) has closed Monday's trading session at $10.35, a gain of 1.37%. The upward move is set to extend, as pre-market figures point to another minor advance to $10.43. Investors have been shrugging off reports of significant sell-offs by insiders in the company. While that is usually seen as a sign of no-confidence, managers at the embattled movie theater firm may have taken advantage of recent gains related to retail traders to take money off the table.

Update March 29: AMC Entertainment Holds Inc (NYSE: AMC has kicked off the short trading week with an upward swing, changing hands at around $10.30 at the time of writing. The embattled theater company is considered a "meme stock" alongside GameStop and others – known for its wild swings related to retail traders. However, the big boys also cause volatility in markets. The liquidation of Archegos, a hedge fund, has triggered a sell-off in CBS Viacom and other shares. Moreover, several commercial banks are suffering significant losses due to their exposure to Archegos – showing that the big boys have their own issues.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

USD/JPY holds above 155.50 ahead of BoJ policy announcement

USD/JPY is trading tightly above 155.50, off multi-year highs ahead of the BoJ policy announcement. The Yen draws support from higher Japanese bond yields even as the Tokyo CPI inflation cooled more than expected.

AUD/USD extends gains toward 0.6550 after Australian PPI data

AUD/USD is extending gains toward 0.6550 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price keeps its range around $2,330, awaits US PCE data

Gold price is consolidating Thursday's rebound early Friday. Gold price jumped after US GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the Fed could lower borrowing costs. Focus shifts to US PCE inflation on Friday.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.